A 403(b) plan and an IRA (Individual Retirement Account) are both retirement savings vehicles, but they have distinct differences in terms of eligibility, contribution limits, investment options, and tax treatment. Understanding these differences is crucial for individuals planning for their retirement and seeking the most suitable option for their financial goals.

Understanding 403(b) Plans

A 403(b) plan, also known as a tax-sheltered annuity (TSA) plan, is a retirement savings plan offered by certain employers, primarily non-profit organizations, public schools, and some government agencies. It allows employees to contribute a portion of their pre-tax income to a retirement account, similar to a 401(k) plan. These contributions are made through payroll deductions, and the funds are invested in various financial products, such as annuities, mutual funds, or certificates of deposit.

One of the key advantages of a 403(b) plan is the tax benefits it offers. Contributions made to the plan are tax-deductible, which means they reduce the employee's taxable income for the year. Additionally, the earnings on the investments within the plan grow tax-free until the funds are withdrawn during retirement.

Key Features of 403(b) Plans

- Eligibility: 403(b) plans are typically available to employees of non-profit organizations, public schools, and certain government agencies. Eligibility may also extend to ministers and certain employees of public health and welfare agencies.

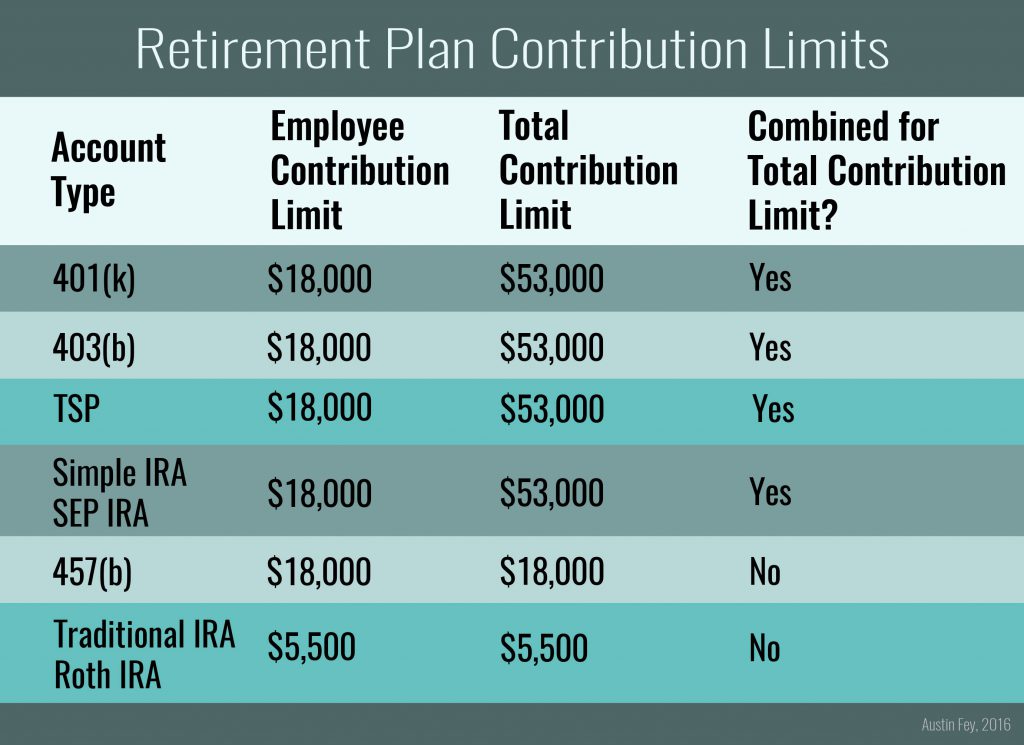

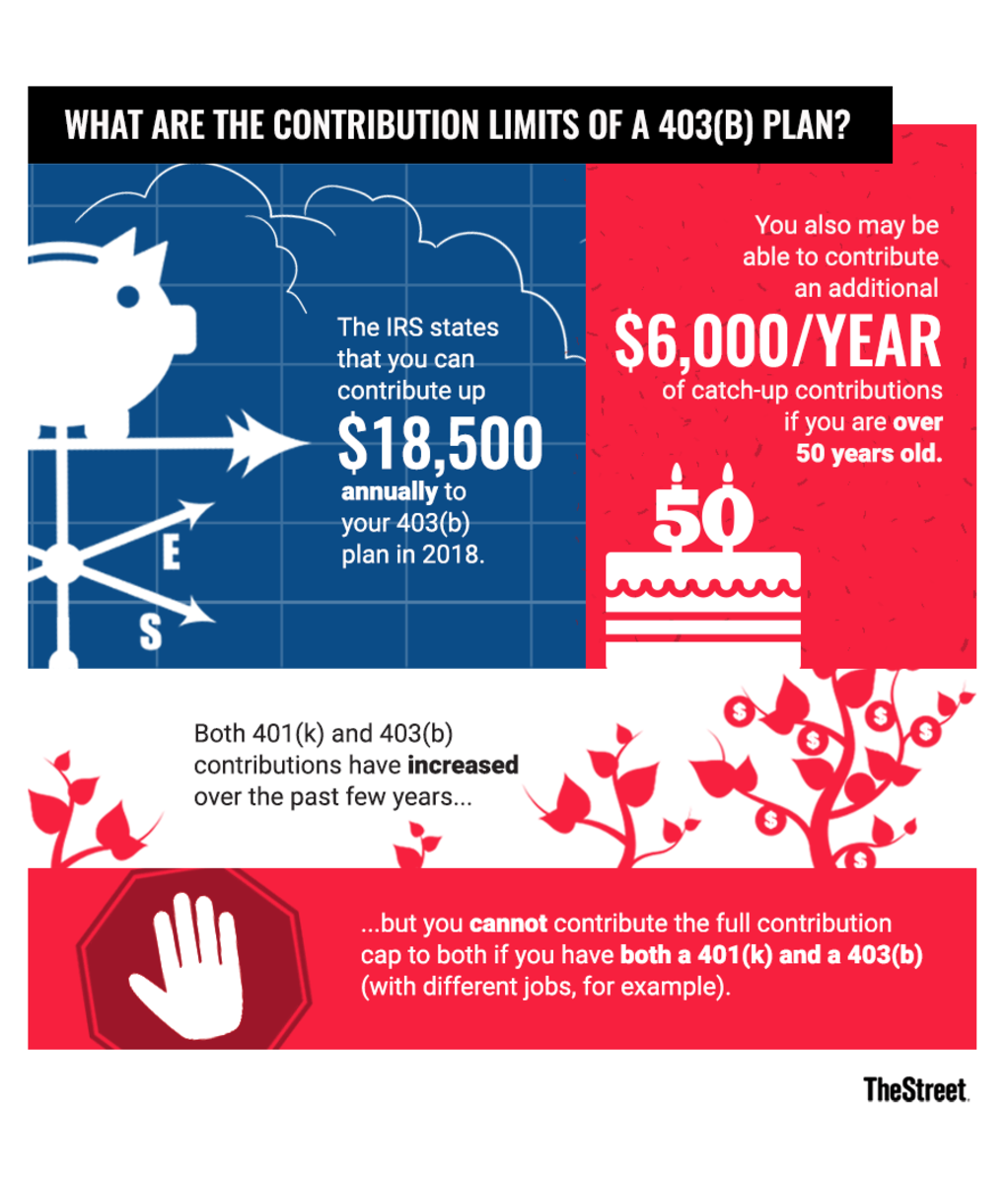

- Contribution Limits: The contribution limits for 403(b) plans are set by the Internal Revenue Service (IRS) and are subject to change annually. For 2023, the elective deferral limit is $20,500, with an additional catch-up contribution of $6,500 for those aged 50 and above.

- Investment Options: 403(b) plans offer a range of investment choices, including annuities, mutual funds, and certificates of deposit. The specific options available may vary depending on the provider and the employer's plan.

