Calculating wages in Maryland is a crucial aspect of understanding the state's labor laws and ensuring fair compensation for employees. This comprehensive guide will walk you through the process of calculating wages in Maryland, covering various scenarios and providing insights into the state's regulations. Whether you're an employer or an employee, this article will equip you with the knowledge needed to navigate Maryland's wage laws.

Understanding Maryland's Minimum Wage

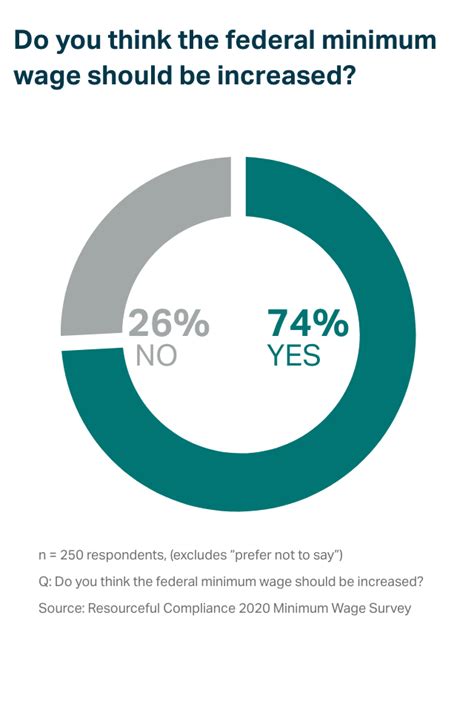

Maryland has implemented a minimum wage rate to ensure that workers receive a fair and livable income. As of [Effective Date], the minimum wage in Maryland is [Amount] per hour. This rate applies to most employees working within the state, with certain exceptions for tipped workers and individuals with disabilities.

It's essential to note that Maryland's minimum wage is subject to periodic adjustments to keep up with the cost of living and inflation. Employers must stay updated with the latest wage rates to comply with the law and provide accurate compensation to their employees.

Calculating Regular Wages

Regular wages refer to the base pay an employee receives for their regular hours of work. To calculate regular wages in Maryland, follow these steps:

- Determine the employee's hourly rate of pay.

- Multiply the hourly rate by the number of hours worked.

- For example, if an employee earns $15 per hour and works 40 hours in a week, their regular wages would be $600 (15 x 40 = 600).

It's important to ensure that the employee's hourly rate meets or exceeds the minimum wage requirements set by the state.

Overtime Wage Calculation

Maryland follows the federal overtime rules, which require employers to pay time-and-a-half for hours worked beyond the standard 40-hour workweek. To calculate overtime wages:

- Identify the employee's regular hourly rate.

- Multiply the regular rate by 1.5 to determine the overtime rate.

- Calculate the number of overtime hours worked.

- Multiply the overtime rate by the number of overtime hours.

- For instance, if an employee earns $18 per hour and works 45 hours in a week, their overtime rate would be $27 per hour (18 x 1.5 = 27). The overtime wages for the additional 5 hours would be $135 (27 x 5 = 135).

Remember, overtime wages are in addition to the regular wages, and employees are entitled to both.

Tipped Employee Wages

Maryland allows employers to pay tipped employees a lower minimum wage, provided that the tips received by the employee make up the difference to reach the standard minimum wage. Here's how to calculate wages for tipped employees:

- Determine the employee's cash wage, which must be at least [Tipped Employee Minimum Wage] per hour.

- Calculate the difference between the standard minimum wage and the cash wage.

- Ensure that the employee's tips, when added to the cash wage, meet or exceed the standard minimum wage.

- If the tips fall short, the employer must make up the difference to ensure the employee receives the full minimum wage.

It's crucial for employers to maintain accurate records of tipped employees' wages and tips received to comply with the law.

Salaried Employee Wages

Salaried employees are typically paid a fixed amount regardless of the number of hours worked. To calculate the hourly rate for a salaried employee in Maryland:

- Divide the annual salary by the number of hours the employee is expected to work in a year.

- For example, if an employee has an annual salary of $50,000 and is expected to work 2,080 hours per year, their hourly rate would be $24.04 (50,000 / 2,080 = 24.04)

It's important to note that salaried employees are still entitled to overtime pay if they work beyond the standard 40-hour workweek.

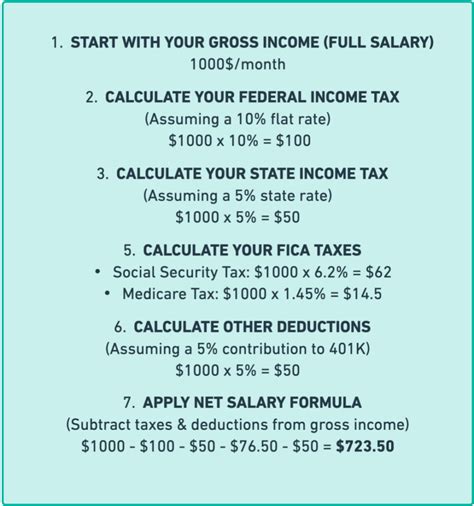

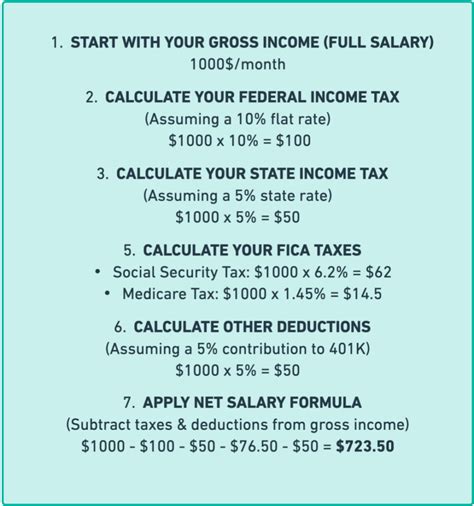

Wage Deductions and Withholdings

Employers in Maryland are required to make certain deductions and withholdings from an employee's wages. These include:

- Federal and state income taxes: Employers must withhold federal and state income taxes based on the employee's earnings and the tax rates set by the respective governments.

