Designing a comprehensive compensation strategy is crucial for attracting and retaining top talent in the competitive field of data science and machine learning. A well-structured compensation package not only motivates employees but also aligns their interests with the organization's goals. In this blog post, we will delve into the key components of a CA PA salary strategy, exploring the various elements that contribute to a successful and competitive compensation plan.

Understanding CA PA Salary Structure

The CA PA (Certified Associate in Project Accounting) role is a critical position within the finance and accounting domain, requiring a unique skill set that combines technical expertise with project management abilities. When constructing a salary strategy for CA PAs, it is essential to consider the following factors:

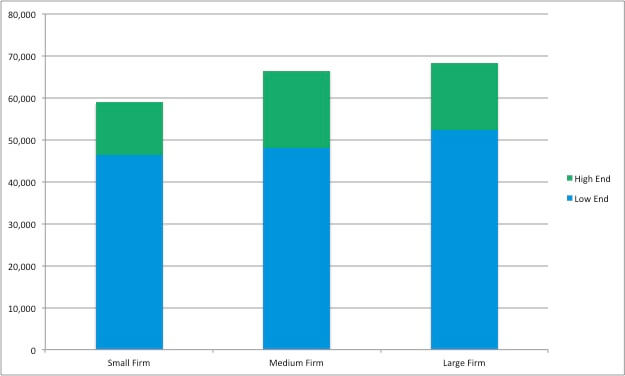

- Industry Benchmarks: Research and analyze industry trends and salary data specific to the CA PA role. This helps in setting a competitive base salary that attracts qualified professionals.

- Experience and Skills: Evaluate the CA PA's experience, certifications, and specialized skills. Offer higher salaries for individuals with extensive experience and expertise in project accounting, as they bring added value to the organization.

- Performance-Based Incentives: Implement performance-based bonuses or profit-sharing plans to motivate CA PAs to deliver exceptional results. These incentives should be tied to key performance indicators (KPIs) relevant to their role, such as project completion rates, accuracy in financial reporting, or successful implementation of cost-saving measures.

- Location and Cost of Living: Consider the geographical location of the position and the associated cost of living. Adjust the salary package accordingly to ensure it remains competitive within the local market.

- Benefits and Perks: In addition to a competitive salary, offer a comprehensive benefits package that includes health insurance, retirement plans, and other perks such as flexible work arrangements or professional development opportunities. These benefits enhance the overall compensation package and improve employee satisfaction.

Key Components of a CA PA Salary Strategy

A comprehensive CA PA salary strategy should encompass the following elements:

Base Salary

The base salary forms the foundation of the compensation package. It should be aligned with industry standards and take into account the CA PA's experience, qualifications, and the cost of living in the designated location. Regular reviews and adjustments should be made to ensure the base salary remains competitive and motivates employees.

Performance Bonuses

Incentivize CA PAs by offering performance-based bonuses. These bonuses can be tied to individual or team performance, with clear goals and metrics set in advance. For example, bonuses could be awarded for successful project completion, meeting financial targets, or implementing innovative cost-saving initiatives.

Profit-Sharing Plans

Implementing a profit-sharing plan is an effective way to align the interests of CA PAs with the organization's financial success. This plan distributes a portion of the company's profits to employees, creating a sense of ownership and encouraging them to drive business growth. The distribution of profits can be based on a formula that considers factors such as tenure, performance, and the overall contribution to the organization's success.

Equity Participation

Offering equity participation or stock options to CA PAs can be a powerful motivator. It provides them with a stake in the company's future and aligns their interests with those of the organization. Equity participation can be structured in various ways, such as granting restricted stock units (RSUs) or stock appreciation rights (SARs), with vesting periods that encourage long-term commitment.

Benefits and Perks

A robust benefits package is an essential component of a CA PA salary strategy. This includes health insurance coverage, retirement plans (such as 401(k) or pension plans), and additional perks like flexible work arrangements, wellness programs, and professional development opportunities. These benefits enhance overall employee satisfaction and contribute to a positive work-life balance.

Creating a Competitive and Fair Compensation Plan

To ensure a competitive and fair compensation plan, consider the following best practices:

- Market Research: Conduct thorough market research to understand salary trends and benchmark compensation against competitors. This helps in setting salaries that are in line with industry standards and attract top talent.

- Regular Salary Reviews: Implement a structured salary review process to assess and adjust salaries based on performance, experience, and market conditions. Regular reviews ensure that employees are fairly compensated and motivated to continue their professional growth.

- Transparent Communication: Foster open communication regarding compensation. Provide employees with clear and transparent information about their salary structure, including base pay, bonuses, and benefits. This builds trust and helps employees understand the value of their contributions.

- Performance Management: Establish a robust performance management system that sets clear goals, provides regular feedback, and recognizes exceptional performance. This ensures that compensation is tied to individual and team achievements, fostering a culture of high performance.

Table: CA PA Salary Structure Example

| Experience Level | Base Salary | Performance Bonus | Profit-Sharing | Equity Participation |

|---|---|---|---|---|

| Entry-Level | $50,000 - $60,000 | Up to 10% of base salary | 2% of profits | RSUs - 500 shares |

| Mid-Level | $65,000 - $80,000 | Up to 15% of base salary | 3% of profits | RSUs - 1,000 shares |

| Senior Level | $85,000 - $100,000 | Up to 20% of base salary | 4% of profits | RSUs - 1,500 shares |

Note: The above table is an example and should be adjusted based on the specific needs and financial situation of the organization.

Notes

ℹ️ Note: The CA PA salary strategy should be flexible and adaptable to the changing needs of the organization and the market. Regular reviews and updates are essential to ensure competitiveness and employee satisfaction.

💡 Tip: When implementing a CA PA salary strategy, consider seeking input from employees to understand their expectations and preferences. This collaborative approach can lead to a more effective and satisfying compensation plan.

In conclusion, a well-designed CA PA salary strategy is crucial for attracting and retaining top talent in the field of project accounting. By offering a competitive base salary, performance-based incentives, profit-sharing plans, and a comprehensive benefits package, organizations can create a compensation plan that motivates employees and aligns their interests with the company's success. Regular reviews, transparent communication, and a focus on performance management further enhance the effectiveness of the salary strategy.

FAQ

What is the average salary range for a CA PA in the industry?

+

The average salary for a CA PA can vary depending on factors such as experience, location, and industry. Entry-level CA PAs may earn between 50,000 and 60,000 annually, while mid-level professionals can expect salaries ranging from 65,000 to 80,000. Senior-level CA PAs with extensive experience and expertise can command salaries upwards of $85,000.

How often should I review and adjust the CA PA salary strategy?

+

It is recommended to conduct salary reviews annually or bi-annually to ensure competitiveness and employee satisfaction. These reviews should take into account factors such as market trends, performance, and the organization’s financial health.

Are there any tax implications for offering equity participation to CA PAs?

+

Yes, there may be tax implications associated with offering equity participation. It is essential to consult with tax professionals or legal advisors to understand the specific tax obligations and ensure compliance with relevant regulations.

How can I measure the effectiveness of my CA PA salary strategy?

+

Measuring the effectiveness of your salary strategy involves tracking key metrics such as employee turnover rates, satisfaction surveys, and performance metrics. Regularly analyzing these metrics will provide insights into the impact of your compensation plan and help identify areas for improvement.