Understanding the difference between net and gross pay is crucial for anyone managing their finances or involved in payroll and accounting. This article will delve into 12 essential facts about net and gross pay, shedding light on their significance and how they impact individuals and businesses.

1. Defining Net and Gross Pay

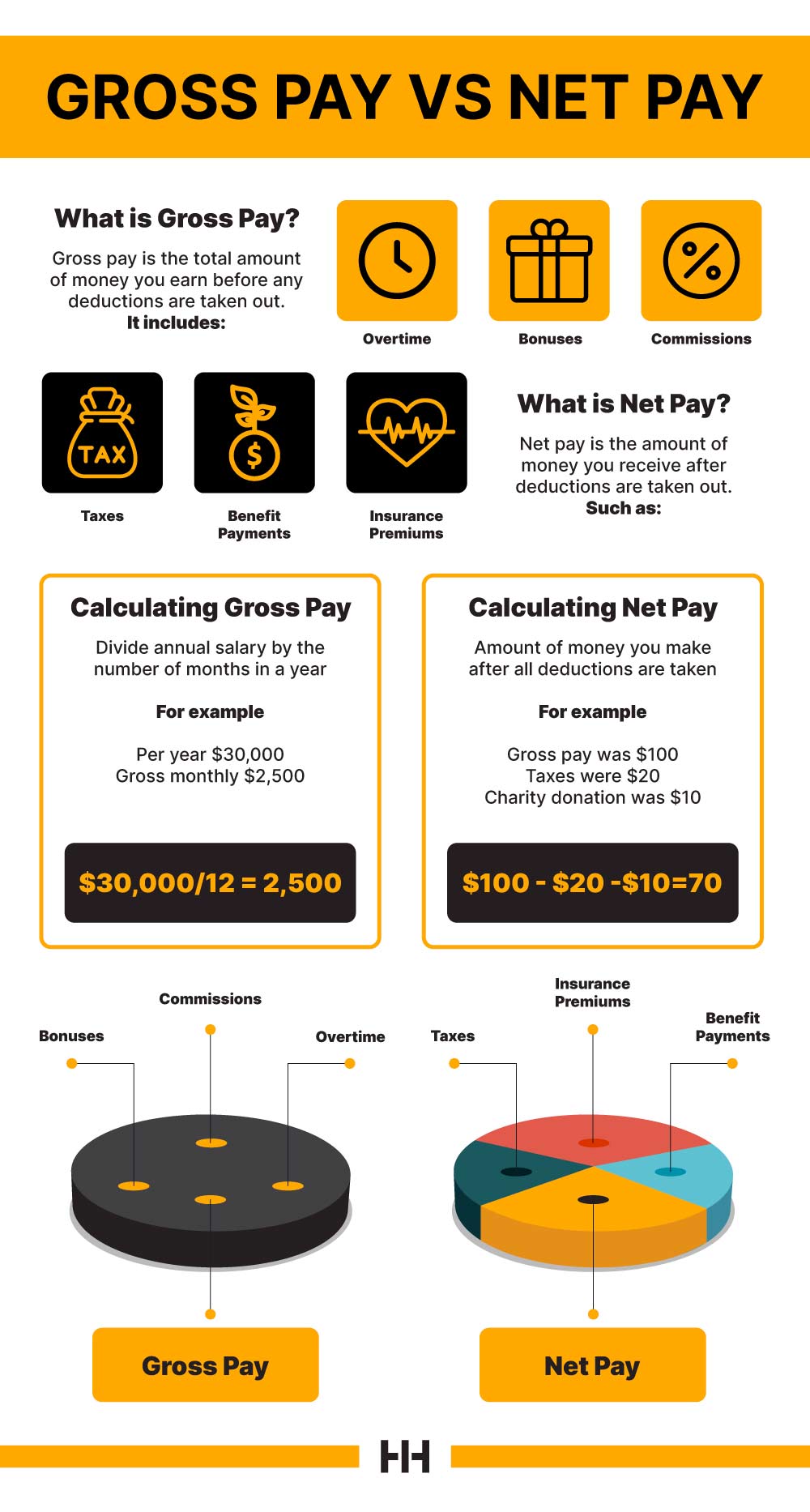

Net pay refers to the actual amount of money an employee receives after all deductions, such as taxes, insurance, and retirement contributions, have been taken out of their gross pay. On the other hand, gross pay represents the total amount earned before any deductions are made.

