Renting commercial real estate involves a detailed and legally binding process, especially when compared to residential rentals. This is due to the complexity of commercial properties and the unique needs of businesses. Here, we will delve into the key aspects of commercial real estate rental contracts, providing an in-depth understanding of the process for both landlords and tenants.

Understanding the Basics of Commercial Real Estate Rental Contracts

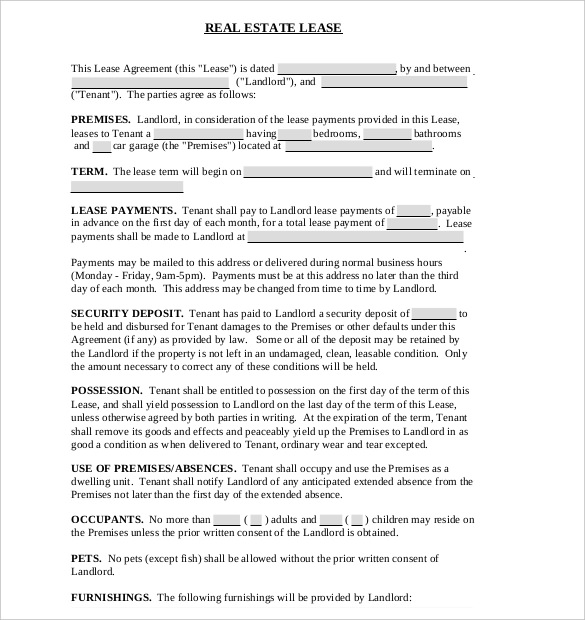

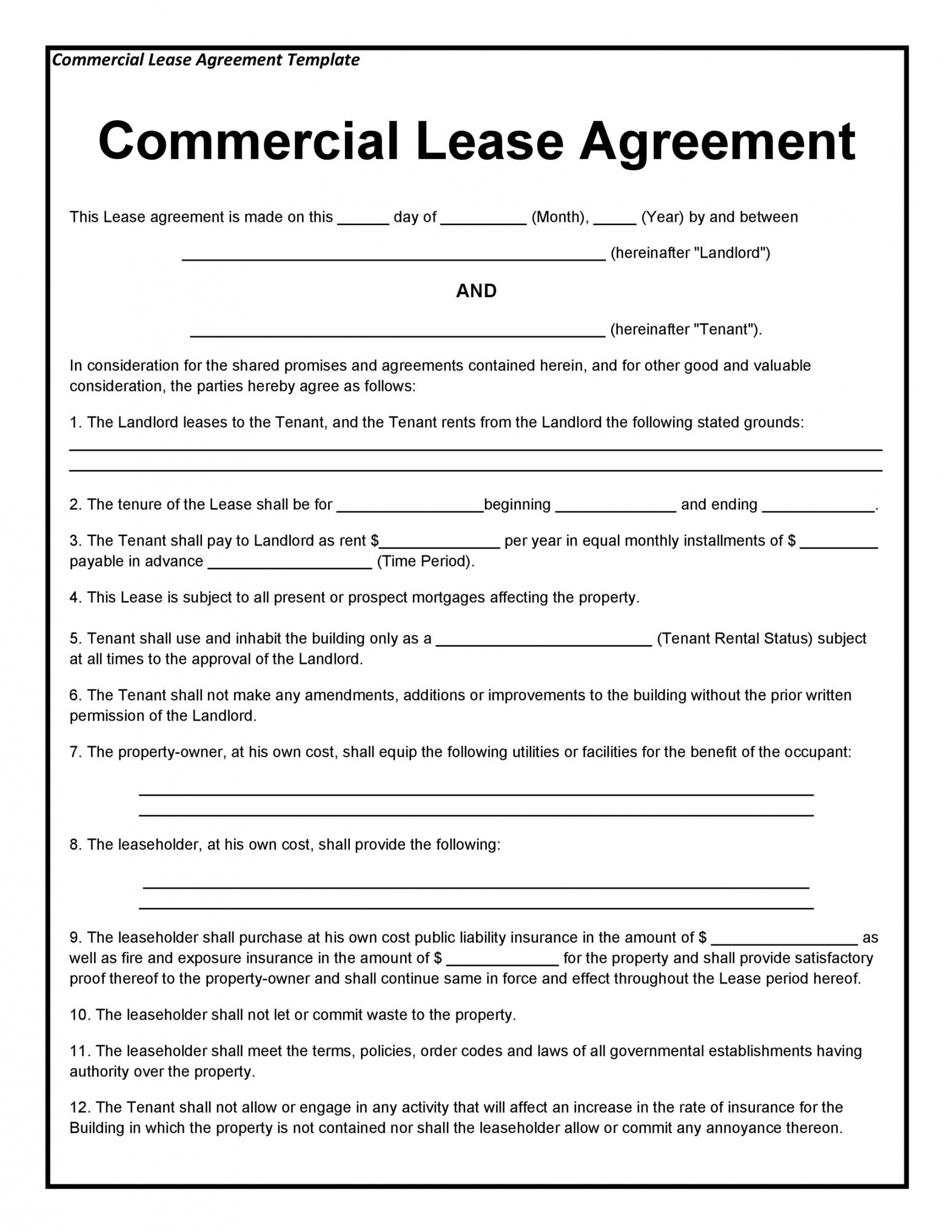

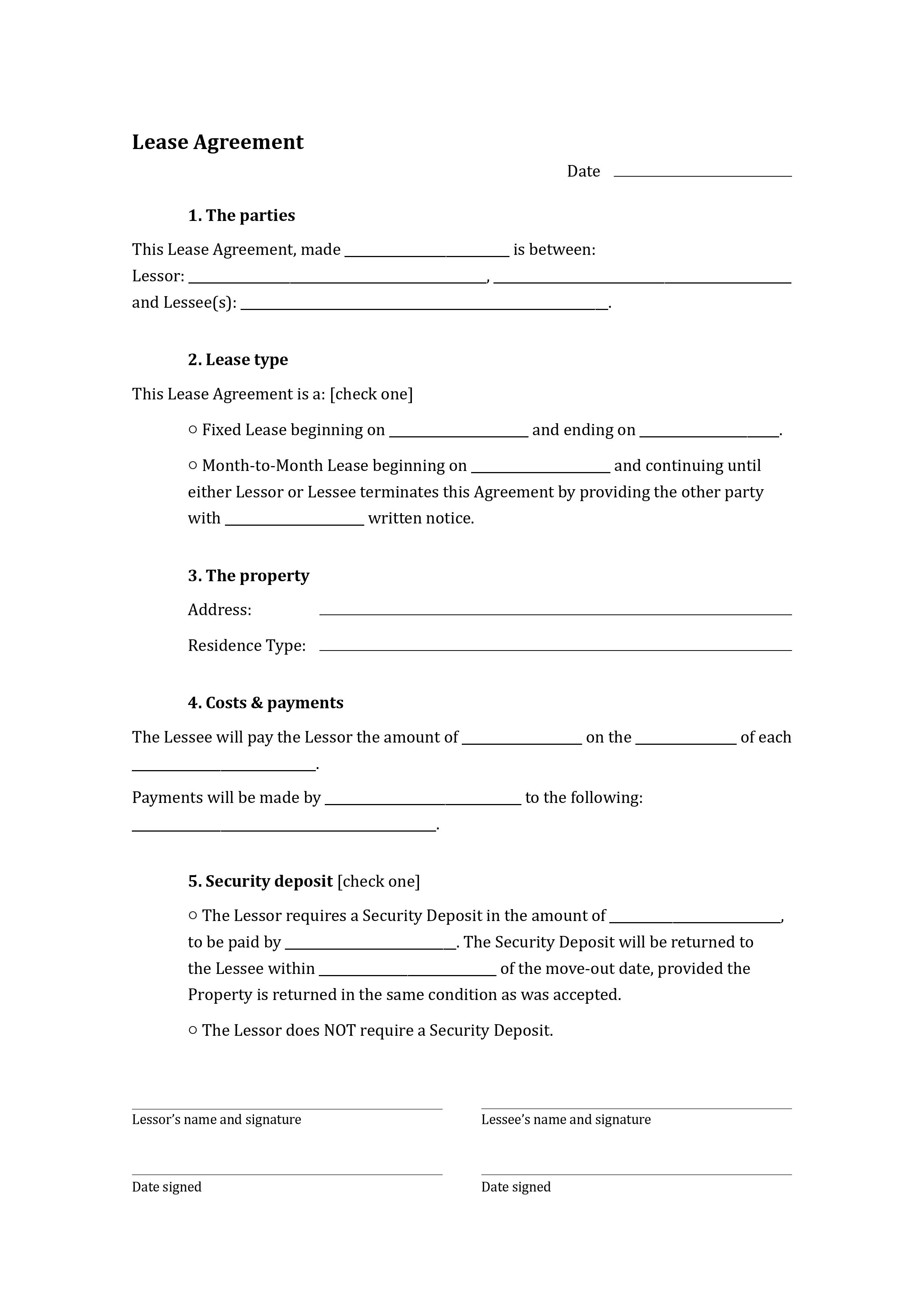

A commercial real estate rental contract, also known as a lease agreement, is a legally binding document that outlines the terms and conditions of the rental arrangement between a landlord and a tenant. It serves as a comprehensive guide, ensuring both parties are aware of their rights, responsibilities, and obligations during the tenancy period.

Key Components of a Commercial Real Estate Rental Contract

- Property Details: The contract should include a detailed description of the property, including its address, square footage, and any unique features or amenities.

- Rent and Payment Terms: Clearly specify the rent amount, due dates, and acceptable payment methods. Also, consider including provisions for late fees, security deposits, and any additional charges.

