Calculating the Compound Annual Growth Rate (CAGR) is a valuable tool for investors and analysts to understand the performance of an investment over a specific period. Excel provides a straightforward way to compute CAGR, making it accessible for anyone to analyze financial data. This guide will walk you through the process of calculating CAGR in Excel, step by step.

Understanding CAGR

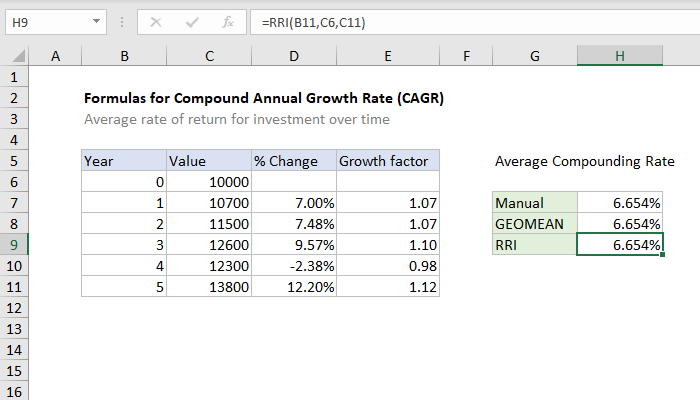

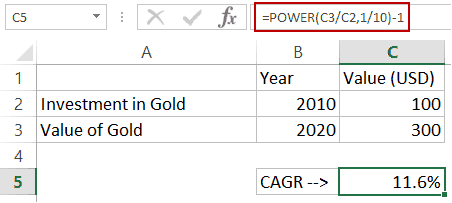

CAGR represents the average annual growth rate of an investment, taking into account the initial and final values along with the time period. It is a valuable metric to compare investments with different starting and ending values over varying time frames. The formula for CAGR is:

CAGR = (Ending Value / Starting Value)^(1/Number of Years) - 1

Here's a simple example to illustrate CAGR calculation. Imagine you invested $1,000 in a fund, and after 5 years, the value grew to $1,500. The CAGR for this investment would be:

CAGR = (1,500 / 1,000)^(1/5) - 1 = 0.068, or approximately 6.8%

Step-by-Step Guide to Calculating CAGR in Excel

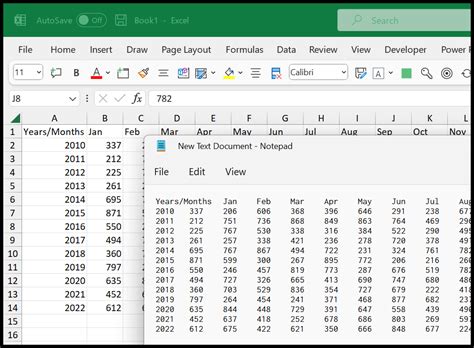

Step 1: Prepare Your Data

Before calculating CAGR, ensure you have the necessary data in your Excel sheet. You'll need the following:

- Starting Value

- Ending Value

- Number of Years

Step 2: Input Your Data

Enter your starting value, ending value, and number of years into designated cells in your Excel sheet. For this example, let's assume the starting value is in cell A2, the ending value is in cell B2, and the number of years is in cell C2.

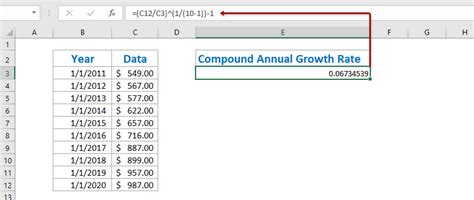

Step 3: Calculate CAGR

To calculate CAGR, use the following formula in an empty cell (e.g., D2):

=((B2/A2)^(1/C2))-1

This formula utilizes Excel's built-in functions to perform the CAGR calculation. Here's a breakdown of the formula components:

- B2/A2: This calculates the ratio of the ending value to the starting value.

- ^(1/C2): This exponentiates the ratio by the inverse of the number of years, effectively calculating the annual growth rate.

- -1: This subtracts 1 from the annual growth rate to get the CAGR.

Step 4: Interpret the Result

The result of the formula in cell D2 will be your CAGR. In our example, if the starting value was $1,000, the ending value was $1,500, and the number of years was 5, the CAGR would be approximately 6.8%.

Tips and Considerations

- Ensure your data is entered accurately, as any errors in the starting or ending values or the number of years will impact the CAGR calculation.

- Consider using named ranges to make your formulas more readable and easier to maintain. For example, you can name the range A2:C2 as InvestmentData and then use =((B2/A2)^(1/C2))-1 as =((InvestmentData[Ending Value]/InvestmentData[Starting Value])^(1/InvestmentData[Number of Years]))-1.

- If you have multiple sets of data, you can copy and paste the formula to calculate CAGR for each set. Excel will automatically adjust the cell references based on the relative position of the formula.

Conclusion

Calculating CAGR in Excel is a straightforward process that can provide valuable insights into the performance of your investments. By following these steps and understanding the formula, you can easily compute CAGR for any investment with known starting and ending values and the number of years. This metric is a powerful tool for comparing and analyzing different investment options, helping you make informed decisions.

FAQ

What is CAGR and why is it important for investment analysis?

+

CAGR stands for Compound Annual Growth Rate, and it’s a metric used to determine the average annual growth rate of an investment over a specific period. It’s important because it allows investors to compare the performance of different investments with varying starting and ending values and time frames. CAGR provides a standardized measure of growth, making it easier to evaluate and select the most suitable investment options.

Can I calculate CAGR for non-financial data or data with negative values?

+

The CAGR formula is designed for financial data where the starting and ending values are positive. If you have non-financial data or data with negative values, the CAGR calculation may not be applicable or meaningful. In such cases, you might consider using other metrics or adjusting your data to make it suitable for CAGR calculation.

How accurate is the CAGR calculation in Excel, and what are the limitations?

+

The CAGR calculation in Excel is accurate as long as the data is entered correctly and the formula is applied properly. However, it’s important to note that CAGR is a simplified metric that assumes a steady growth rate over the entire period. In reality, investments may experience fluctuations and varying growth rates, so CAGR should be used as a rough estimate rather than an exact representation of investment performance.