Understanding the difference between net pay and gross pay is crucial when it comes to managing your finances and ensuring you're receiving the correct compensation for your work. Let's delve into the intricacies of these two terms and explore how they impact your paycheck.

Gross Pay: The Big Picture

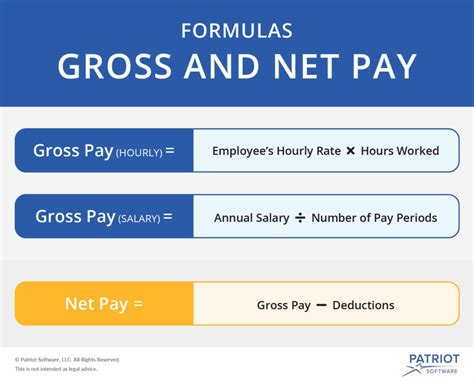

Gross pay represents the total amount of money earned by an employee before any deductions are made. It encompasses the entire sum of money agreed upon in an employment contract or specified in an offer letter. This figure serves as the starting point for calculating an employee's earnings and is often used as a reference point for various financial decisions.

For instance, consider a scenario where an employee is offered a gross salary of $60,000 per year. This means that the employee is entitled to receive $60,000 annually, without considering any deductions or additional earnings. Gross pay provides a clear indication of the maximum earning potential for an employee and is a crucial factor in negotiating employment terms.

Net Pay: What's Left in Your Pocket

Net pay, on the other hand, represents the actual amount of money an employee takes home after all deductions have been made. It is the final amount that appears on an employee's paycheck and reflects the true earnings available for personal use. Net pay is calculated by subtracting various deductions, such as taxes, insurance premiums, and retirement contributions, from the gross pay.

Let's continue with the example of an employee earning a gross salary of $60,000 per year. If we assume that the employee has deductions totaling $10,000 per year, including income tax, social security contributions, and health insurance premiums, the net pay would be $50,000. This means that the employee takes home $50,000 annually, which is the amount they can use for their living expenses, savings, and other financial obligations.

The Relationship Between Gross Pay and Net Pay

The relationship between gross pay and net pay is straightforward: gross pay is the starting point, and net pay is the result after all deductions are accounted for. The difference between these two figures can be significant, especially when considering the various deductions that can be applied to an employee's paycheck.

Deductions can include mandatory contributions, such as income tax and social security, as well as voluntary deductions like retirement plan contributions and insurance premiums. These deductions can vary depending on an employee's personal circumstances, such as their marital status, number of dependents, and health insurance coverage choices.

Understanding Your Paycheck: A Step-by-Step Guide

Decoding your paycheck can be a daunting task, especially if you're new to the workforce or have recently started working for a new employer. Here's a step-by-step guide to help you understand the key components of your paycheck:

Step 1: Identify Your Gross Pay

Start by locating the gross pay section on your paycheck. This is typically the first section and will display the total amount earned during the pay period, such as a week, biweekly, or monthly. Remember, this is the amount agreed upon in your employment contract or offer letter.

Step 2: Review Deductions

Next, carefully examine the deductions section of your paycheck. This section will list all the deductions made from your gross pay. Common deductions include federal and state income taxes, social security and Medicare contributions, health insurance premiums, and any voluntary deductions you may have chosen, such as retirement plan contributions or charitable donations.

Step 3: Calculate Your Net Pay

To calculate your net pay, simply subtract the total deductions from your gross pay. The resulting amount is your net pay, which represents the actual money you will receive and can use for your personal expenses.

Step 4: Review Additional Earnings

In addition to your regular earnings, your paycheck may also include other forms of compensation, such as overtime pay, bonuses, or commissions. These additional earnings are typically listed separately on your paycheck and are added to your gross pay to calculate your total earnings for the pay period.

Factors Affecting Deductions and Net Pay

The amount of deductions and, consequently, your net pay can be influenced by several factors, including:

- Tax Withholdings: The amount of income tax deducted from your paycheck depends on your tax bracket and the number of allowances you claim on your W-4 form. Adjusting your tax withholdings can impact your net pay and the amount you receive in tax refunds or owe to the IRS.

- Retirement Plan Contributions: If you participate in a retirement plan, such as a 401(k) or pension, a portion of your gross pay will be deducted for these contributions. The amount deducted can vary based on your contribution rate and the plan's rules.

- Health Insurance Premiums: The cost of health insurance premiums can vary depending on the coverage you choose and your employer's contribution policy. Higher-tier plans or adding dependents to your coverage may result in higher premiums and, consequently, lower net pay.

- Voluntary Deductions: You may choose to have certain amounts deducted from your paycheck for voluntary purposes, such as charitable donations, union dues, or gym memberships. These deductions will directly impact your net pay.

Maximizing Your Net Pay

While some deductions, such as taxes and mandatory contributions, are unavoidable, there are strategies you can employ to maximize your net pay and ensure you're keeping more of your earnings:

- Review Your Tax Withholdings: Regularly review your W-4 form and adjust your tax withholdings to ensure you're not paying more in taxes than necessary. This can help increase your net pay and reduce the likelihood of owing money to the IRS at tax time.

- Optimize Retirement Plan Contributions: While contributing to a retirement plan is essential for your future financial security, you can optimize your contributions to strike a balance between saving for retirement and maximizing your current net pay. Consider the tax advantages and employer matching contributions when deciding on your contribution rate.

- Compare Health Insurance Options: Carefully evaluate the health insurance options offered by your employer. Compare the costs and coverage of different plans to find the one that provides the best value for your needs. Choosing a plan with lower premiums can increase your net pay.

- Negotiate Voluntary Deductions: If you have voluntary deductions, such as gym memberships or professional organization fees, consider negotiating with the service providers to obtain a better rate or explore alternatives that offer similar benefits at a lower cost.

Conclusion: Taking Control of Your Paycheck

Understanding the difference between gross pay and net pay is essential for managing your finances effectively. By familiarizing yourself with the components of your paycheck and the factors that impact your deductions, you can make informed decisions to maximize your net pay and achieve your financial goals. Remember, your net pay is the money you have available to cover your living expenses, save for the future, and enjoy your hard-earned income.

Frequently Asked Questions

What is the difference between gross pay and net pay?

+

Gross pay is the total amount of money earned before any deductions, while net pay is the actual amount you take home after all deductions, such as taxes and insurance premiums, have been made.

How are deductions calculated from gross pay to arrive at net pay?

+

Deductions are calculated based on various factors, including income tax, social security contributions, and any voluntary deductions you may have chosen, such as retirement plan contributions or insurance premiums. These deductions are subtracted from your gross pay to determine your net pay.

Can I increase my net pay by reducing deductions?

+

While some deductions, like taxes, are mandatory and cannot be avoided, you can optimize your voluntary deductions to increase your net pay. This includes reviewing your retirement plan contributions, health insurance coverage choices, and other voluntary deductions to find a balance that suits your financial goals.

How often should I review my tax withholdings to maximize my net pay?

+

It is recommended to review your tax withholdings annually or whenever there is a significant change in your financial situation, such as getting married, having a child, or receiving a substantial pay raise. This ensures that you are not overpaying taxes and can maximize your net pay.

Are there any strategies to reduce my gross pay for tax purposes?

+

Yes, there are legal strategies to reduce your gross pay for tax purposes, such as contributing to tax-advantaged retirement plans like a 401(k) or IRA. These contributions lower your taxable income, which can result in a lower tax liability and potentially increase your net pay.