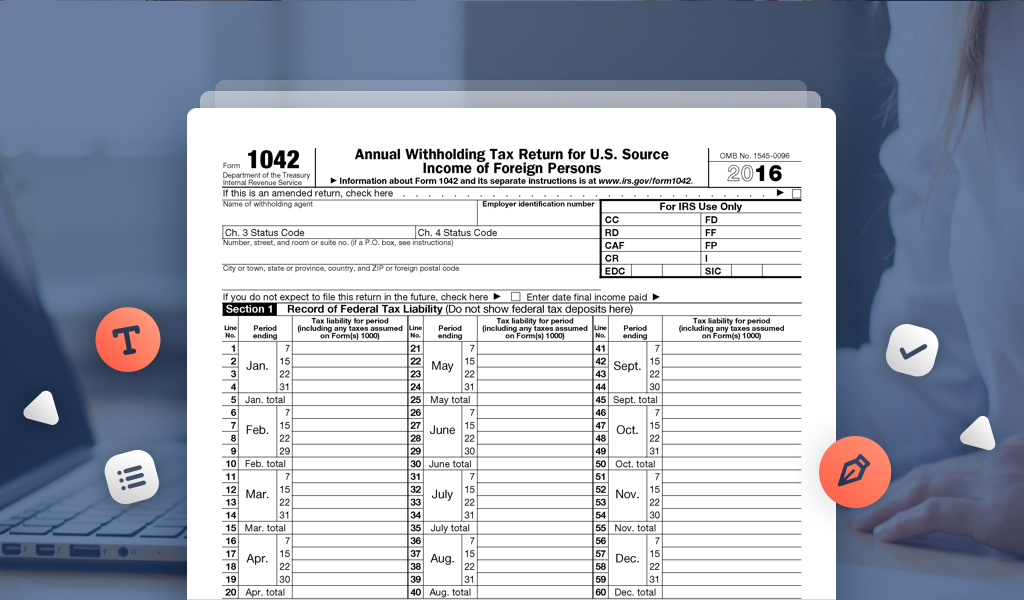

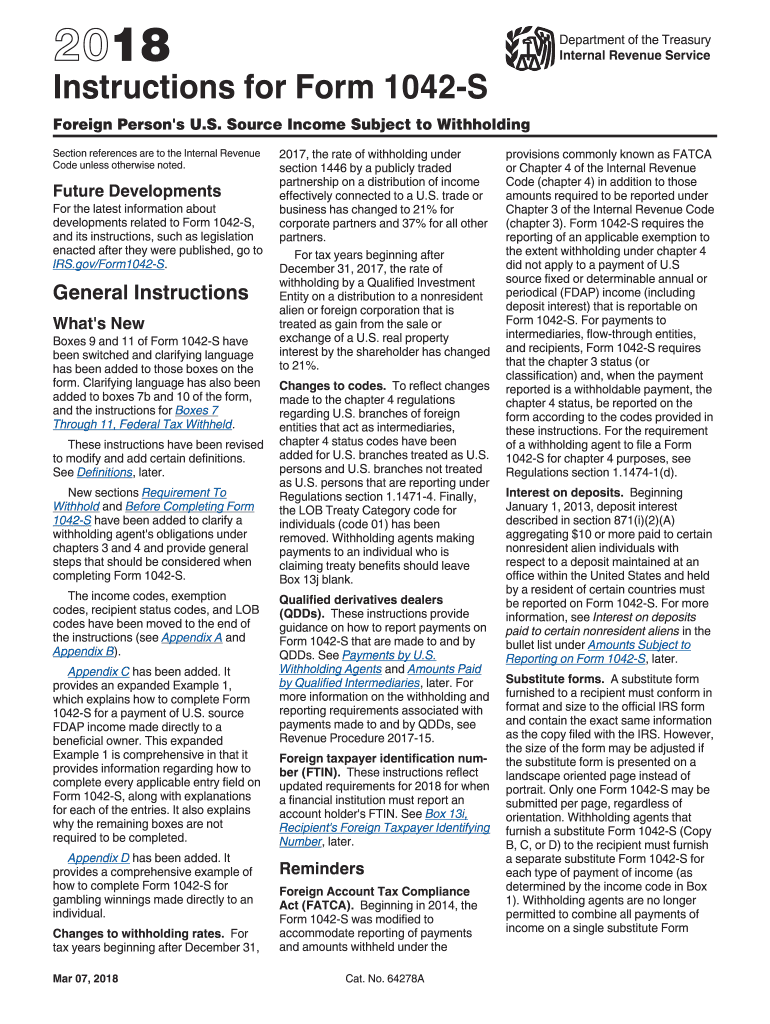

Introduction to the 1042-S Form

The 1042-S form is a crucial document for non-resident aliens (NRAs) and foreign entities with U.S. income. This form, issued by payers, provides essential information about the taxes withheld from their U.S. source income. Understanding and accurately completing this form is vital for NRAs and foreign entities to comply with U.S. tax regulations and avoid penalties. In this comprehensive guide, we will walk you through the process of filling out the 1042-S form, covering everything from the purpose of the form to its various sections and the importance of accurate reporting.

Purpose of the 1042-S Form

The primary purpose of the 1042-S form is to report the amount of U.S. source income and the taxes withheld from that income for NRAs and foreign entities. It serves as a vital tool for the Internal Revenue Service (IRS) to track and monitor the tax obligations of individuals and entities with U.S. income. By issuing this form, payers provide a transparent record of the taxes withheld, ensuring compliance with U.S. tax laws.

Who Needs to Fill Out the 1042-S Form?

The 1042-S form is specifically designed for NRAs and foreign entities who receive income from U.S. sources. This includes individuals and businesses located outside the United States who have earned income through various means, such as:

- Wages or salaries from U.S. employers.

- Rental income from U.S. properties.

- Royalties or license fees from U.S. sources.

- Interest or dividends from U.S. financial institutions.

- Business income from U.S. operations.

If you fall into any of these categories, it is essential to understand your obligations and accurately complete the 1042-S form to avoid any legal consequences.

Obtaining the 1042-S Form

The 1042-S form is typically issued by the payer, such as a U.S. employer, financial institution, or rental property owner. They are responsible for withholding the appropriate taxes and providing the form to the NRA or foreign entity. The form is usually sent by mail or made available online through a secure portal.

If you have not received your 1042-S form or have any doubts about its status, it is advisable to contact the payer directly. They should be able to provide you with the necessary information and assistance in obtaining the form.

