An Easy Step-by-Step Guide to Calculating Your Kentucky Paycheck

Welcome to the Ultimate Guide on Generating Your Kentucky Paycheck! In this comprehensive guide, we will walk you through the process of calculating your paycheck in Kentucky, ensuring you understand every aspect of your earnings. Whether you’re a recent transplant to the Bluegrass State or a long-time resident, this guide will provide you with the tools to navigate your paycheck calculations with ease. So, let’s dive in and unlock the secrets of your Kentucky paycheck!

Understanding Your Earnings

Before we begin, it’s essential to grasp the fundamental components of your earnings. Your paycheck is a reflection of your hard work and the compensation you receive for it. In Kentucky, like many other states, your earnings are subject to various deductions and contributions, which we will explore in detail. By the end of this guide, you’ll have a clear understanding of how your paycheck is calculated and what each component represents.

Step 1: Gross Pay Calculation

The first step in generating your Kentucky paycheck is determining your gross pay. Gross pay refers to the total amount of money you earn before any deductions or contributions are made. It is the sum of your regular wages, overtime pay, bonuses, and any other additional compensation you receive. To calculate your gross pay, follow these simple steps:

- Identify Your Regular Pay: Start by calculating your regular pay, which is typically based on your hourly rate or salary. Multiply your hourly rate by the number of hours worked or divide your annual salary by the number of pay periods in a year.

- Add Overtime Pay (if applicable): If you work overtime hours, calculate your overtime pay by multiplying your overtime rate (usually 1.5 times your regular rate) by the number of overtime hours worked.

- Include Bonuses and Additional Compensation: If you receive bonuses, commissions, or any other forms of additional compensation, add these amounts to your regular pay to determine your total gross pay.

Step 2: Deductions and Contributions

Now that we have calculated your gross pay, it’s time to explore the deductions and contributions that will impact your final take-home pay. These deductions and contributions are essential for various reasons, including tax obligations, social security, and healthcare benefits. Let’s break down each category:

Federal and State Taxes

- Federal Income Tax: Kentucky, like most states, follows the federal income tax system. The amount deducted for federal income tax depends on your filing status, income level, and allowances claimed on your W-4 form. This deduction is mandatory and contributes to funding federal government operations.

- State Income Tax: Kentucky has a progressive income tax system, meaning the tax rate increases as your income rises. The state income tax deduction is calculated based on your Kentucky taxable income and the applicable tax rates. This deduction supports state-level initiatives and services.

Social Security and Medicare

- Social Security (FICA): Social Security is a federal program that provides retirement, disability, and survivor benefits. A portion of your earnings is deducted to contribute to this program. The Social Security tax rate is currently set at 6.2% for both employees and employers, with a maximum taxable income limit.

- Medicare Tax: Medicare is a federal health insurance program for individuals aged 65 and older, as well as those with certain disabilities. The Medicare tax rate is 1.45% for employees, and there is no income limit for this deduction.

Other Deductions and Contributions

- Local Taxes (if applicable): Some areas in Kentucky may have additional local taxes, such as city or county taxes. These deductions are typically based on your earnings and support local government operations and services.

- Retirement Contributions: If you participate in a retirement plan, such as a 401(k) or pension, a portion of your earnings may be deducted to contribute to your retirement savings. These contributions are often matched by your employer, providing a valuable benefit for your future.

- Healthcare Premiums: If you have healthcare coverage through your employer, a portion of your earnings may be deducted to cover the cost of your insurance premiums. These contributions ensure you have access to essential healthcare services.

- Other Voluntary Deductions: You may have the option to enroll in various voluntary deductions, such as flexible spending accounts (FSAs), health savings accounts (HSAs), or employee benefit programs. These deductions allow you to save for specific expenses or take advantage of additional benefits.

Step 3: Net Pay Calculation

Once you have calculated your gross pay and understood the various deductions and contributions, it’s time to determine your net pay. Net pay, also known as take-home pay, is the amount of money you receive after all deductions and contributions have been made. To calculate your net pay, simply subtract the total deductions and contributions from your gross pay. This final amount represents the money you will have in your pocket or your bank account after your paycheck is processed.