- Tax Treatment: Contributions to a 403(b) plan are made with pre-tax dollars, which means they reduce the employee's taxable income. The earnings on the investments grow tax-deferred until withdrawal. When funds are withdrawn during retirement, they are taxed as ordinary income.

Exploring IRAs

An IRA, or Individual Retirement Account, is a retirement savings account that individuals can set up on their own, regardless of their employment status. It provides a flexible and accessible way to save for retirement, offering tax advantages and a wide range of investment options.

There are two main types of IRAs: traditional IRAs and Roth IRAs. Traditional IRAs offer tax-deductible contributions, similar to 403(b) plans, while Roth IRAs provide tax-free withdrawals during retirement, making them an attractive option for those who expect to be in a higher tax bracket in the future.

Key Features of IRAs

- Eligibility: Anyone with earned income can contribute to an IRA, regardless of their employment status or income level. However, there are income limits for those who wish to take full advantage of the tax benefits, especially for Roth IRAs.

- Contribution Limits: For 2023, the contribution limit for IRAs is $6,000, with an additional catch-up contribution of $1,000 for those aged 50 and above. The specific limits may vary depending on the type of IRA and the individual's income.

- Investment Options: IRAs offer a wide range of investment choices, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). The investment options are typically more diverse and flexible compared to 403(b) plans.

- Tax Treatment: The tax treatment of IRAs depends on the type of account. Traditional IRAs offer tax-deductible contributions but taxable withdrawals during retirement. Roth IRAs, on the other hand, provide tax-free withdrawals, making them a popular choice for long-term retirement planning.