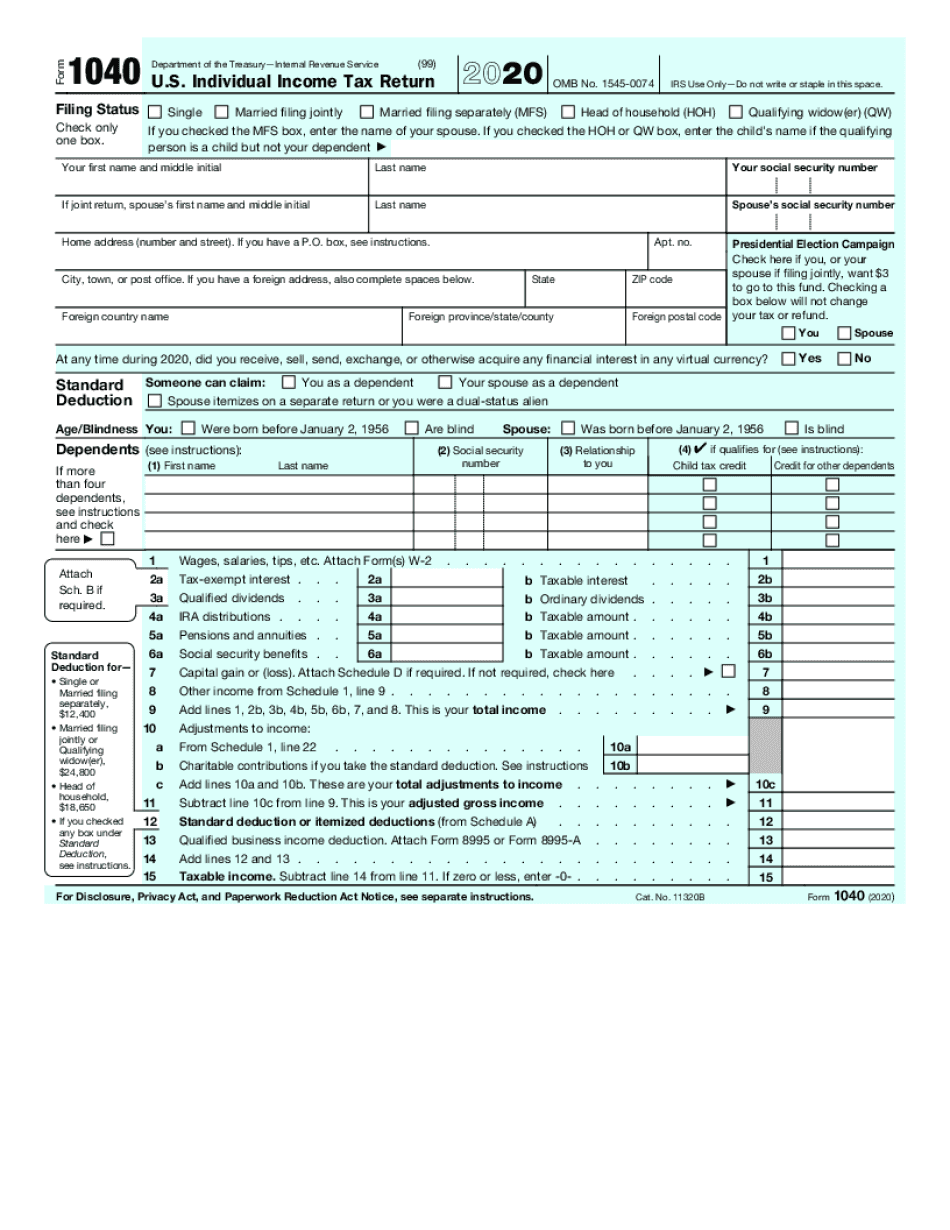

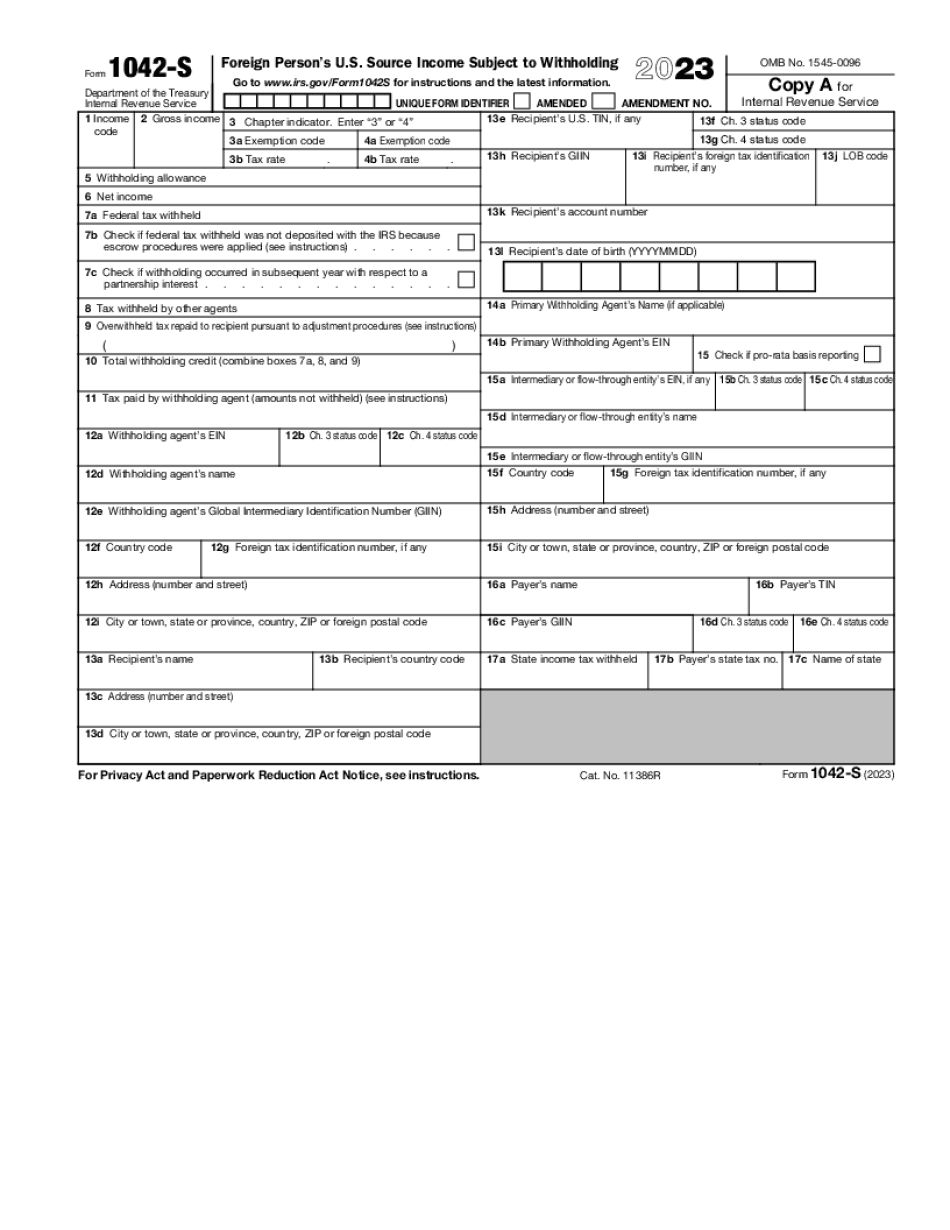

Understanding the Sections of the 1042-S Form

The 1042-S form consists of several sections, each requiring specific information. Let’s break down these sections and explain what you need to fill out:

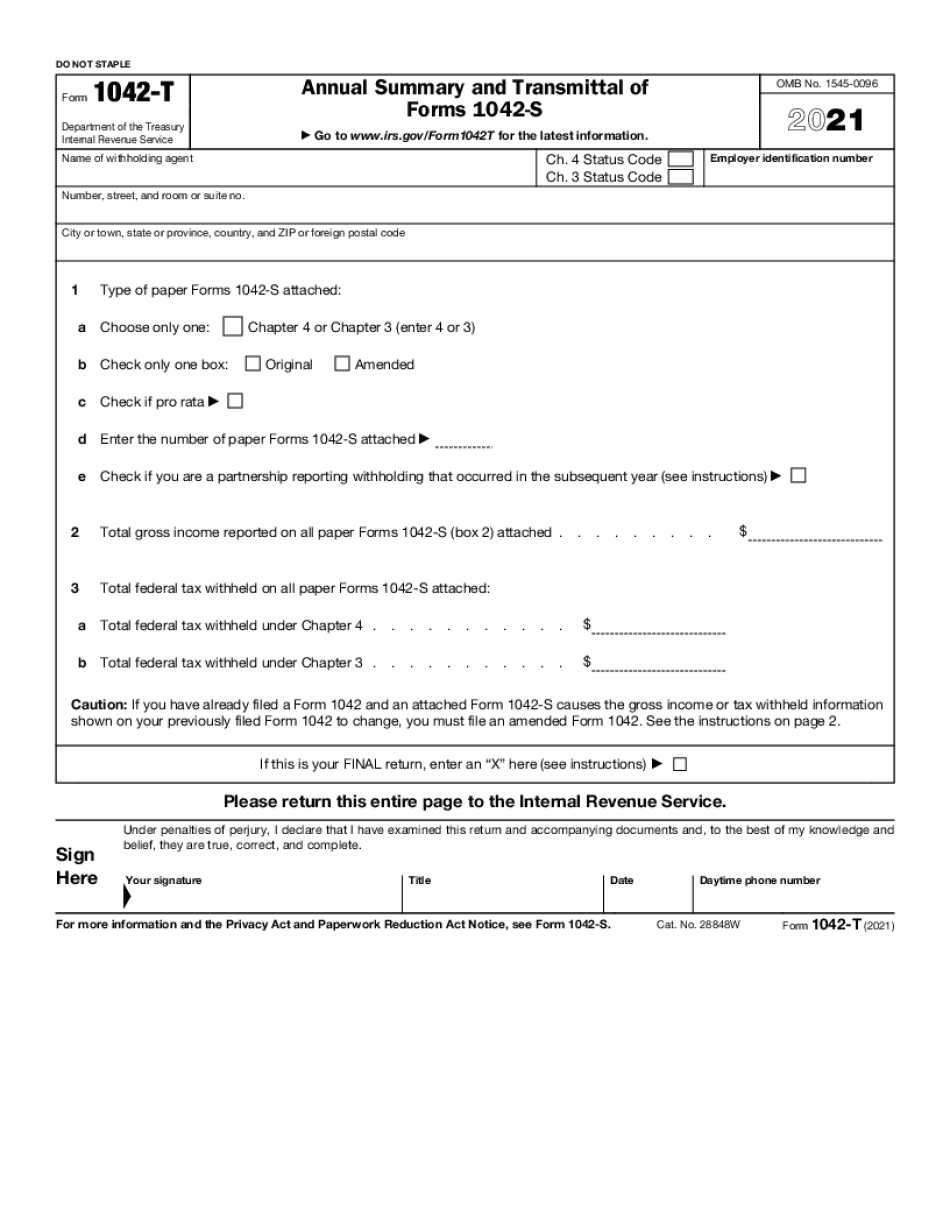

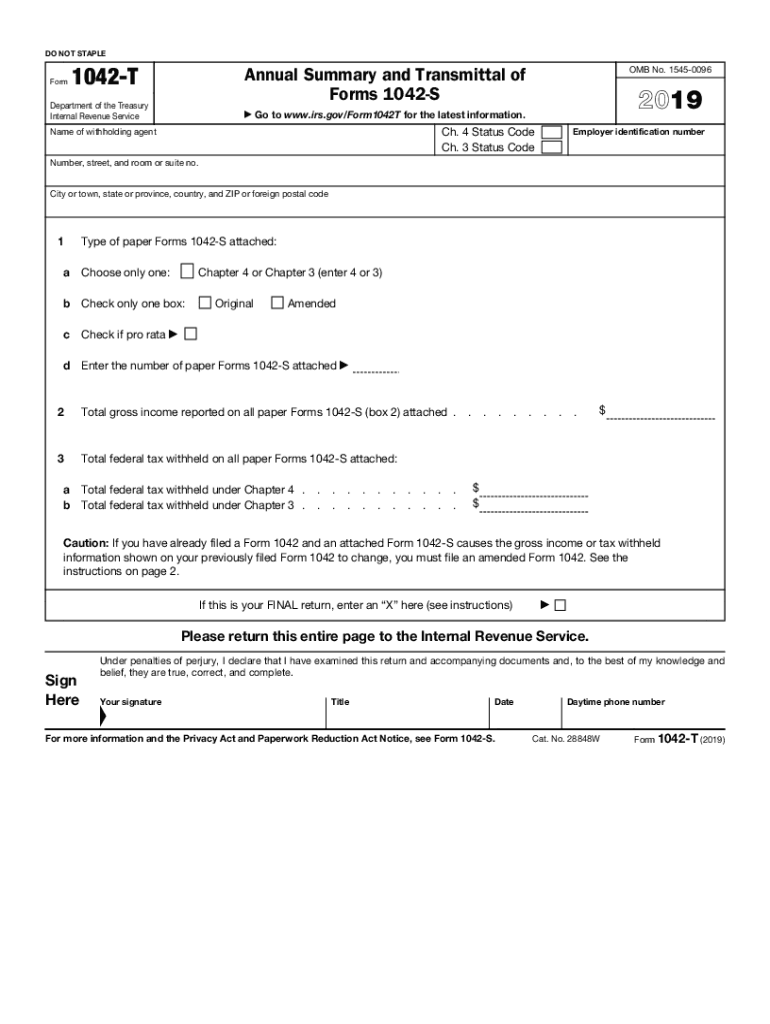

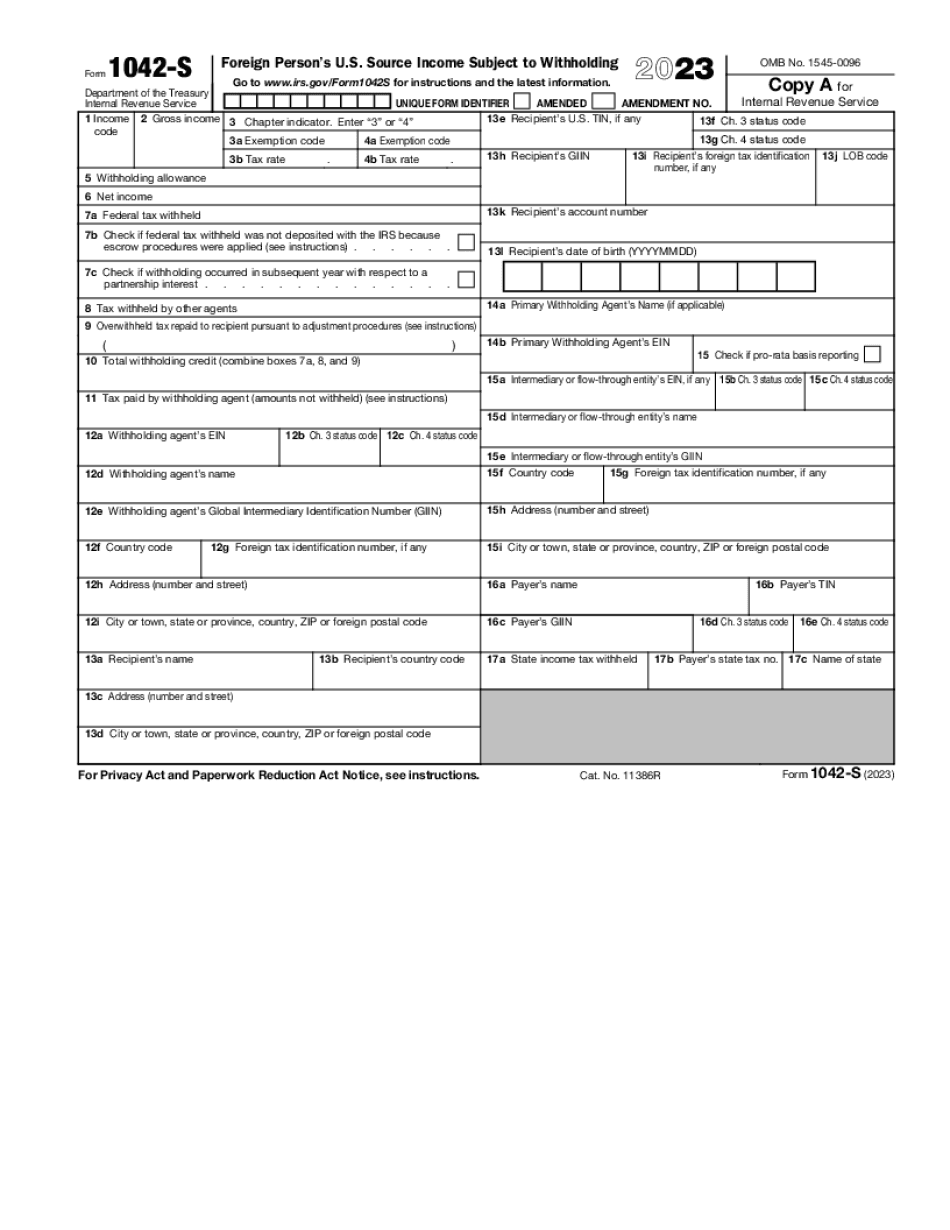

Section 1: Payer’s Information

- Payer’s Name, Address, and EIN: This section requires the payer’s name, address, and Employer Identification Number (EIN). The EIN is a unique identification number assigned to businesses by the IRS. Ensure that you enter the correct information to avoid any discrepancies.

- Payer’s Tax Year: Enter the tax year for which the form is being issued. This information is crucial for accurate record-keeping and tax reporting.

Section 2: Recipient’s Information

- Recipient’s Name and Address: Provide your full name and address as it appears on your official identification documents. Ensure accuracy to avoid any issues with tax compliance.

- Recipient’s Taxpayer Identification Number (TIN): Enter your TIN, which could be your Individual Taxpayer Identification Number (ITIN) or your U.S. Social Security Number (SSN) if you have one. The TIN is a unique identifier used by the IRS to track tax obligations.

- Recipient’s Country of Residence: Specify your country of residence. This information is essential for determining the appropriate tax treaties and agreements that may apply to your situation.

