The Army Reserve is an integral part of the military, offering individuals the opportunity to serve their country while maintaining a civilian career. One of the key considerations for Army Reserve members is their compensation, which includes a combination of basic pay, special pays, and various allowances. Developing an effective pay strategy can help individuals maximize their earnings and make the most of their service.

Understanding Army Reserve Pay Structure

Before delving into the pay strategy, it's crucial to grasp the fundamentals of Army Reserve pay. The compensation structure is designed to recognize the commitment and dedication of Reserve soldiers. Here's a breakdown of the key components:

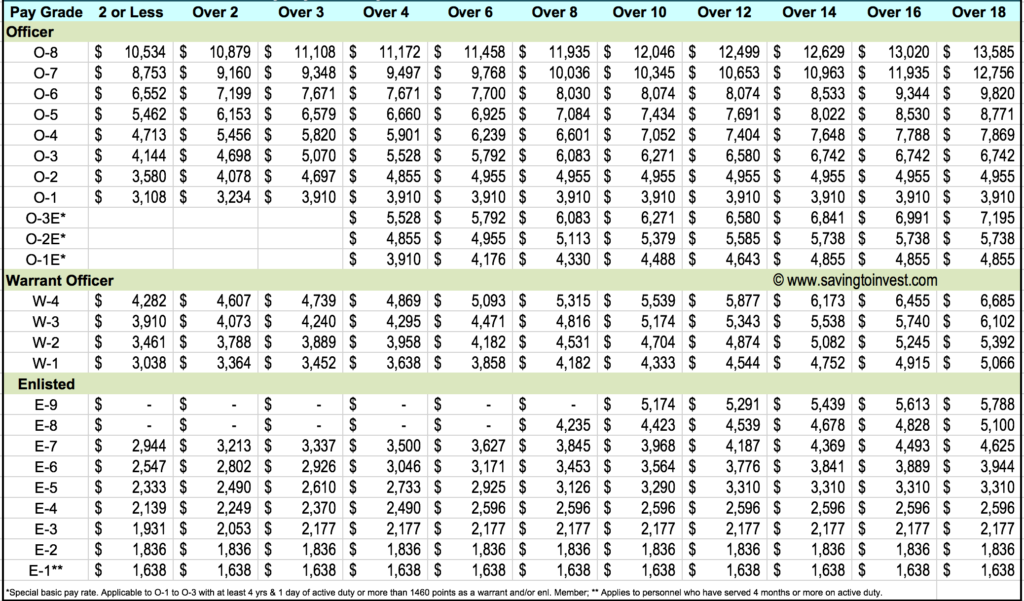

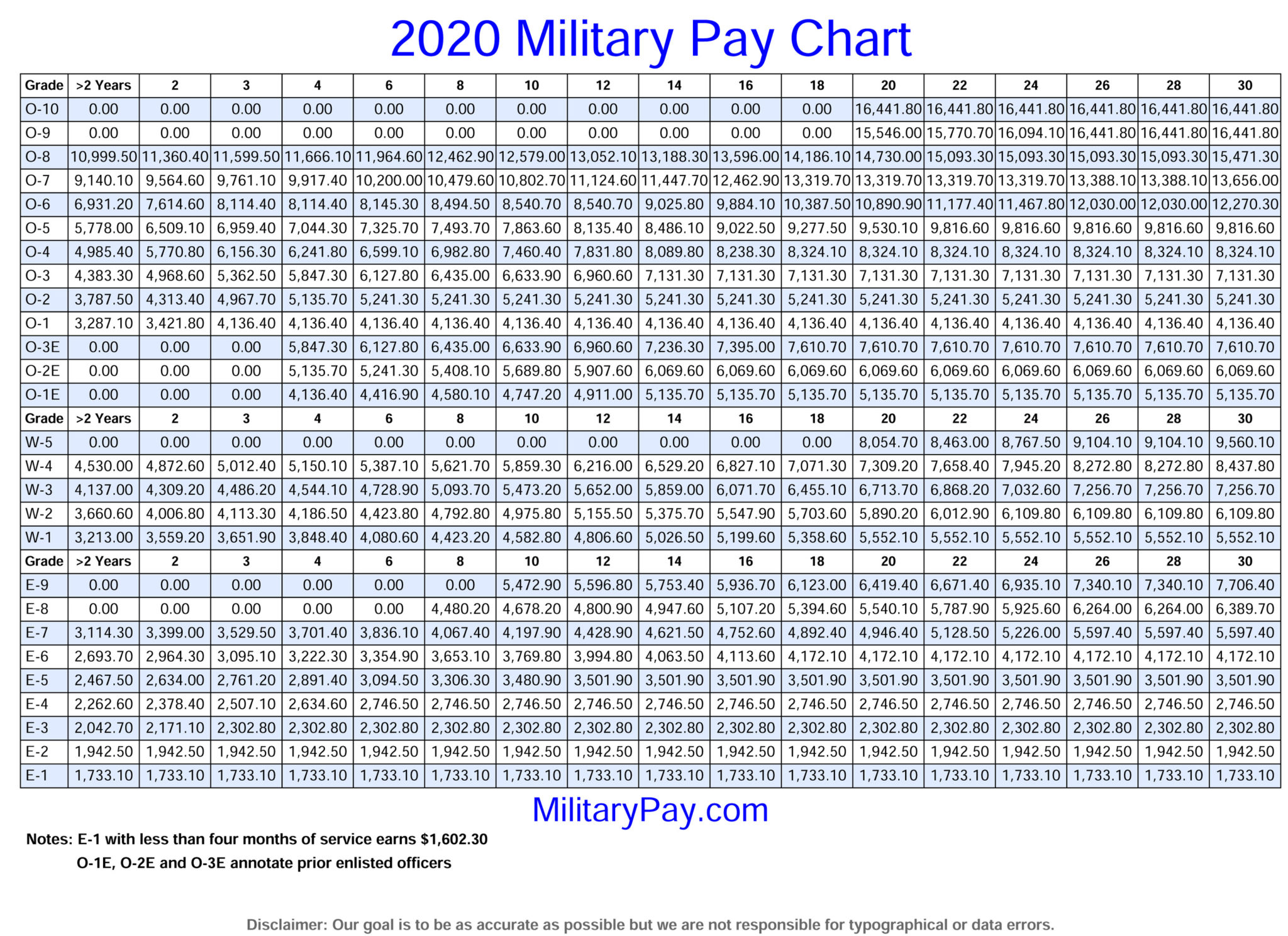

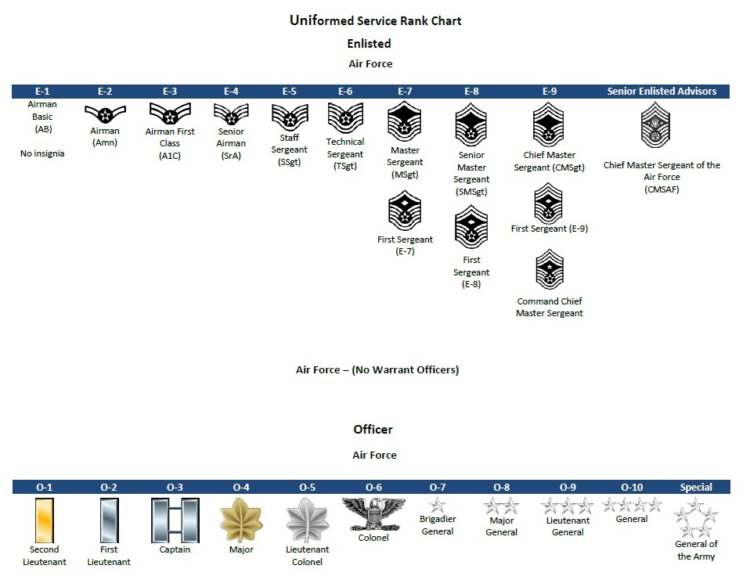

- Basic Pay: This is the primary income for Army Reserve members, calculated based on their rank and years of service. It follows the same pay scale as active-duty soldiers, ensuring a fair and standardized compensation system.

- Special Pays: Army Reserve members may be eligible for additional pays, such as deployment pay, hazardous duty pay, or combat pay. These are designed to recognize the unique challenges and risks associated with certain assignments.

- Allowances: Various allowances are provided to cover specific expenses, such as housing, subsistence, and clothing. These allowances help Reserve soldiers manage their financial obligations effectively.

Maximizing Basic Pay

Basic pay forms the foundation of an Army Reserve member's income. To maximize this component, consider the following strategies:

- Promotions: Advancing in rank is a sure way to increase basic pay. Focus on professional development, seek out leadership opportunities, and aim for promotions within the Reserve. Regularly review the promotion guidelines and requirements to stay on track.

- Drill Attendance: Army Reserve members are typically required to attend monthly drills and annual training. Ensuring consistent attendance not only fulfills your service obligations but also maintains your eligibility for basic pay. Aim for a perfect attendance record to maximize your earnings.

- Additional Duties: Volunteering for additional duties or assignments can lead to increased basic pay. These opportunities may include serving as a training instructor, participating in specialized teams, or taking on temporary leadership roles. Not only do these assignments enhance your skills and experience, but they also provide a financial boost.

