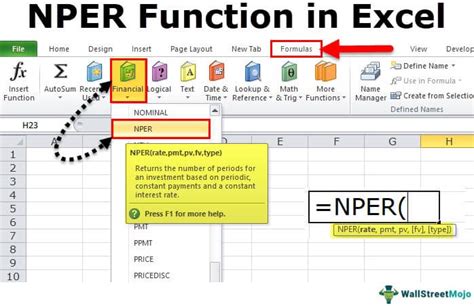

Excel's NPER function is a powerful tool for financial analysis and planning. It allows you to calculate the number of periods required to pay off a loan or investment based on regular payments. In this blog post, we will explore eight ultimate formulas using the NPER function that will enhance your Excel skills and make financial calculations a breeze.

Understanding the NPER Function

The NPER function in Excel is designed to calculate the number of periods for an investment or loan. It takes into account the periodic payment, interest rate, and the present value of the investment. By providing these inputs, you can determine the time it will take to reach a specific financial goal or repay a loan.

Formula 1: Basic NPER Calculation

The most fundamental use of the NPER function is to calculate the number of periods for a loan repayment. Here's the formula:

=NPER(rate, pmt, pv)

- rate: This is the interest rate per period.

- pmt: The payment made each period. It should be a negative value.

- pv: The present value, or the total amount that is owed.

For example, if you have a loan with an annual interest rate of 5%, a monthly payment of $200, and a total amount owed of $10,000, you can calculate the number of months required to repay the loan using:

=NPER(0.05/12, -200, 10000)

This formula will return the result as the number of months needed to repay the loan.

Formula 2: Including End-of-Period Payments

In some cases, payments may be made at the end of each period instead of the beginning. To account for this, you can use the following formula:

=NPER(rate, pmt, pv, 0, type)

- type: This argument specifies when payments are due.

0indicates that payments are due at the end of the period.

For instance, if you have a loan with the same details as above but payments are made at the end of each month, you can calculate the number of months using:

=NPER(0.05/12, -200, 10000, 0, 0)

Formula 3: Finding the Monthly Payment

You can also use the NPER function to determine the monthly payment required to repay a loan within a certain number of periods. Here's the formula:

=pmt(rate, nper, pv)

- rate: The interest rate per period.

- nper: The number of periods.

- pv: The present value of the loan.

Suppose you want to repay a $15,000 loan with an annual interest rate of 6% within 3 years. You can find the monthly payment using:

=pmt(0.06/12, 3*12, -15000)

Formula 4: Calculating Interest Rates

The NPER function can also help you calculate the interest rate when you know the number of periods and the payment amount. The formula is as follows:

=RATE(nper, pmt, pv)

- nper: The number of periods.

- pmt: The payment made each period.

- pv: The present value.

For example, if you want to pay off a $20,000 loan in 5 years with a monthly payment of $400, you can find the annual interest rate using:

=RATE(5*12, -400, 20000)

Formula 5: Handling Irregular Payments

Sometimes, loans or investments may have irregular payment amounts. In such cases, you can use the NPER function along with the IPMT function to calculate the number of periods. Here's the formula:

=NPER(rate, ipmt(rate, period, nper, pv, fv, type), pv, fv, type)

- ipmt: This function calculates the interest payment for a given period.

- period: The specific period for which you want to calculate the interest payment.

- fv: The future value, or the balance you want to have after the last payment.

Let's say you have a loan with an annual interest rate of 4%, a present value of $12,000, and you want to pay it off in 4 years. However, the payments are irregular: $300 in the first year, $400 in the second year, $500 in the third year, and $600 in the fourth year. You can calculate the number of years using:

=NPER(0.04/12, IPMT(0.04/12, 1, 4*12, 12000, 0, 0), 12000, 0, 0)

Formula 6: Finding the Present Value

If you know the number of periods, the interest rate, and the payment amount, you can use the NPER function to calculate the present value of an investment or loan. The formula is:

=PV(rate, nper, pmt)

- rate: The interest rate per period.

- nper: The total number of periods.

- pmt: The payment made each period.

For instance, if you want to invest a certain amount of money to have $5,000 after 10 years with an annual interest rate of 3%, you can find the present value using:

=PV(0.03/12, 10*12, -5000)

Formula 7: Calculating Future Value

Similarly, you can use the NPER function to determine the future value of an investment or loan when you know the present value, interest rate, and payment amount. The formula is:

=FV(rate, nper, pmt, pv)

- rate: The interest rate per period.

- nper: The total number of periods.

- pmt: The payment made each period.

- pv: The present value.

Suppose you want to invest $3,000 with an annual interest rate of 4% and make monthly payments of $150 for 5 years. You can calculate the future value using:

=FV(0.04/12, 5*12, -150, -3000)

Formula 8: Amortization Schedule

Creating an amortization schedule can be useful to understand how your loan or investment payments are distributed over time. You can use the NPER function along with other Excel functions to create a comprehensive schedule. Here's a simplified example:

| Period | Beginning Balance | Payment | Interest | Principal | Ending Balance |

|---|---|---|---|---|---|

| 1 | $10,000 | $200 | $41.67 | $158.33 | $9,841.67 |

| 2 | $9,841.67 | $200 | $41.33 | $158.67 | $9,683.00 |

| ... | ... | ... | ... | ... | ... |

| N | ... | $200 | ... | ... | $0 |

In this example, you can use formulas like =PPMT(rate, period, nper, pv) to calculate the principal payment and =IPMT(rate, period, nper, pv) to calculate the interest payment for each period.

Notes

🌟 Note: Remember to ensure that your rate and nper arguments are consistent with the periods used in your calculations. For example, if you are calculating monthly payments, ensure your rate is expressed as a monthly rate and nper is the total number of months.

⚠️ Note: When using the NPER function, ensure that the present value (pv) is a positive number and the payment (pmt) is a negative number to reflect the outflow of money.

📝 Note: The formulas provided here are simplified for demonstration purposes. In real-world scenarios, additional factors like compounding frequencies, fees, and prepayment options may need to be considered.

Conclusion

The NPER function in Excel is a versatile tool for financial calculations. By mastering these eight ultimate formulas, you can confidently analyze loans, investments, and repayment plans. Whether you're calculating the number of periods, finding the monthly payment, or creating an amortization schedule, Excel's NPER function has got you covered. Start exploring these formulas today to enhance your financial analysis skills!

FAQ

What is the NPER function in Excel used for?

+

The NPER function in Excel is used to calculate the number of periods required to pay off a loan or investment based on regular payments, interest rates, and the present value.

How do I calculate the monthly payment using the NPER function?

+

To calculate the monthly payment, you can use the pmt function along with the NPER function. The formula is =pmt(rate, nper, pv), where rate is the interest rate per period, nper is the total number of periods, and pv is the present value.

Can I use the NPER function for investments with irregular payments?

+

Yes, you can use the NPER function for investments with irregular payments by combining it with the ipmt function. The formula is =NPER(rate, ipmt(rate, period, nper, pv, fv, type), pv, fv, type), where ipmt calculates the interest payment for a specific period.

What is the difference between NPER and PV functions in Excel?

+

The NPER function calculates the number of periods, while the PV function calculates the present value. The PV function is often used to determine the initial investment required to reach a future value.