Example Paycheck Calculation

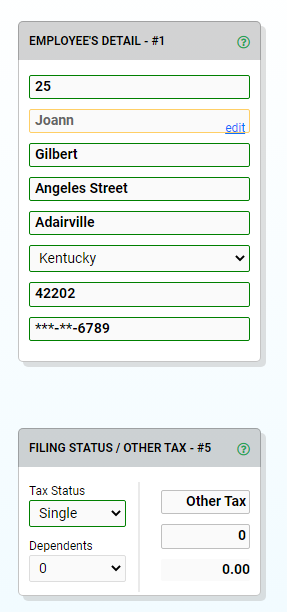

To illustrate the process, let’s consider an example paycheck calculation for an employee named John:

Gross Pay Calculation: - Regular Pay: 2,000 (based on hourly rate or salary) - Overtime Pay: 200 (1.5 times regular rate for 10 overtime hours) - Bonuses and Additional Compensation: 500 - Total Gross Pay: 2,700

Deductions and Contributions: - Federal Income Tax: 250 - State Income Tax: 120 - Social Security (FICA): 163.80 (6.2% of gross pay up to the maximum limit) - Medicare Tax: 39.90 (1.45% of gross pay) - Local Taxes: 20 - Retirement Contributions: 100 - Healthcare Premiums: 50 - Other Voluntary Deductions: 25 - Total Deductions and Contributions: $768.70

Net Pay Calculation: - Net Pay: 2,700 (gross pay) - 768.70 (total deductions and contributions) = $1,931.30

So, John’s net pay for this pay period would be $1,931.30, representing the money he will take home after all deductions and contributions have been made.

Additional Considerations

- Pay Periods: Kentucky employers typically follow a biweekly or semi-monthly pay schedule. Ensure you understand your pay period to accurately calculate your earnings and deductions.

- Tax Withholding: Review your W-4 form and make any necessary adjustments to ensure your tax withholding aligns with your personal circumstances and desired refund or liability amount.

- Benefits and Perks: Kentucky employers may offer additional benefits and perks, such as paid time off, health and wellness programs, or employee discounts. These benefits enhance your overall compensation package.

Notes:

🌟 Note: The information provided in this guide is for educational purposes only. For accurate and up-to-date information regarding tax rates, deductions, and contributions, consult official government sources or seek professional advice.

⚠️ Note: Paycheck calculations can vary based on individual circumstances and employer policies. Always refer to your paystub or consult with your employer for specific details regarding your earnings and deductions.

Conclusion

Congratulations! You have successfully navigated the process of generating your Kentucky paycheck. By understanding your gross pay, deductions, and contributions, you can now calculate your net pay with confidence. Remember, your paycheck is a reflection of your hard work and the various factors that impact your earnings. Stay informed, review your paystub regularly, and take advantage of the benefits and perks offered by your employer. With this knowledge, you can make informed financial decisions and plan for a secure future. Thank you for joining us on this ultimate guide, and we wish you continued success in your professional endeavors!

FAQ

What is the difference between gross pay and net pay?

+

Gross pay refers to the total amount of money earned before any deductions, while net pay is the take-home pay after all deductions and contributions have been made.

How often are Kentucky paychecks issued?

+Kentucky employers typically issue paychecks on a biweekly or semi-monthly basis.

Can I adjust my tax withholding in Kentucky?

+Yes, you can adjust your tax withholding by completing a new W-4 form with your employer. This allows you to tailor your tax withholding to your personal circumstances.

Are there any additional local taxes in Kentucky?

+Some areas in Kentucky may have additional local taxes, such as city or county taxes. These vary depending on your location.

Can I contribute to a retirement plan in Kentucky?

+Yes, many employers in Kentucky offer retirement plans, such as 401(k)s, which allow you to save for retirement with potential employer matching contributions.