Section 3: Income and Withholding Information

- Income Code and Description: Select the appropriate income code that best describes the type of income you received. Common codes include wages, salaries, scholarships, and fellowships. Provide a brief description of the income source if necessary.

- Income Amount: Enter the gross amount of income received from the payer during the tax year. This amount should match the income reported on your pay stubs or other income statements.

- Federal Income Tax Withheld: This field requires the amount of federal income tax withheld from your income. The payer should provide you with this information.

- FICA Taxes Withheld: If applicable, enter the amount of FICA (Federal Insurance Contributions Act) taxes withheld from your income. FICA taxes include Social Security and Medicare taxes.

- State Income Tax Withheld: If the payer is located in a state that imposes income tax, enter the amount of state income tax withheld from your income.

- Local Income Tax Withheld: For income earned in jurisdictions that levy local income taxes, enter the amount withheld for local tax purposes.

Section 4: Foreign Status and Withholding Information

- Foreign Status Code: Select the appropriate foreign status code that applies to you. Common codes include student, teacher, researcher, or business visitor. Choose the code that best describes your reason for being in the United States.

- Withholding Method Code: Indicate the method used to determine the amount of tax withheld from your income. The payer should provide you with this information.

- Treaty Benefits Claimed: If you are eligible for tax treaty benefits, indicate whether you claimed these benefits and provide the relevant treaty article number.

- Claim of Exemption: If you are exempt from U.S. taxation based on a specific exemption, indicate the exemption code and provide any necessary supporting documentation.

Section 5: Certification and Signature

- Certification: Read and understand the certification statement carefully. It confirms that the information provided on the form is accurate and complete to the best of your knowledge.

- Signature and Date: Sign and date the form to indicate your agreement with the certification statement. Ensure that your signature is legible and matches the name provided in Section 2.

