Understanding Navy pay is crucial for those serving in the military and their families. It can be a complex system, but with the right knowledge, you can navigate it effectively. This guide aims to provide an in-depth look at Navy pay, covering everything from basic pay to special incentives and allowances. By the end, you'll have a comprehensive understanding of how Navy pay works and be able to make informed decisions about your financial future.

Basic Pay: The Foundation of Navy Compensation

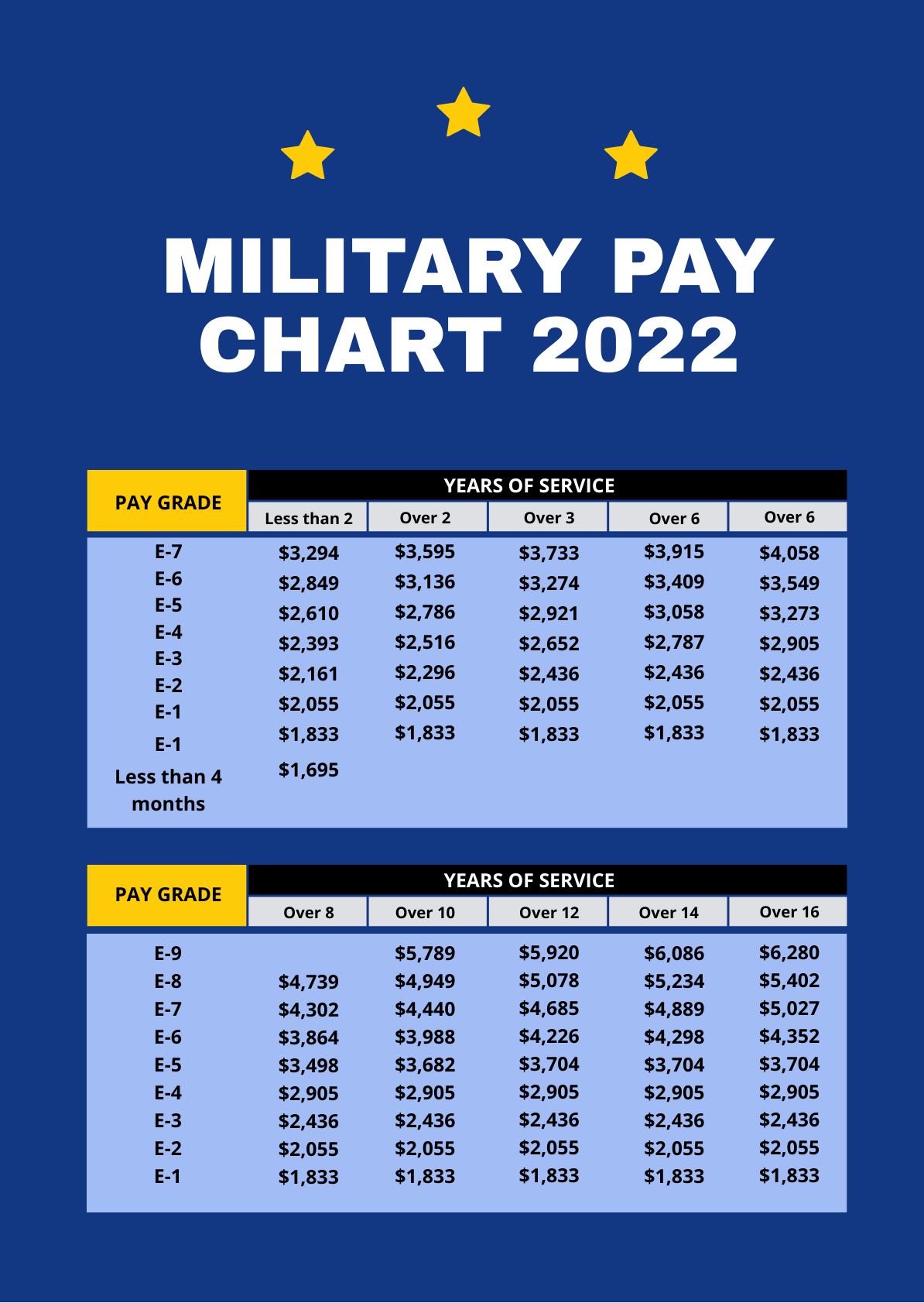

Basic pay forms the backbone of Navy compensation. It is determined by your rank, years of service, and pay grade. The pay grades range from E-1 to E-9 for enlisted personnel and O-1 to O-10 for officers. Each pay grade has a corresponding pay scale, which increases with experience and rank. Here’s a simplified table illustrating the basic pay structure:

| Pay Grade | Rank | Years of Service | Monthly Basic Pay |

|---|---|---|---|

| E-1 | Seaman Recruit | 0-2 | $1,733 |

| E-2 | Seaman Apprentice | 2-4 | $1,942 |

| E-3 | Seaman | 4-6 | $2,167 |

| ... | ... | ... | ... |

| O-1 | Ensign | 0-2 | $3,161 |

| O-2 | Lieutenant Junior Grade | 2-4 | $4,267 |

| ... | ... | ... | ... |

Basic pay is a crucial component of your overall compensation, but it's not the only factor. There are several other allowances and incentives that can significantly impact your total pay package.