2. Calculating Net Pay

To calculate net pay, you need to subtract all applicable deductions from the gross pay. These deductions can include federal, state, and local taxes, as well as any voluntary contributions to benefits like health insurance, life insurance, and retirement plans.

Common Deductions:

- Federal Income Tax

- State and Local Taxes

- Social Security and Medicare Contributions

- Health Insurance Premiums

- Retirement Plan Contributions

- Union Dues (if applicable)

3. Understanding Gross Pay

Gross pay is the total amount an employee earns before any deductions are made. It includes the base salary or hourly wage, as well as any additional earnings such as bonuses, commissions, and overtime pay. Gross pay is often used as a benchmark for comparing salaries and evaluating the financial health of a business.

4. The Impact of Deductions on Net Pay

Deductions can significantly impact an employee’s net pay. For example, an employee with a high income may have a larger portion of their gross pay deducted for taxes, resulting in a lower net pay. Similarly, voluntary deductions for benefits can also reduce the net pay, but they offer valuable coverage and savings opportunities.

5. Net Pay and Take-Home Income

Net pay is often referred to as take-home income, as it represents the actual amount of money an employee can spend or save after all necessary deductions have been made. It is important for employees to understand their net pay to manage their finances effectively and plan for their financial goals.

6. Gross Pay and Business Expenses

For businesses, gross pay is a critical metric for understanding their payroll costs and overall financial health. It helps businesses determine their expenses related to employee compensation, including base salaries, bonuses, and benefits. By analyzing gross pay, businesses can make informed decisions about their payroll budget and strategies.

7. The Role of Taxes in Net Pay

Taxes are a significant factor in calculating net pay. Employees are required to pay federal, state, and local taxes, which can vary depending on their income level and residence. Understanding the tax implications is essential for both employees and employers to ensure accurate payroll processing and tax compliance.

8. Voluntary Deductions and Employee Benefits

Voluntary deductions allow employees to contribute a portion of their gross pay towards various benefits, such as health insurance, life insurance, and retirement plans. These deductions provide employees with valuable coverage and the opportunity to save for their future. Employers often offer these benefits as part of their compensation packages to attract and retain talent.

9. Net Pay and Budgeting

Understanding net pay is crucial for effective budgeting. Employees can use their net pay as a starting point to create a realistic budget, considering their essential expenses, savings goals, and discretionary spending. By aligning their spending with their net pay, individuals can achieve financial stability and work towards their long-term financial goals.

10. Gross Pay and Compensation Packages

Gross pay is a key component of an employee’s compensation package. It includes not only the base salary or hourly wage but also any additional earnings and benefits. When evaluating job offers, candidates often consider the gross pay as an indicator of the overall value and competitiveness of the compensation package.

11. Net Pay and Financial Planning

Net pay plays a vital role in financial planning. Financial advisors and planners work with individuals to understand their net pay and create personalized financial plans. By considering net pay, financial professionals can provide tailored advice on savings, investments, and retirement planning, ensuring that individuals make the most of their take-home income.

12. The Importance of Accurate Payroll Processing

Accurate payroll processing is essential to ensure that employees receive the correct net pay. Employers must carefully calculate and deduct the appropriate amounts for taxes and benefits, considering the employee’s income, residence, and any voluntary deductions. Regular audits and compliance checks are necessary to maintain accuracy and avoid legal issues.

Conclusion

Understanding the distinction between net and gross pay is crucial for both employees and employers. Net pay, or take-home income, is the amount an employee actually receives, while gross pay represents the total earnings before deductions. The impact of deductions, taxes, and voluntary contributions on net pay can be significant, affecting an individual’s financial planning and budgeting. For businesses, gross pay is a vital metric for understanding payroll costs and making informed decisions. Accurate payroll processing is essential to ensure employees receive the correct net pay, and financial advisors play a crucial role in helping individuals maximize their take-home income through effective financial planning.

FAQ

What is the difference between net and gross pay?

+

Net pay is the amount an employee receives after all deductions, while gross pay is the total earnings before any deductions are made.

How are taxes calculated for net pay?

+

Taxes are calculated based on an employee’s income level and residence, with federal, state, and local taxes applied accordingly.

Can employees choose their voluntary deductions?

+

Yes, employees often have the option to choose voluntary deductions for benefits like health insurance and retirement plans.

How does net pay affect financial planning?

+

Net pay is a crucial factor in financial planning, as it determines an individual’s take-home income and their ability to save and invest.