- Lease Term: Specify the duration of the lease, whether it's a short-term or long-term agreement. Discuss renewal options and the process for extending the lease.

- Use and Occupancy: Define the permitted use of the property. Commercial leases often allow for a variety of business operations, but it's crucial to specify any restrictions or limitations.

- Maintenance and Repairs: Outline the responsibilities of both parties regarding maintenance and repairs. Determine who is responsible for routine maintenance, emergency repairs, and major renovations.

- Insurance and Liability: Ensure the contract includes provisions for insurance coverage, detailing the type and amount of insurance required. Also, address liability issues, including indemnification clauses, to protect both parties.

- Subletting and Assignment: Decide whether the tenant has the right to sublet or assign the lease to another party. If permitted, include conditions and restrictions to protect the landlord's interests.

- Default and Termination: Outline the circumstances that could lead to a default, such as non-payment of rent or breach of contract. Specify the steps for termination and the consequences for either party.

- Renewal and Options: Discuss the tenant's right to renew the lease and any options for renegotiating the terms. Include a timeline for providing notice of renewal or termination.

- Legal and Miscellaneous Provisions: Cover legal matters, such as governing law, dispute resolution, and attorney fees. Additionally, address any other relevant issues, such as signage, alterations, and parking.

Tips for Landlords

- Ensure the contract is comprehensive and covers all essential aspects of the rental arrangement.

- Seek legal advice to draft a contract that protects your interests and complies with local laws and regulations.

- Be transparent and communicate any potential issues or restrictions to prospective tenants.

- Consider offering incentives or flexible terms to attract and retain desirable tenants.

Tips for Tenants

- Carefully review the contract, ensuring you understand all terms and conditions.

- Negotiate favorable terms, especially regarding rent, lease duration, and renewal options.

- Seek legal advice if needed to clarify any complex provisions or to address your specific business needs.

- Maintain open communication with the landlord to address any concerns or issues that may arise during the tenancy.

