In the world of investing, it's essential to stay ahead of the curve and seize opportunities that can potentially yield significant returns. One such opportunity that has caught the attention of many is Alex Becker's Tesla stock strategy. With his unique approach, Becker has sparked curiosity and interest among investors, prompting them to act now and explore this potentially lucrative venture.

Understanding Alex Becker's Tesla Stock Strategy

Alex Becker, a renowned investor and entrepreneur, has developed a strategy centered around Tesla, Inc. (TSLA), a leading electric vehicle and clean energy company. His approach involves a combination of thorough research, technical analysis, and a deep understanding of the company's vision and market position.

Becker's strategy is based on the belief that Tesla's innovative products and disruptive technologies position it as a long-term growth stock. He argues that despite short-term fluctuations, the company's potential for sustained growth and market dominance make it an attractive investment opportunity.

Key Factors of Becker's Strategy

- Long-Term Vision: Becker emphasizes the importance of adopting a long-term perspective when investing in Tesla. He believes that short-term price movements should not deter investors from recognizing the company's long-term potential.

- Fundamental Analysis: He conducts a thorough analysis of Tesla's financial health, growth prospects, and competitive advantages. This includes evaluating the company's revenue streams, profitability, and market share.

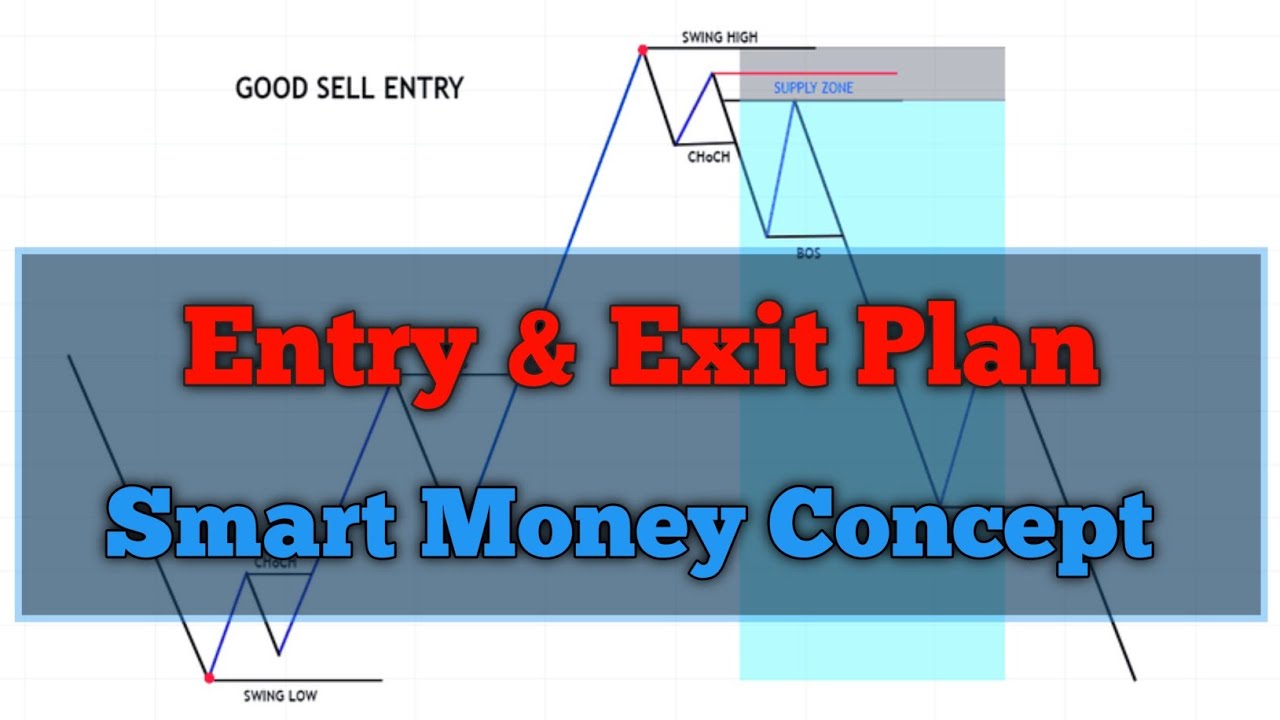

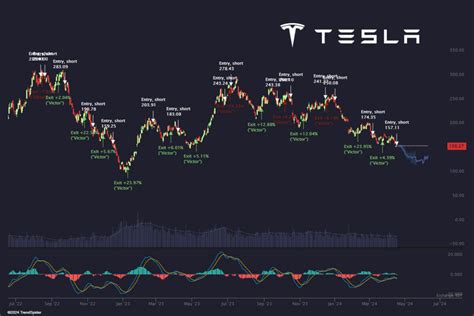

- Technical Analysis: Becker also utilizes technical indicators and chart patterns to identify potential entry and exit points for trades. He believes that combining fundamental and technical analysis provides a more comprehensive view of the stock's performance.