Allowances and Incentives: Boosting Your Navy Pay

1. Basic Allowance for Housing (BAH)

BAH is designed to assist service members with their housing costs. It is paid as a flat rate, based on your pay grade, duty station, and whether you have dependents. BAH rates vary significantly across different locations, so it’s essential to understand the specific rate for your duty station.

2. Basic Allowance for Subsistence (BAS)

BAS is provided to cover the cost of meals and is paid monthly. The rate is standardized and does not vary based on your duty station. This allowance helps offset the cost of food, whether you choose to eat on base or off.

3. Family Separation Allowance

If you’re deployed or on temporary duty away from your permanent duty station for an extended period, you may be eligible for Family Separation Allowance. This additional pay is intended to help cover the additional costs associated with being away from your family.

4. Hostile Fire Pay

For service members deployed to combat zones or areas of imminent danger, Hostile Fire Pay is available. This special pay is intended to compensate for the increased risk and stress of serving in such environments.

5. Special Pays and Incentives

The Navy offers a range of special pays and incentives to attract and retain personnel with specific skills or for serving in high-demand roles. These can include:

- Special Duty Assignment Pay

- Incentive Pays for Critical Skills

- Flight Pay

- Dive Pay

- Sea Pay

These special pays can significantly boost your overall compensation and are often sought after by service members.

Taxes and Deductions: Managing Your Navy Pay

As with any income, Navy pay is subject to taxes and deductions. Understanding these deductions is crucial for managing your finances effectively. Here are some key deductions to be aware of:

- Federal Income Tax: This is deducted based on your filing status and the number of allowances you claim.

- Social Security Tax: A percentage of your pay is deducted to contribute to Social Security benefits.

- Medicare Tax: A fixed amount is deducted to cover Medicare expenses.

- State and Local Taxes: Depending on your duty station, you may be subject to state and local income taxes.

- Retirement Contributions: A portion of your pay is automatically contributed to your retirement savings.

It's essential to understand these deductions and plan your budget accordingly. Consider seeking financial advice to ensure you're making the most of your Navy pay.

Planning for the Future: Navy Retirement and Benefits

Navy service offers more than just a steady paycheck. It provides access to a range of benefits and retirement plans that can significantly impact your long-term financial well-being. Here’s an overview of some key benefits:

- Military Retirement: After 20 years of service, you become eligible for military retirement. This provides a steady income stream based on your years of service and highest three years of basic pay.

- Healthcare Benefits: The Navy offers comprehensive healthcare coverage for service members and their families. This includes access to military hospitals and clinics, as well as the TRICARE program for off-base care.

- Education Benefits: The Post-9⁄11 GI Bill provides significant financial support for education and training. It covers tuition, housing, and books, making it easier to pursue higher education or career training.

- Life Insurance: The Servicemembers’ Group Life Insurance (SGLI) program offers low-cost life insurance coverage, providing financial protection for your loved ones.

By understanding these benefits and planning accordingly, you can make the most of your Navy service and set yourself up for a secure financial future.

Maximizing Your Navy Pay: Expert Strategies

To make the most of your Navy pay, consider the following expert strategies:

- Focus on Promotions: Advancing in rank is a sure way to increase your basic pay. Aim for promotions and take advantage of professional development opportunities to enhance your skills and competitiveness.

- Seek Special Pays: If you have specialized skills or are willing to take on high-demand roles, explore the various special pays and incentives offered by the Navy. These can significantly boost your income.

- Manage Your Deductions: Review your tax withholdings and retirement contributions regularly. Ensure you’re maximizing your deductions and saving for the future.

- Utilize Benefits: Take full advantage of the benefits offered by the Navy. From healthcare to education, these benefits can save you money and provide long-term financial security.

By implementing these strategies, you can optimize your Navy pay and build a solid financial foundation for yourself and your family.

🌟 Note: The information provided in this guide is intended as a general overview. For specific details and the most up-to-date information, always refer to official Navy resources and guidance.

How often are Navy pay rates updated?

+

Navy pay rates are typically updated annually, often effective from the start of the new fiscal year.

Are there any tax advantages for military personnel?

+

Yes, military personnel may be eligible for certain tax benefits, such as the Combat Zone Tax Exclusion and the exclusion of certain allowances from taxable income.

Can I negotiate my Navy pay?

+

Basic pay and most allowances are standardized and non-negotiable. However, you can pursue special pays and incentives for specific skills or roles.