Exploring Special Pays

Special pays are an essential aspect of Army Reserve compensation, providing additional income for specific assignments or duties. Here's how to make the most of these opportunities:

- Deployment Pay: When deployed for active duty, Army Reserve members are entitled to deployment pay. This additional income recognizes the challenges and risks associated with serving in a deployed environment. Ensure you understand the deployment pay rates and eligibility criteria to maximize your earnings during these periods.

- Hazardous Duty Pay: Army Reserve members assigned to hazardous duty areas may be eligible for hazardous duty pay. This pay recognizes the increased risk and physical demands of certain assignments. Stay informed about the criteria for hazardous duty pay and advocate for yourself if you believe you meet the requirements.

- Combat Pay: Soldiers serving in combat zones are entitled to combat pay, which is designed to compensate for the inherent dangers and stresses of combat operations. If you are deployed to a combat zone, ensure you receive the appropriate combat pay. This additional income can significantly boost your overall compensation.

Optimizing Allowances

Allowances are an important part of Army Reserve pay, covering essential expenses such as housing, food, and clothing. To make the most of these allowances, consider the following tips:

- Housing Allowance: The Basic Allowance for Housing (BAH) is designed to cover the cost of off-base housing. To maximize this allowance, research and compare housing options in your duty station area. Consider sharing housing with fellow soldiers or exploring cost-effective alternatives such as renting a room or finding a roommate. This can help stretch your BAH further.

- Subsistence Allowance: The Basic Allowance for Subsistence (BAS) is provided to cover the cost of meals when not on government-provided rations. To make the most of this allowance, plan your meals carefully and consider cooking at home instead of eating out frequently. This simple step can help you save a significant portion of your BAS.

- Clothing Allowance: The Clothing Allowance is provided to cover the cost of military uniforms and other required clothing items. To optimize this allowance, plan your purchases wisely. Research and compare prices for military clothing, and consider buying in bulk or during sales to get the best value for your money.

Utilizing Tax Benefits

Army Reserve members are eligible for various tax benefits, which can significantly impact their overall compensation. Here's how to make the most of these opportunities:

- Military Tax Exemptions: Army Reserve members may be eligible for certain tax exemptions, such as the exclusion of basic pay from federal income tax. Stay informed about the available tax exemptions and ensure you claim them correctly when filing your taxes. Consult with a tax professional or use reliable tax preparation software to maximize your tax benefits.