- Risk Management: Becker stresses the significance of risk management in any investment strategy. He advises investors to set stop-loss orders and diversify their portfolios to mitigate potential losses.

Why Act Now?

The appeal of Becker's Tesla stock strategy lies in its potential for significant returns. Here's why investors are urged to act now:

- Market Momentum: Tesla has been experiencing a surge in popularity and market demand. Its electric vehicles and energy storage solutions are gaining traction, and the company's market capitalization has been on an upward trajectory.

- Innovative Products: Tesla continues to innovate and launch new products, such as the highly anticipated Cybertruck and its expanding range of energy storage solutions. These developments further strengthen the company's position in the market.

- Strong Leadership: With Elon Musk at the helm, Tesla benefits from his visionary leadership and strategic decision-making. Musk's influence and reputation attract investors and create a sense of confidence in the company's future.

- Limited Time Opportunity: While Tesla's stock price may fluctuate, Becker's strategy emphasizes the importance of timing. By acting now, investors can potentially capitalize on favorable market conditions and position themselves for long-term gains.

Implementing Becker's Strategy

If you're considering adopting Alex Becker's Tesla stock strategy, here's a step-by-step guide to get you started:

- Conduct Your Own Research: While Becker's insights are valuable, it's crucial to conduct your own due diligence. Study Tesla's financial statements, industry reports, and market trends to form an independent opinion.

- Set Realistic Goals: Define your investment goals and risk tolerance. Determine whether you're investing for the long term or seeking short-term gains. This will help you align your strategy with your financial objectives.

- Monitor Market Conditions: Stay updated on market news and Tesla-specific developments. Keep an eye on industry trends, regulatory changes, and competitor movements that may impact the company's performance.

- Utilize Technical Analysis: Learn the basics of technical analysis to identify potential entry and exit points. Tools like moving averages, relative strength index (RSI), and support and resistance levels can aid in making informed trading decisions.

- Practice Risk Management: Implement risk management strategies to protect your investment. Consider setting stop-loss orders to limit potential losses and diversify your portfolio to mitigate risk.

Benefits of Following Becker's Strategy

- Potential for Long-Term Growth: By adopting Becker's long-term vision, investors can potentially benefit from Tesla's sustained growth and market dominance.

- Capitalizing on Market Momentum: Acting now allows investors to take advantage of favorable market conditions and potentially capitalize on Tesla's rising stock price.

- Diversification: Investing in Tesla as part of a diversified portfolio can provide exposure to the rapidly growing electric vehicle and clean energy sectors.

- Learning from an Expert: Following Becker's strategy provides an opportunity to learn from an experienced investor who has successfully navigated the stock market.

Conclusion

Alex Becker's Tesla stock strategy offers an intriguing approach to investing in one of the most innovative companies in the world. By combining fundamental and technical analysis, along with a long-term vision, investors can potentially benefit from Tesla's growth potential. However, it's important to remember that investing involves risks, and thorough research and due diligence are essential. Act now to explore this strategy and make informed investment decisions.

Frequently Asked Questions

Is Alex Becker’s Tesla stock strategy suitable for beginners?

+

While Becker’s strategy provides valuable insights, it may be more suitable for experienced investors who have a basic understanding of stock market concepts and risk management. Beginners are advised to start with simpler investment strategies and gradually build their knowledge.

How can I stay updated on Tesla’s latest developments?

+

To stay informed about Tesla’s news and developments, you can follow their official website, subscribe to industry newsletters, and follow reputable financial news sources. Additionally, keeping an eye on social media platforms and online forums dedicated to Tesla can provide valuable insights.

What are some alternative investment options in the electric vehicle sector?

+

Apart from Tesla, there are other promising companies in the electric vehicle sector, such as NIO Inc. (NIO), Lucid Group (LCID), and Rivian Automotive (RIVN). Researching and analyzing these companies can provide alternative investment opportunities.

How can I minimize risks when investing in Tesla stock?

+

To minimize risks, it’s crucial to diversify your portfolio by investing in multiple stocks or asset classes. Additionally, setting stop-loss orders and regularly reviewing your investment strategy can help manage potential losses.

Are there any tax implications to consider when investing in Tesla stock?

+

Yes, investing in Tesla stock may have tax implications. It’s important to consult with a tax professional or financial advisor to understand the tax obligations associated with your investments and ensure compliance with relevant regulations.