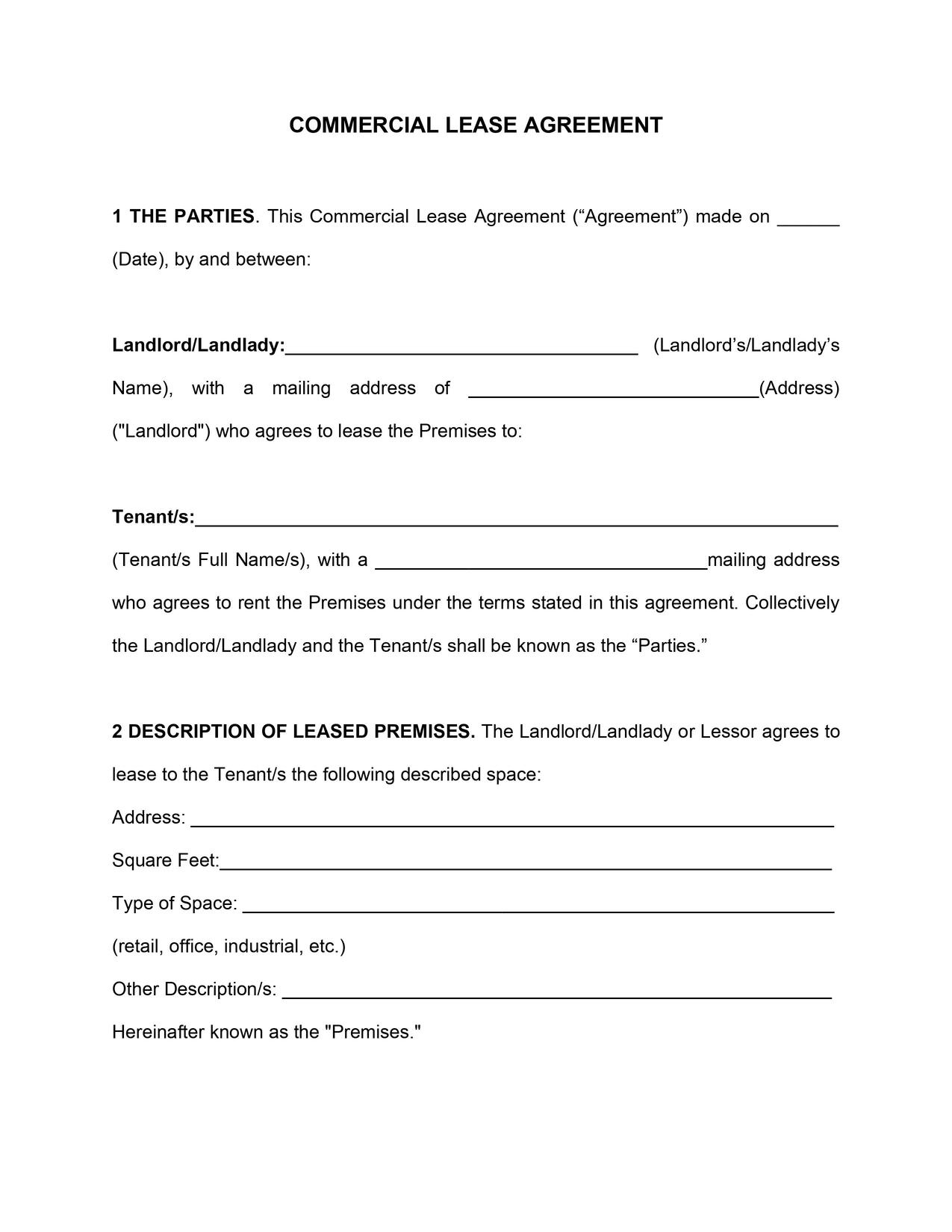

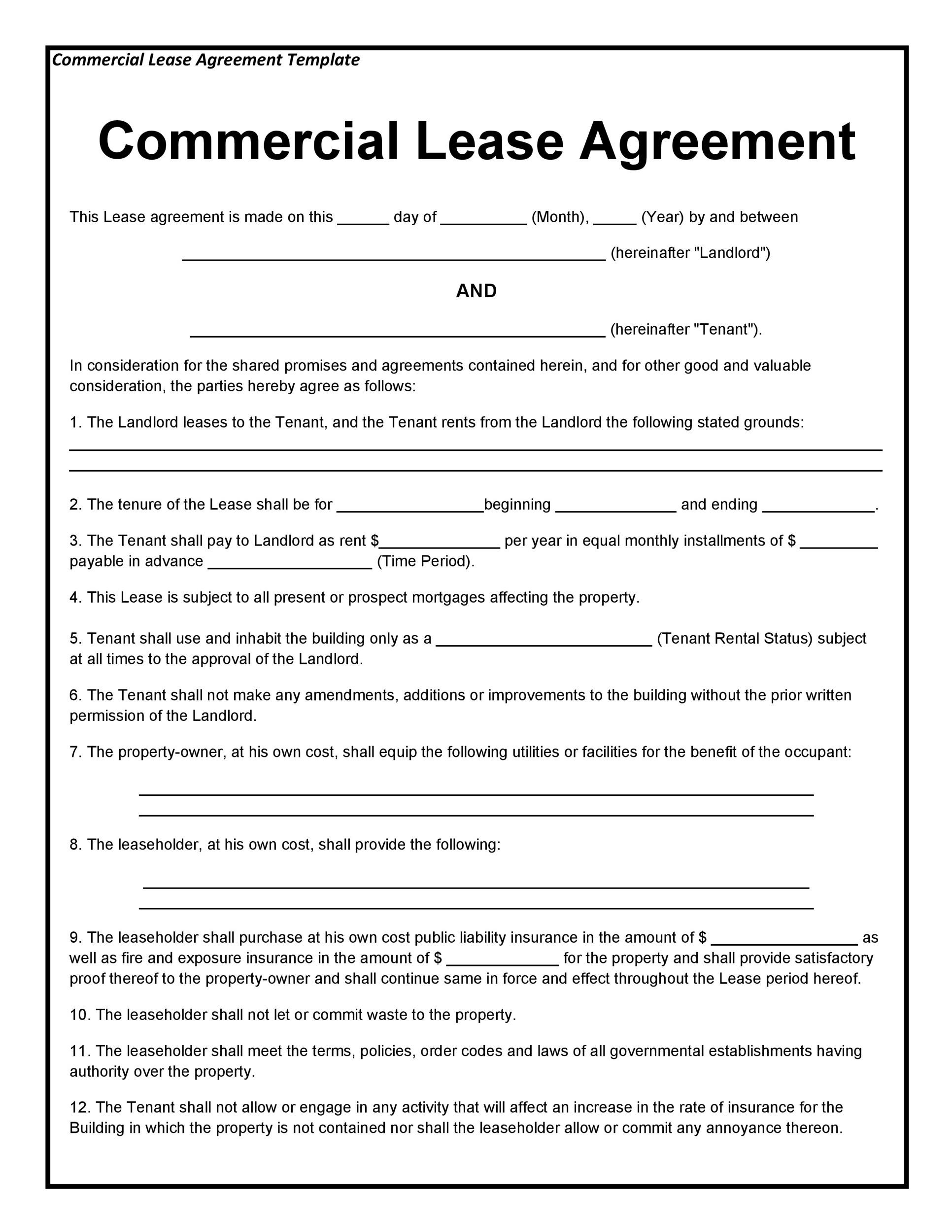

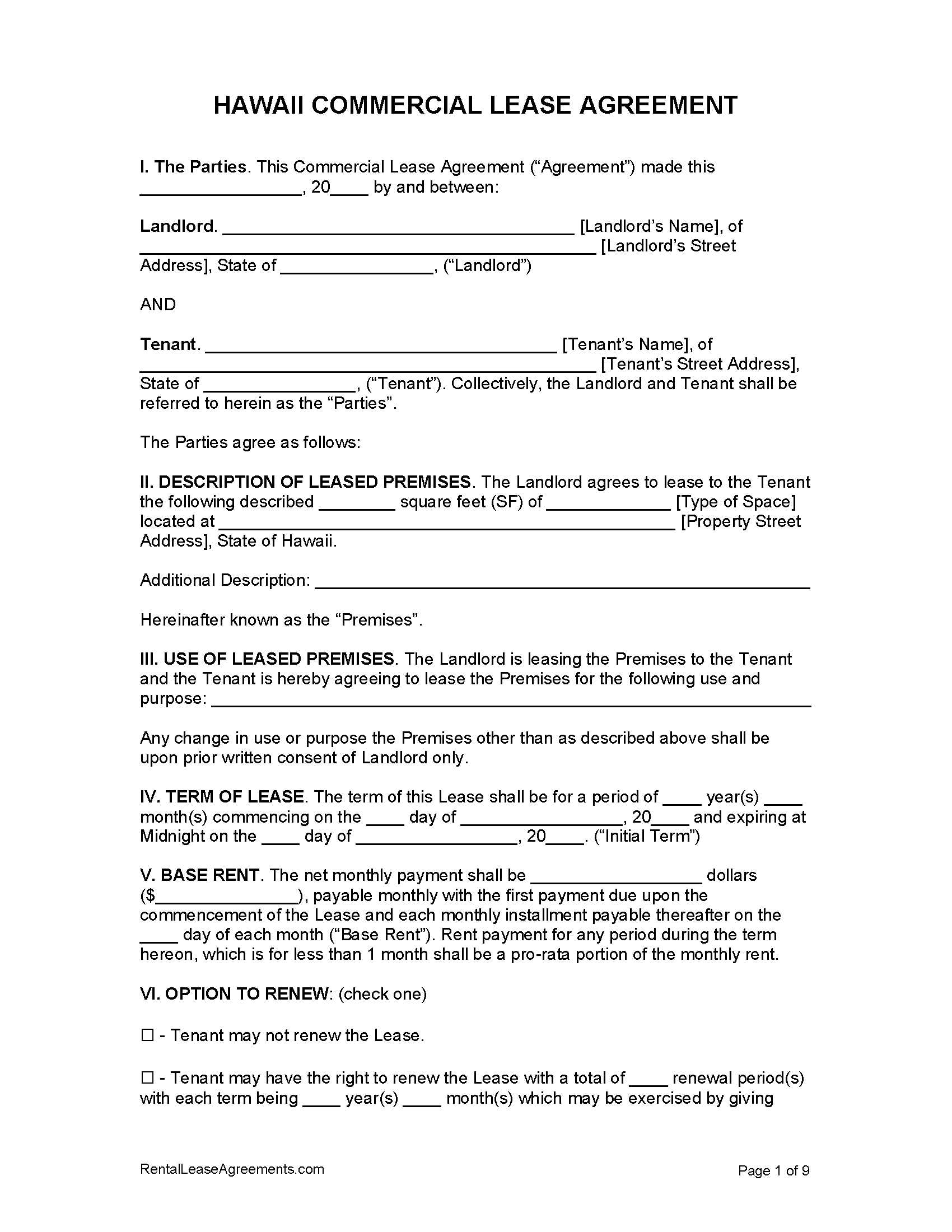

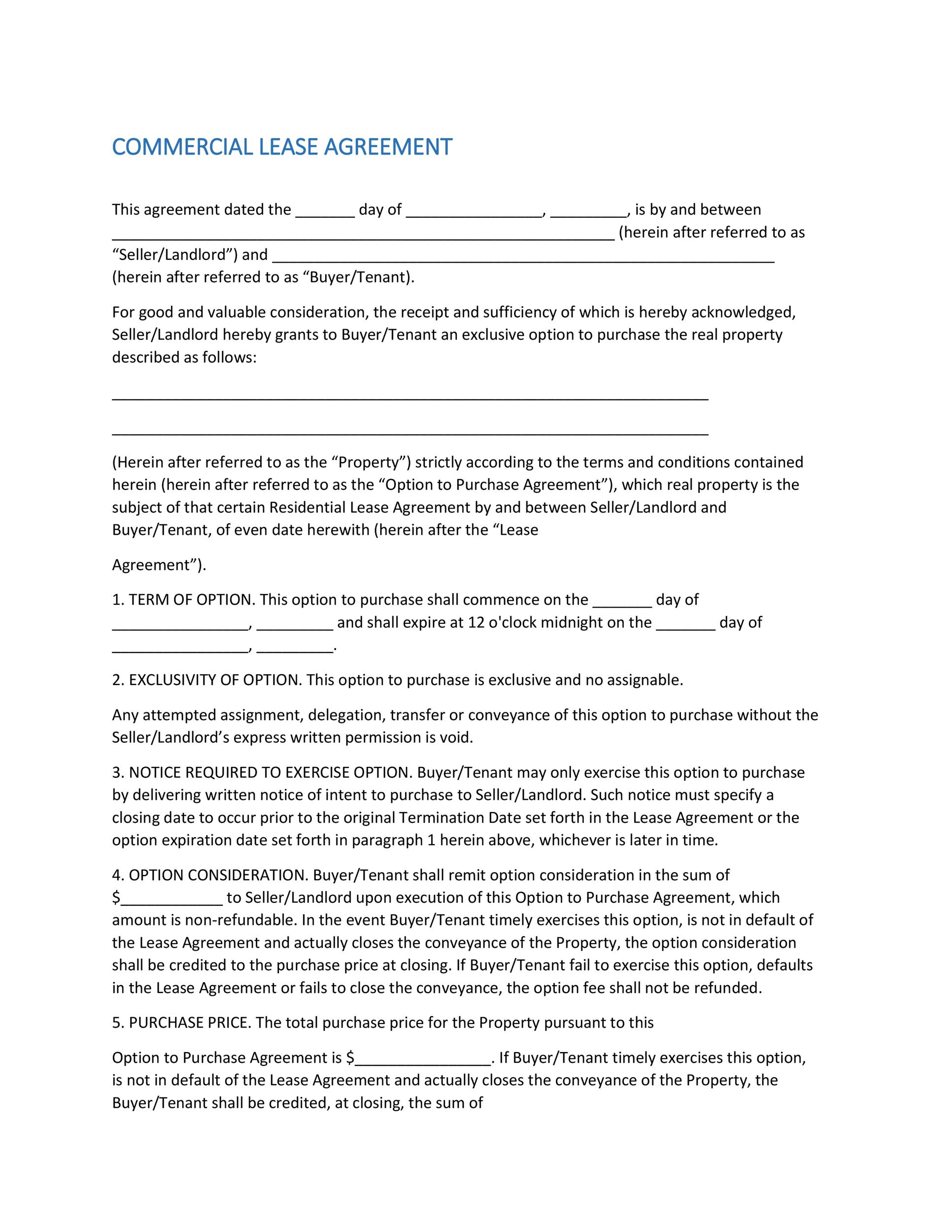

Sample Commercial Real Estate Rental Contract

To provide a better understanding, here's a simplified sample commercial real estate rental contract. Please note that this is for illustrative purposes only and may not cover all aspects of a comprehensive lease agreement.

| Property Address | 123 Main Street, City, State, ZIP |

|---|---|

| Lease Term | 3 years, with a 2-year renewal option |

| Rent | $2,500 per month, due on the 1st of each month |

| Security Deposit | $5,000 (to be returned at the end of the lease, minus any deductions for damages) |

| Use and Occupancy | Office space for a technology startup |

| Maintenance and Repairs | Landlord is responsible for major repairs and maintenance of the building's structure. Tenant is responsible for routine maintenance and repairs within the leased space. |

| Insurance and Liability | Tenant must obtain commercial general liability insurance with a minimum of $1 million in coverage. Landlord must provide proof of property insurance. |

