Understanding compound interest is crucial for anyone looking to grow their wealth over time. It's a powerful concept that can significantly impact your financial future. In this blog post, we'll delve into seven perfect formulas to calculate compound interest and explore how they can help you make informed decisions about your investments.

The Basics of Compound Interest

Compound interest is the interest calculated on the initial principal amount and the accumulated interest from previous periods. In simpler terms, it's the interest earned on interest, making it a powerful tool for wealth accumulation. Unlike simple interest, which is calculated only on the principal amount, compound interest has the potential to snowball your savings or investments.

The frequency of compounding, whether it's annually, semi-annually, quarterly, monthly, or even daily, plays a significant role in the final amount. The more frequent the compounding, the higher the final amount, as interest is earned on a larger balance.

Formula 1: Annual Compound Interest

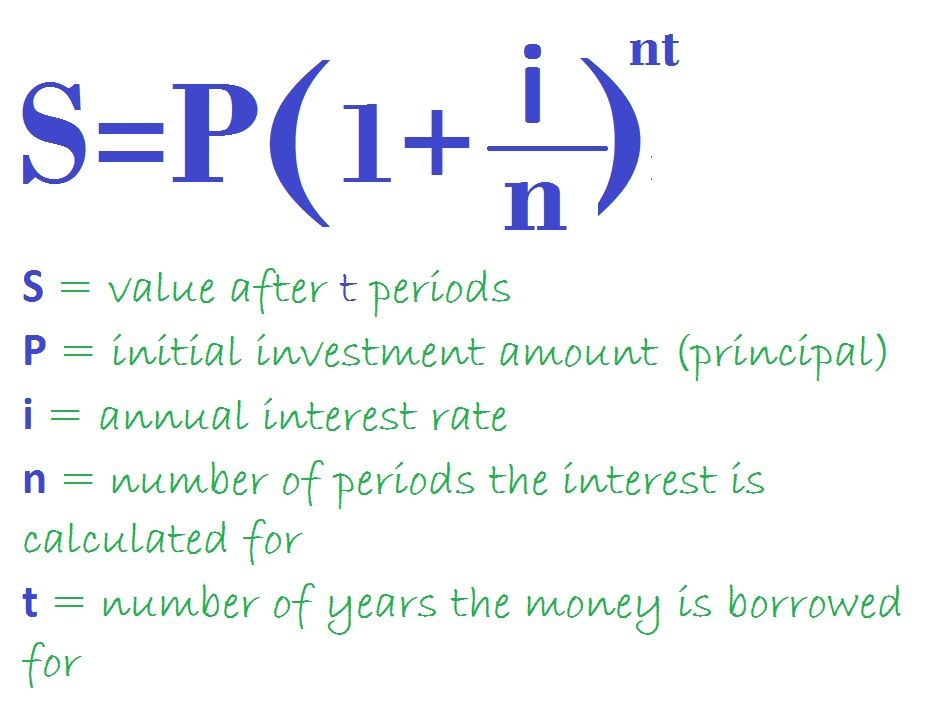

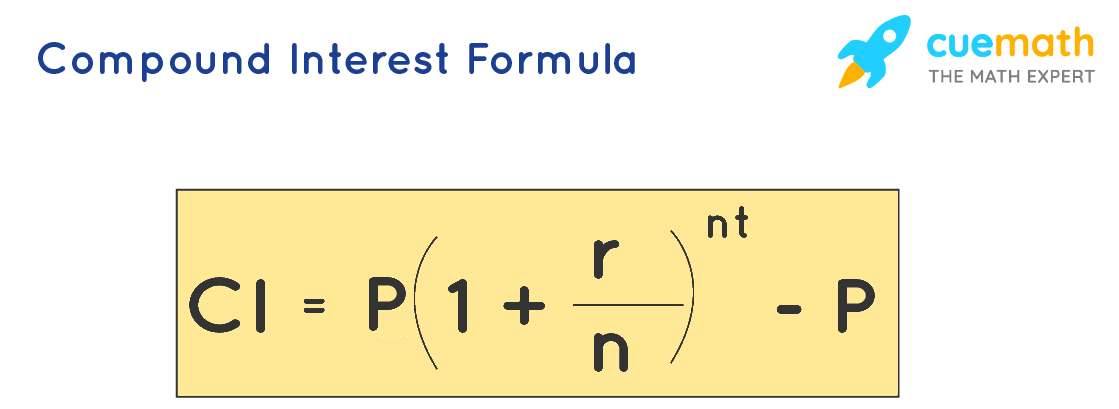

The most basic compound interest formula calculates the future value of an investment with annual compounding. The formula is as follows:

Future Value (FV) = P(1 + r/n)^(nt)

- P represents the principal amount.