- Social Security and Medicare taxes: These are mandatory deductions, with a combined rate of [Social Security and Medicare Tax Rate]%, which is shared equally between the employer and the employee.

- Unemployment taxes: Employers are responsible for paying unemployment taxes to fund unemployment benefits. The rate and eligibility criteria vary depending on the employer's industry and employment history.

- Other deductions: Additional deductions may include health insurance premiums, retirement plan contributions, or voluntary deductions authorized by the employee.

It's crucial to obtain proper authorization and maintain accurate records for all wage deductions to avoid legal complications.

Payroll Frequency and Payment Methods

Maryland law does not specify a mandatory payroll frequency, allowing employers to choose between weekly, biweekly, semi-monthly, or monthly pay periods. However, employers must consistently follow the chosen payroll schedule.

As for payment methods, Maryland permits various options, including direct deposit, paper checks, or payroll cards. Employers must provide employees with a written statement detailing their earnings, deductions, and net pay for each pay period.

Wage Payment Laws

Maryland has specific laws governing the payment of wages to ensure employees receive their earned compensation promptly. Here are some key points to consider:

- Regular Paydays: Employers must establish regular paydays and adhere to them consistently. The frequency of paydays should be specified in the employment contract or company policy.

- Final Paycheck: In the event of an employee's termination or resignation, employers must pay the final wages within a specified timeframe. Maryland requires employers to pay the final wages within 48 hours of the employee's last day of work or the next scheduled payday, whichever is later.

- Wage Statements: Employers must provide accurate and detailed wage statements to employees, including information such as hours worked, rate of pay, deductions, and net pay. Wage statements should be provided with each payment.

- Payroll Records: Employers are required to maintain accurate payroll records for at least three years. These records should include information about wages, hours worked, deductions, and payments made to employees.

Wage Laws for Specific Industries

Certain industries in Maryland have additional wage regulations and requirements. Here are a few examples:

- Agriculture: Agricultural employees in Maryland are entitled to a minimum wage rate that may differ from the general minimum wage. Employers should consult the specific regulations for agricultural workers to ensure compliance.

- Domestic Workers: Maryland has implemented laws to protect the rights and wages of domestic workers, such as housekeepers, nannies, and caregivers. Employers must adhere to the minimum wage and overtime requirements for domestic workers.

- Construction: The construction industry in Maryland has specific wage and hour regulations, including prevailing wage rates for public works projects. Employers must ensure compliance with these regulations to avoid legal penalties.

Enforcement and Legal Remedies

Maryland has established mechanisms to enforce wage laws and protect employees' rights. If an employee believes their employer has violated wage laws, they can file a complaint with the Maryland Department of Labor's Wage and Hour Division. The division investigates complaints and takes appropriate actions to ensure compliance.

Employees who have experienced wage violations may be entitled to legal remedies, including back wages, liquidated damages, and attorney's fees. It's essential for employees to document any wage-related issues and seek legal advice if necessary.

Staying Informed and Compliant

To ensure compliance with Maryland's wage laws, employers and employees should stay informed about any updates or changes to the regulations. The Maryland Department of Labor provides resources and guidance on wage laws, including fact sheets, frequently asked questions, and contact information for further assistance.

Additionally, employers should establish clear wage and hour policies, communicate them to employees, and provide training to ensure understanding and compliance.

Conclusion

Calculating wages in Maryland involves understanding the state's minimum wage, overtime rules, and specific regulations for different industries. Employers must ensure fair compensation, accurate record-keeping, and timely payment of wages to comply with the law. Employees, on the other hand, should be aware of their rights and the resources available to address any wage-related concerns.

By staying informed and adhering to Maryland's wage laws, both employers and employees can foster a fair and transparent work environment, promoting economic stability and worker well-being.

What is the current minimum wage in Maryland?

+

As of [Effective Date], the minimum wage in Maryland is [Amount] per hour. It’s important to stay updated with any changes to the minimum wage rate.

Are there any exceptions to the minimum wage for certain employees?

+

Yes, Maryland allows for certain exceptions to the minimum wage, such as for tipped employees and individuals with disabilities. Employers must ensure that these employees receive fair compensation while adhering to the law.

How often should employers pay their employees in Maryland?

+

Maryland does not specify a mandatory payroll frequency. Employers can choose weekly, biweekly, semi-monthly, or monthly pay periods, but they must consistently follow the chosen schedule.

What are the consequences of violating Maryland’s wage laws?

+

Employers who violate Maryland’s wage laws may face legal penalties, including fines, back wages, and potential criminal charges. Employees who experience wage violations can seek legal remedies and compensation.

Where can I find more information about Maryland’s wage laws and regulations?

+

For detailed information and resources on Maryland’s wage laws, visit the Maryland Department of Labor’s website or contact their Wage and Hour Division directly. They provide comprehensive guidance and assistance to ensure compliance.