Completing your W-4 form accurately is crucial for ensuring you have the right amount of tax withheld from your paycheck. Whether you're a new employee or updating your tax information, this comprehensive guide will walk you through the process step by step. By the end, you'll have a clear understanding of how to fill out your W-4 form confidently and efficiently.

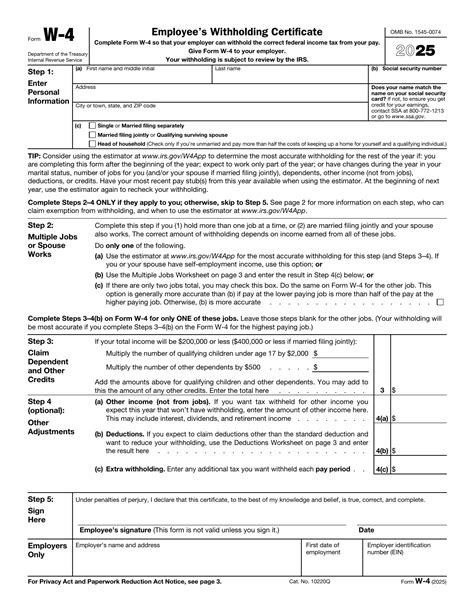

Step 1: Personal Information

Begin by providing your basic details on the W-4 form. This includes your full name, home address, and Social Security Number (SSN). Ensure you double-check and accurately enter this information to avoid any discrepancies.

Step 2: Work Status

Indicate your work status by selecting the appropriate option. Choose from single, married, widowed, divorced, or head of household. This information is crucial for determining your tax withholding.

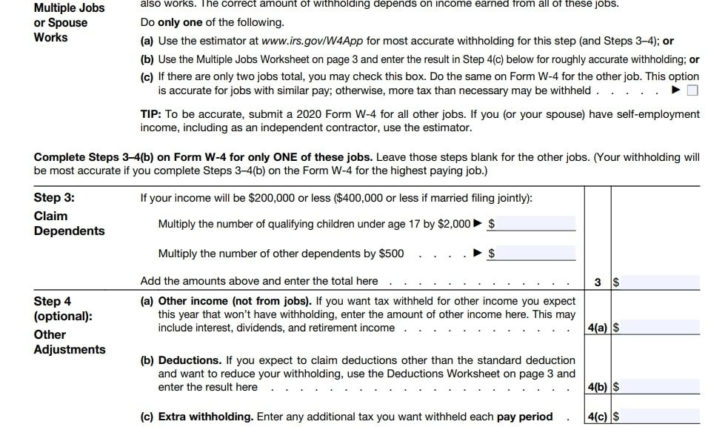

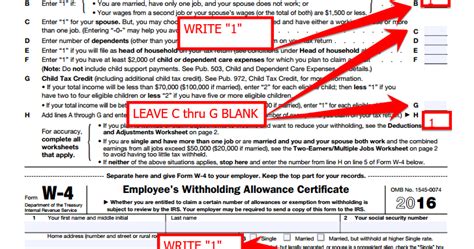

Step 3: Multiple Jobs or Spouse Works

If you have more than one job or your spouse works, you need to consider the "Multiple Jobs" or "Two-Earners/Multiple Jobs" worksheet. This worksheet helps you calculate the correct amount of tax to withhold when you have multiple income sources.

Instructions:

- Complete the worksheet by entering your total wages and the number of jobs you or your spouse have.

- Follow the instructions to determine the number of allowances you should claim.

- Use the result to fill out the appropriate sections on your W-4 form.

Step 4: Additional Withholding

If you want to have additional tax withheld from your paycheck, you can do so by entering the desired amount in the "Additional Withholding" section. This is useful if you anticipate owing taxes at the end of the year or want to increase your tax refund.

Step 5: Deductions and Adjustments

The W-4 form allows you to claim certain deductions and adjustments. These deductions can reduce the amount of tax withheld from your paycheck. Common deductions include student loan interest, education expenses, and certain medical expenses.

Instructions:

- Review the list of deductions and adjustments provided on the W-4 form.

- Indicate which deductions or adjustments apply to you by checking the appropriate boxes.

- If needed, provide additional information or documentation to support your claims.

Step 6: Sign and Submit

Once you have completed all the necessary sections of the W-4 form, review it carefully for accuracy. Ensure that all the information you've provided is correct and up-to-date. Finally, sign and date the form, and submit it to your employer.

Notes:

🌟 Note: Keep a copy of your completed W-4 form for your records. It's important to have this information readily available in case of any future tax-related inquiries.

💡 Note: Remember, the W-4 form is not a final determination of your tax liability. It's an estimate based on the information you provide. Your actual tax liability may differ, and you may still need to file a tax return to settle any remaining taxes owed or receive a refund.

Conclusion

Filling out your W-4 form accurately is essential for ensuring you have the right amount of tax withheld from your paycheck. By following these six simple steps, you can navigate the process with ease. Remember to review and update your W-4 form annually or whenever there are significant changes in your financial or personal circumstances. Stay informed, and take control of your tax withholding to avoid surprises come tax season.

Frequently Asked Questions

What happens if I make a mistake on my W-4 form?

+

If you realize you’ve made a mistake on your W-4 form, don’t panic. You can simply submit a new W-4 form with the correct information to your employer. It’s important to correct any errors promptly to ensure accurate tax withholding.

Can I adjust my tax withholding throughout the year?

+

Yes, you can adjust your tax withholding by submitting a new W-4 form to your employer. This is particularly useful if your financial or personal circumstances change, such as getting married, having a child, or experiencing a significant change in income.

How often should I review and update my W-4 form?

+

It’s recommended to review and update your W-4 form annually or whenever there are significant changes in your life. This ensures that your tax withholding remains accurate and aligned with your current financial situation.