- r is the annual interest rate (in decimal form).

- n is the number of times interest is compounded per year (for annual compounding, n = 1).

- t is the number of years.

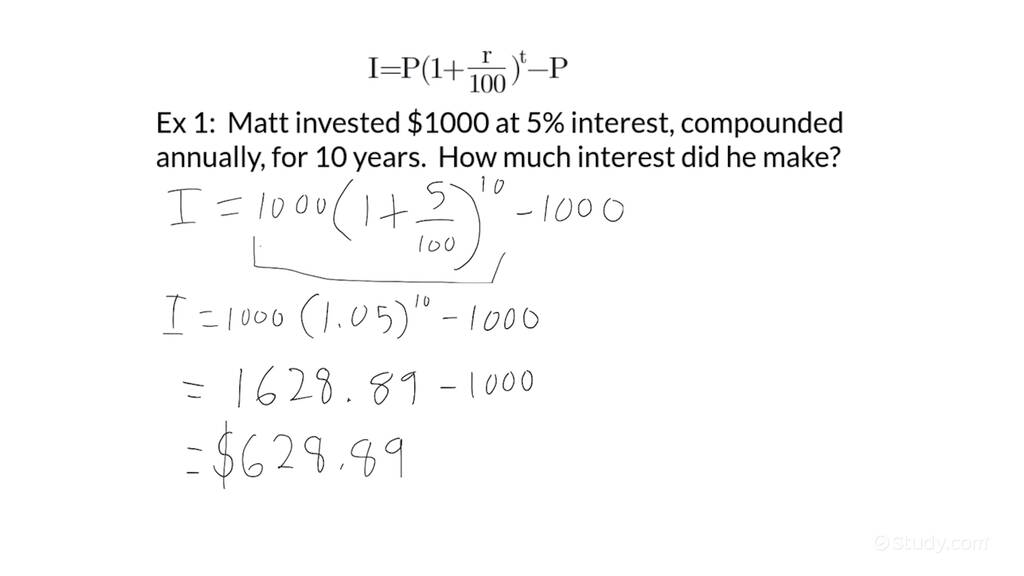

Let's say you invest $1,000 at an annual interest rate of 5% for 3 years. The formula would be:

FV = $1000(1 + 0.05/1)^(1*3) = $1157.63

Formula 2: Semi-Annual Compound Interest

When interest is compounded semi-annually, the formula adjusts slightly:

FV = P(1 + r/(n*2))^(n*2*t)

Using the same example, if the interest is compounded semi-annually, the formula becomes:

FV = $1000(1 + 0.05/(1*2))^(1*2*3) = $1159.54

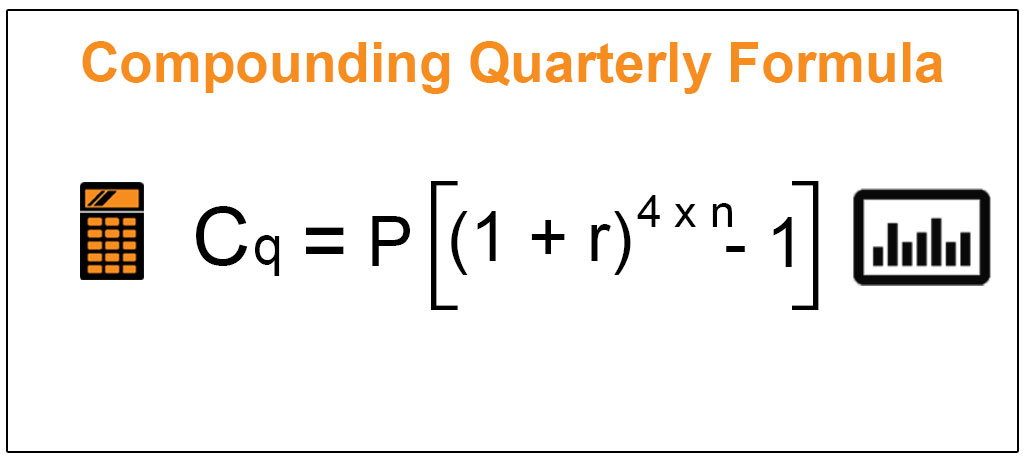

Formula 3: Quarterly Compound Interest

For quarterly compounding, the formula is:

FV = P(1 + r/(n*4))^(n*4*t)

With quarterly compounding, the $1,000 investment at 5% interest for 3 years results in:

FV = $1000(1 + 0.05/(1*4))^(1*4*3) = $1161.80

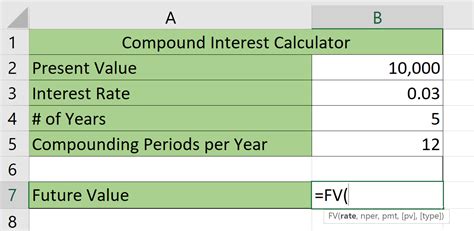

Formula 4: Monthly Compound Interest

Monthly compounding is a common practice, and the formula is:

FV = P(1 + r/(n*12))^(n*12*t)

For monthly compounding, the future value is:

FV = $1000(1 + 0.05/(1*12))^(1*12*3) = $1163.93

Formula 5: Daily Compound Interest

Daily compounding is the most frequent and offers the highest future value. The formula is:

FV = P(1 + r/365)^(365*t)

With daily compounding, the $1,000 investment at 5% interest for 3 years becomes:

FV = $1000(1 + 0.05/365)^(365*3) = $1165.10

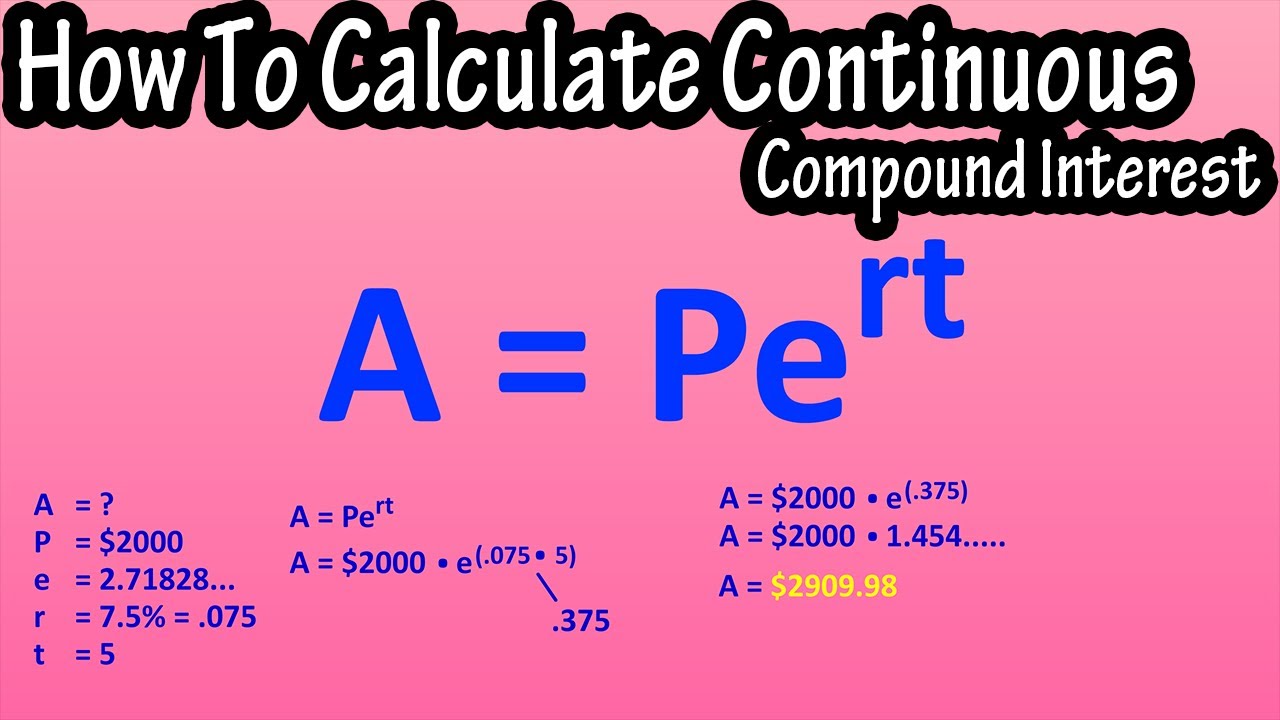

Formula 6: Continuous Compound Interest

In the limit as the number of compounding periods per year goes to infinity, continuous compounding is achieved. The formula is:

FV = Pe^(rt)

Using continuous compounding, the future value is:

FV = $1000e^(0.05*3) = $1165.43

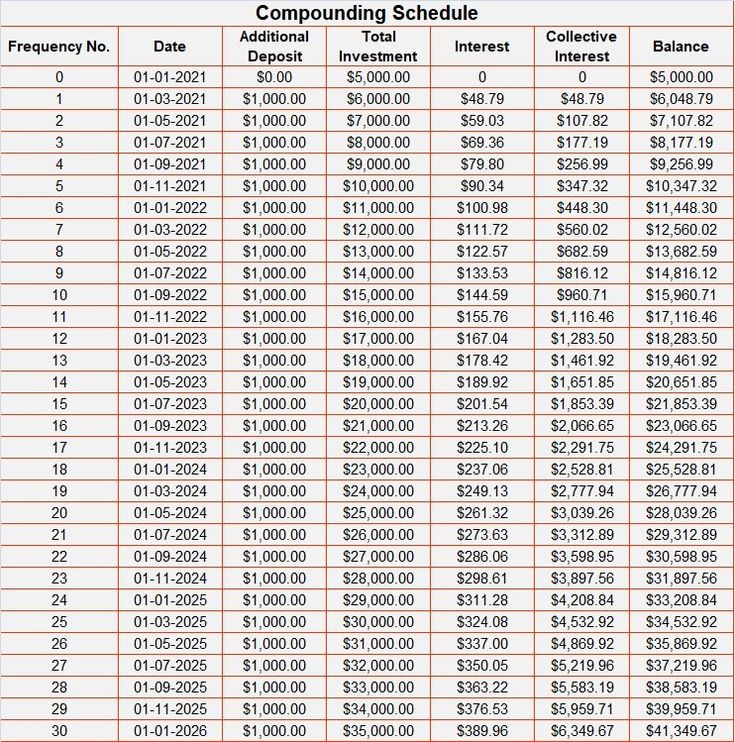

Formula 7: Compound Interest with Regular Deposits

If you make regular deposits, the formula changes to account for the additional contributions. The formula is:

FV = P(1 + r/n)^(nt) + D[(1 + r/n)^(nt) - 1] / (r/n)

Where D is the regular deposit amount.

Let's say you invest $1,000 initially and then deposit an additional $100 per year at an annual interest rate of 5% for 3 years. The formula becomes:

FV = $1000(1 + 0.05/1)^(1*3) + $100[(1 + 0.05/1)^(1*3) - 1] / (0.05/1) = $1376.65

Key Considerations and Notes

💡 Note: Always ensure you understand the compounding frequency and the applicable interest rate when dealing with compound interest calculations.

💰 Pro Tip: Compound interest is most effective when you start early and let your investments grow over an extended period.

⚠️ Warning: Be cautious of high-interest loans or debts, as compound interest can work against you in those cases.

Compound interest is a powerful financial tool, and understanding these formulas can help you make informed decisions about your savings and investments. Remember, the frequency of compounding and the time horizon play significant roles in the final outcome.

Conclusion

In this blog post, we've explored seven essential formulas for calculating compound interest, each tailored to different compounding frequencies. By applying these formulas, you can better understand the potential growth of your investments and make more strategic financial choices. Whether you're saving for retirement, planning for a large purchase, or managing debt, compound interest is a concept that can significantly impact your financial journey.

FAQ

What is the difference between simple and compound interest?

+

Simple interest is calculated only on the principal amount, while compound interest is calculated on the principal and the accumulated interest from previous periods.

How does the compounding frequency affect the final amount?

+

The more frequent the compounding, the higher the final amount, as interest is earned on a larger balance.

Can compound interest work against me?

+

Yes, if you have high-interest loans or debts, compound interest can increase the amount you owe over time.

When is the best time to start investing to benefit from compound interest?

+

The earlier you start investing, the more time your money has to grow, and the more significant the impact of compound interest.