Tips for Accurate Form Filling

To ensure the accuracy of your 1042-S form and avoid potential issues with the IRS, consider the following tips:

- Review and Understand the Form: Take the time to carefully read and understand each section of the form. Familiarize yourself with the instructions and definitions provided to avoid mistakes.

- Use Official Sources: Rely on official IRS publications and guidelines for accurate information. The IRS website provides comprehensive resources and forms related to the 1042-S form and tax obligations for NRAs and foreign entities.

- Seek Professional Assistance: If you are unsure about any aspect of the form or have complex tax situations, consider seeking the advice of a tax professional or accountant. They can provide guidance and ensure compliance with U.S. tax laws.

- Keep Records: Maintain organized records of your income, expenses, and tax-related documents. This will help you verify the information reported on the 1042-S form and facilitate any future tax inquiries.

- Double-Check Your Information: Before submitting the form, review it thoroughly to ensure the accuracy of your personal information, income amounts, and withholding details. Small errors can lead to significant issues, so take your time and double-check.

Importance of Accurate Reporting

Accurate reporting on the 1042-S form is crucial for several reasons:

- Compliance with U.S. Tax Laws: The IRS strictly enforces tax compliance for NRAs and foreign entities. Accurate reporting ensures that you meet your tax obligations and avoid penalties or legal consequences.

- Avoiding Tax Disputes: Incorrect or incomplete information on the form can lead to tax disputes with the IRS. Accurate reporting helps resolve any potential issues quickly and efficiently.

- Efficient Tax Refunds: If you are entitled to a tax refund, accurate reporting ensures that you receive the correct amount promptly. Mistakes on the form may delay or reduce your refund.

- Peace of Mind: Filling out the 1042-S form accurately provides peace of mind, knowing that you have fulfilled your tax obligations and complied with U.S. tax regulations.

Conclusion

Completing the 1042-S form accurately is a critical step for NRAs and foreign entities with U.S. income. By understanding the purpose of the form, obtaining it from the payer, and carefully filling out each section, you can ensure compliance with U.S. tax laws. Remember to review the form thoroughly, seek professional assistance when needed, and maintain accurate records. Accurate reporting not only helps you avoid legal issues but also facilitates efficient tax processing and potential refunds. Stay informed, stay compliant, and ensure a smooth tax experience with the 1042-S form.

FAQ

What happens if I don’t receive my 1042-S form from the payer?

+

If you don’t receive your 1042-S form from the payer, you should contact them directly to request the form. They are responsible for providing it to you. If you still encounter issues, you can contact the IRS for assistance.

Can I file my taxes without the 1042-S form?

+

It is recommended to have the 1042-S form when filing your taxes as it contains important information about your U.S. source income and tax withholding. However, if you have not received the form, you can still file your taxes by estimating the income and tax withheld. It is advisable to contact the payer or seek professional advice to ensure accurate reporting.

Are there any penalties for incorrect or late submission of the 1042-S form?

+

Yes, the IRS imposes penalties for incorrect or late submission of the 1042-S form. Penalties may include fines, interest charges, or even criminal prosecution in severe cases. It is crucial to ensure accurate and timely submission to avoid any legal consequences.

Can I make changes to the 1042-S form after submission?

+

If you discover errors or need to make changes to the 1042-S form after submission, you should contact the payer immediately. They can issue a corrected form, known as a 1042-S-C, to reflect the necessary changes. It is important to address any discrepancies promptly to avoid potential tax issues.

Where can I find more information about the 1042-S form and tax obligations for NRAs and foreign entities?

+

The IRS website provides comprehensive resources and publications related to the 1042-S form and tax obligations for NRAs and foreign entities. You can find detailed instructions, forms, and guidelines to help you navigate the tax process. Additionally, seeking professional tax advice can provide personalized guidance based on your specific circumstances.