| Subletting and Assignment | Tenant may sublet the space with the landlord's written consent. Assignment of the lease is not permitted without the landlord's approval. |

| Default and Termination | Landlord may terminate the lease if the tenant fails to pay rent for 30 days or breaches any other material terms. Tenant may terminate with 60 days' notice if the landlord fails to maintain the property. |

| Renewal and Options | Tenant has the option to renew the lease for an additional 2 years at a 5% increase in rent. Notice of renewal must be provided 90 days prior to the lease expiration. |

Additional Considerations

- Environmental Concerns: Address any potential environmental issues, such as hazardous materials or contamination, and include provisions for testing and remediation.

- Alterations and Improvements: Specify whether the tenant can make alterations or improvements to the property and under what conditions. Include a process for obtaining approval and any requirements for returning the property to its original state.

- Common Area Maintenance: Clarify the tenant's responsibility for common area maintenance, including costs and any specific obligations.

- Utilities: Determine who is responsible for paying utilities, including electricity, water, and internet services.

- Signage and Advertising: Discuss the tenant's right to display signage and advertise their business on the property.

- Key Handover and Inspection: Outline the process for handing over keys and conducting a joint inspection of the property at the beginning and end of the lease term.

🚨 Note: This blog post provides a general overview of commercial real estate rental contracts. It is essential to consult legal professionals for specific advice tailored to your situation.

Conclusion

Commercial real estate rental contracts are intricate documents that require careful consideration and legal expertise. By understanding the key components and following the tips provided, landlords and tenants can navigate the rental process with confidence. Remember, a well-drafted lease agreement is the foundation for a successful and harmonious tenancy.

FAQ

What happens if the tenant wants to make alterations to the property?

+

The lease agreement should specify the conditions under which tenants can make alterations or improvements. Typically, tenants must obtain written consent from the landlord and may be required to return the property to its original state upon lease termination.

Can the landlord increase the rent during the lease term?

+

Rent increases are usually addressed in the lease agreement. Landlords may have the right to increase rent, but the terms and conditions should be clearly outlined. It’s important to review the lease to understand the specific provisions regarding rent increases.

What happens if the tenant needs to break the lease early?

+

Early lease termination can be a complex issue. The lease agreement should specify the circumstances under which the tenant can break the lease and any penalties or fees that may apply. It’s crucial to review the terms and consider seeking legal advice if necessary.

How can tenants protect themselves from unexpected repairs or maintenance issues?