Comparing 403(b) Plans and IRAs

When deciding between a 403(b) plan and an IRA, it's essential to consider several factors, including eligibility, contribution limits, investment options, and tax treatment.

| Factor | 403(b) Plan | IRA |

|---|---|---|

| Eligibility | Available to employees of non-profit organizations, public schools, and certain government agencies. | Anyone with earned income can contribute, regardless of employment status. |

| Contribution Limits | Elective deferral limit of $20,500 (plus catch-up contributions for those aged 50+) | Contribution limit of $6,000 (plus catch-up contributions for those aged 50+) |

| Investment Options | Limited to the options provided by the employer's plan, often including annuities and mutual funds. | Wide range of investment choices, including stocks, bonds, mutual funds, and ETFs. |

| Tax Treatment | Tax-deductible contributions and tax-deferred earnings. Withdrawals during retirement are taxed as ordinary income. | Tax treatment depends on the type of IRA. Traditional IRAs offer tax-deductible contributions, while Roth IRAs provide tax-free withdrawals. |

Choosing the Right Retirement Savings Vehicle

The decision between a 403(b) plan and an IRA depends on individual circumstances and financial goals. If you are employed by a non-profit organization, public school, or certain government agencies, a 403(b) plan may be your primary retirement savings option. In such cases, it's essential to maximize your contributions to take full advantage of the tax benefits and potential employer matching contributions.

On the other hand, if you are not eligible for a 403(b) plan or have additional retirement savings goals, an IRA can be a flexible and powerful tool. IRAs offer more control over investment choices and provide the option to choose between tax-deductible contributions (traditional IRA) or tax-free withdrawals (Roth IRA) based on your financial situation and future tax expectations.

It's important to note that you can have both a 403(b) plan and an IRA, allowing you to maximize your retirement savings and take advantage of the benefits offered by each.

💡 Note: Before making any retirement savings decisions, it's advisable to consult with a financial advisor who can provide personalized guidance based on your unique circumstances and goals.

Maximizing Retirement Savings

To ensure a comfortable retirement, it's crucial to maximize your retirement savings. Here are some strategies to consider:

- Contribution Strategies: Aim to contribute the maximum allowed by your retirement plan, whether it's a 403(b) plan or an IRA. Consider setting up automatic contributions through payroll deductions or regular transfers to ensure consistent savings.

- Employer Matching Contributions: If your employer offers matching contributions for your 403(b) plan, make sure to contribute enough to receive the full match. This is essentially free money that can significantly boost your retirement savings.

- Investment Diversification: Diversify your investment portfolio within your retirement plan to manage risk and take advantage of different asset classes. Consider a mix of stocks, bonds, and other investments based on your risk tolerance and retirement timeline.

- Regular Reviews: Periodically review your retirement savings and investment performance. Make adjustments as needed to stay on track with your financial goals. Consider rebalancing your portfolio to maintain your desired asset allocation.

Seeking Professional Guidance

Retirement planning can be complex, and it's essential to seek professional guidance to make informed decisions. A financial advisor can provide personalized advice based on your financial situation, goals, and risk tolerance. They can help you navigate the various retirement savings options, such as 403(b) plans and IRAs, and ensure that your retirement strategy aligns with your long-term objectives.

Additionally, a financial advisor can assist with tax planning, investment selection, and portfolio management. They can also provide guidance on other aspects of financial planning, such as estate planning and insurance needs.

Remember, retirement planning is a long-term process, and it's never too early or too late to start. By taking proactive steps and seeking professional guidance, you can ensure a secure and comfortable retirement.

Conclusion

In conclusion, a 403(b) plan and an IRA are both valuable retirement savings vehicles, each with its own set of advantages and considerations. Understanding the differences between these options is crucial for making informed decisions about your retirement planning. Whether you choose a 403(b) plan, an IRA, or a combination of both, maximizing your contributions and seeking professional guidance will help you achieve your retirement goals and secure a comfortable future.

Can I have both a 403(b) plan and an IRA?

+

Yes, you can have both a 403(b) plan and an IRA. They serve different purposes and can complement each other in your retirement savings strategy.

Are there any income limits for contributing to a 403(b) plan or an IRA?

+

Yes, there are income limits for certain types of IRAs, such as Roth IRAs. However, 403(b) plans typically do not have income limits for eligibility.

Can I roll over my 403(b) plan into an IRA?

+

Yes, you can roll over your 403(b) plan into an IRA, providing you with more investment options and control over your retirement savings.

What are the tax implications of withdrawing funds from a 403(b) plan or an IRA?

+

Withdrawing funds from a 403(b) plan during retirement is taxed as ordinary income. Roth IRA withdrawals are tax-free, while traditional IRA withdrawals are taxed as ordinary income.

Can I contribute to both a 403(b) plan and an IRA in the same year?

+

Yes, you can contribute to both a 403(b) plan and an IRA in the same year, as long as you stay within the contribution limits for each.