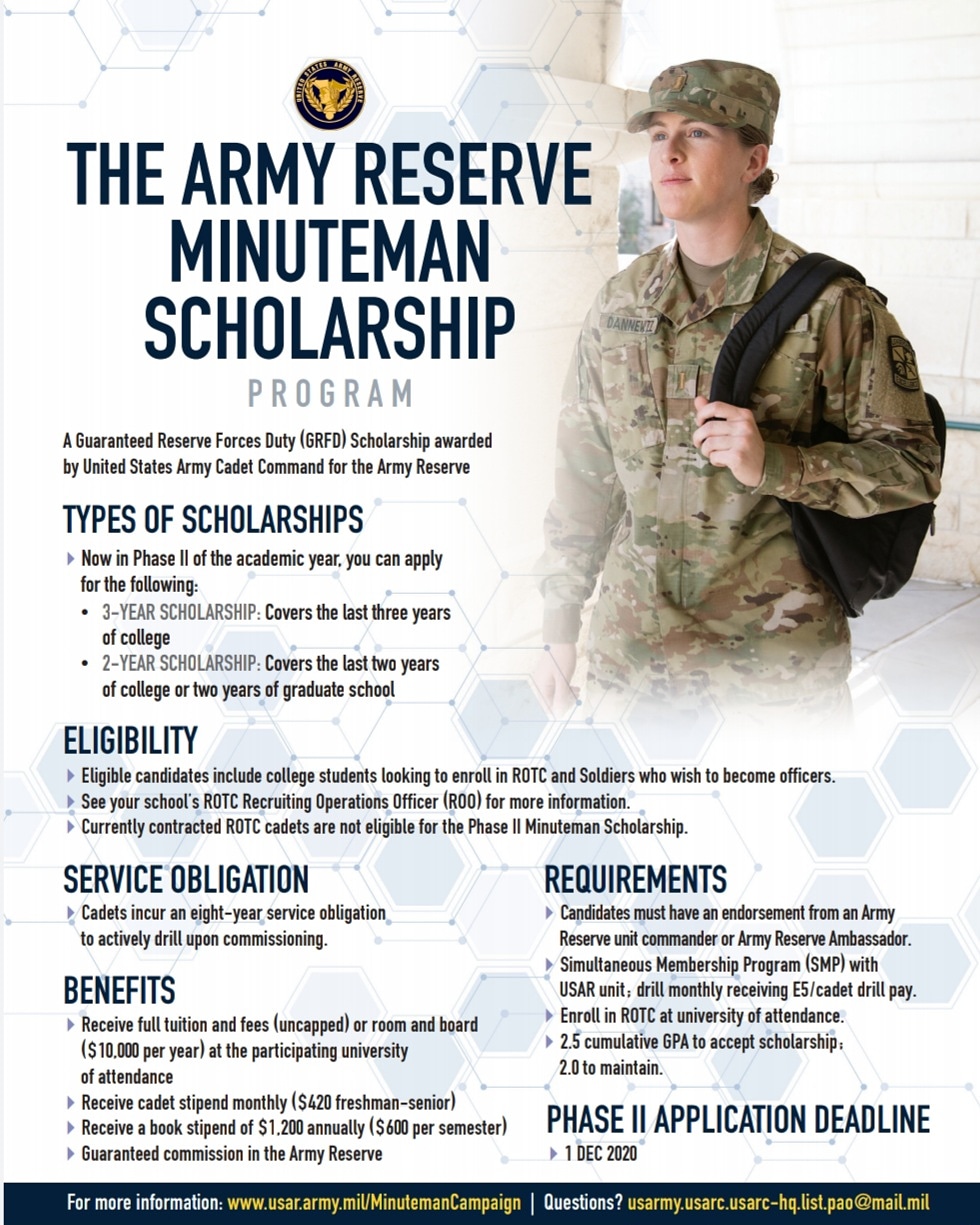

- Education Tax Benefits: Many Army Reserve members pursue higher education while serving. Take advantage of education tax benefits such as the GI Bill or tuition assistance programs. These benefits can help cover the cost of tuition, books, and other educational expenses, making your military service more financially rewarding.

Planning for Retirement

Army Reserve service can also lead to a comfortable retirement. Here's how to plan effectively for your post-military life:

- Retirement Pay: Army Reserve members who meet the eligibility requirements can receive retirement pay after completing a certain number of years of service. Understand the retirement pay calculation and the factors that impact it, such as your rank, years of service, and retirement points. Plan your service strategically to maximize your retirement pay.

- Thrift Savings Plan (TSP): The TSP is a retirement savings and investment plan available to Army Reserve members. Contribute regularly to your TSP account to build a substantial retirement fund. Consider the different investment options and allocate your contributions wisely to align with your financial goals and risk tolerance.

Financial Management and Budgeting

Effective financial management is crucial to making the most of your Army Reserve pay. Consider the following strategies:

- Create a Budget: Develop a comprehensive budget that outlines your income, expenses, and savings goals. This will help you allocate your pay efficiently and identify areas where you can cut back or save more. Regularly review and adjust your budget to reflect your changing financial situation and goals.

- Automate Your Savings: Set up automatic transfers from your paychecks to your savings or investment accounts. This disciplined approach ensures that you consistently save a portion of your income without having to remember to do it manually.

- Build an Emergency Fund: Unexpected expenses can arise, so it's essential to have an emergency fund. Aim to save enough to cover at least three to six months' worth of living expenses. This fund will provide a financial safety net and reduce the need to dip into your regular savings or take on debt during unforeseen circumstances.

Utilizing Military Discounts

Army Reserve members are often eligible for various military discounts, which can help stretch your pay further. Here's how to make the most of these opportunities:

- Retail and Entertainment Discounts: Many retailers, restaurants, and entertainment venues offer military discounts. Research and compile a list of these discounts, and make it a habit to ask for the military rate whenever you make a purchase or plan an outing. These savings can add up over time and significantly impact your overall financial well-being.

- Travel Discounts: Army Reserve members and their families can take advantage of travel discounts when planning vacations or personal trips. From airline tickets to hotel stays, there are numerous discounts available specifically for military personnel. Plan your travels strategically to maximize these savings and enjoy well-deserved vacations without breaking the bank.

Conclusion

Developing an ultimate Army Reserve pay strategy involves a comprehensive approach that maximizes basic pay, explores special pays, optimizes allowances, utilizes tax benefits, plans for retirement, and practices effective financial management. By implementing these strategies and staying informed about the various compensation components, Army Reserve members can make the most of their service and achieve financial security. Remember, a well-planned pay strategy can set you up for success both during and after your military career.

How often are Army Reserve members paid?

+

Army Reserve members are typically paid on a monthly basis, with their pay distributed at regular intervals. The exact payment schedule may vary based on individual circumstances and the nature of their service.

Can Army Reserve members receive educational benefits while serving?

+

Yes, Army Reserve members are eligible for various educational benefits, including the GI Bill and tuition assistance programs. These benefits can help cover the cost of higher education, making it more accessible while serving.

Are there any tax benefits specifically for Army Reserve members?

+

Absolutely! Army Reserve members are entitled to certain tax exemptions, such as the exclusion of basic pay from federal income tax. Additionally, they may qualify for other tax benefits, such as deductions for military-related expenses.