+

Tenants can negotiate maintenance and repair provisions in the lease agreement. It’s advisable to clearly define the responsibilities of both parties and include a process for addressing emergency repairs. Additionally, tenants can consider obtaining rental insurance to protect themselves from potential financial losses.

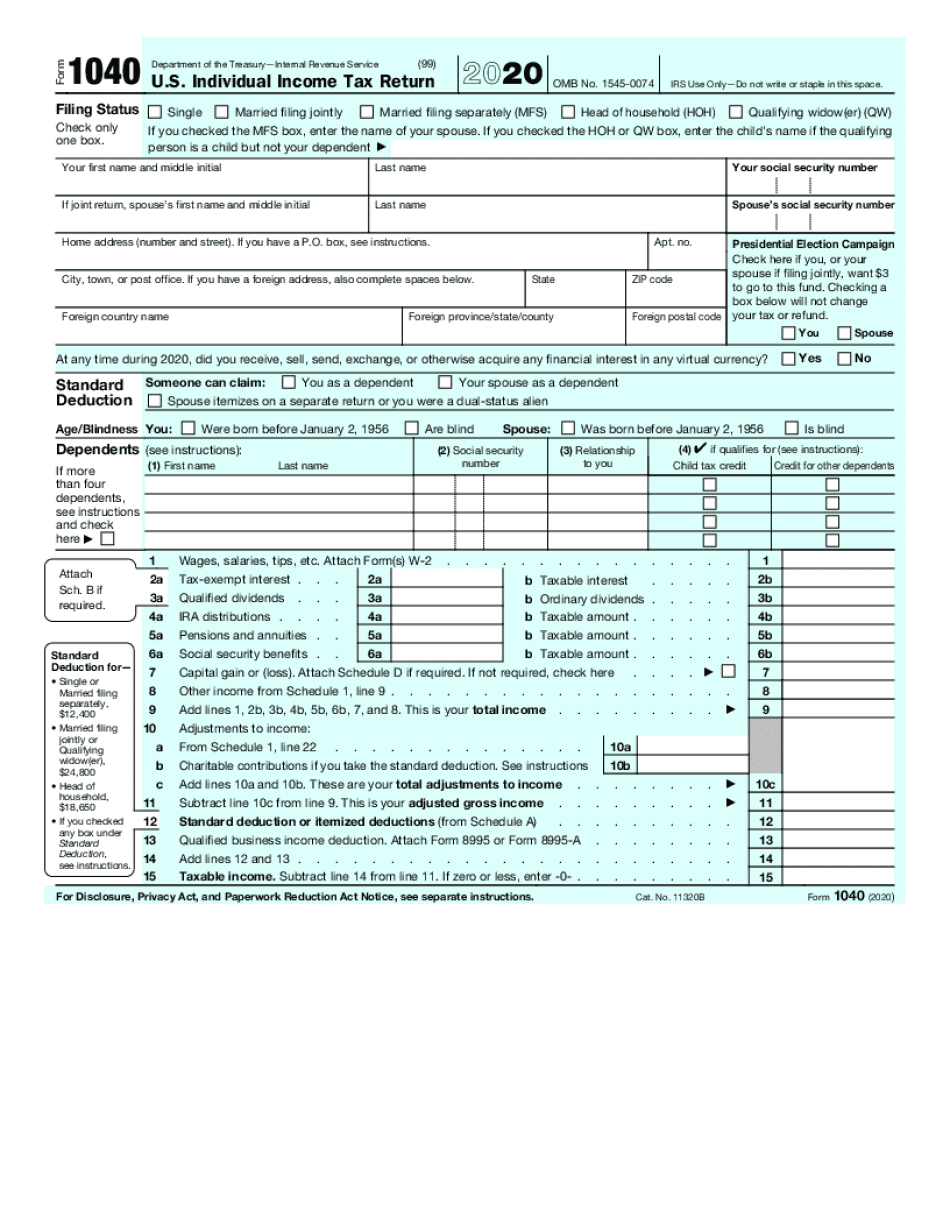

Are there any tax implications for commercial real estate rentals?

+

Yes, there may be tax implications for both landlords and tenants. Landlords may need to pay property taxes, while tenants may be able to deduct rental expenses from their business taxes. It’s essential to consult tax professionals to understand the specific tax obligations and benefits associated with commercial real estate rentals.