Planning your finances effectively is crucial for achieving financial stability and meeting your short- and long-term goals. One essential aspect of financial planning is understanding your pay dates, especially if you are a member of USAA. In this comprehensive guide, we will cover everything you need to know about USAA pay dates in 2025, providing you with the tools to manage your finances with confidence.

Understanding USAA Pay Dates

USAA, a leading financial services provider for military members and their families, offers a range of banking and investment products. Knowing your pay dates is vital for budgeting, saving, and making informed financial decisions. Here's what you should know about USAA pay dates in 2025:

Regular Pay Dates

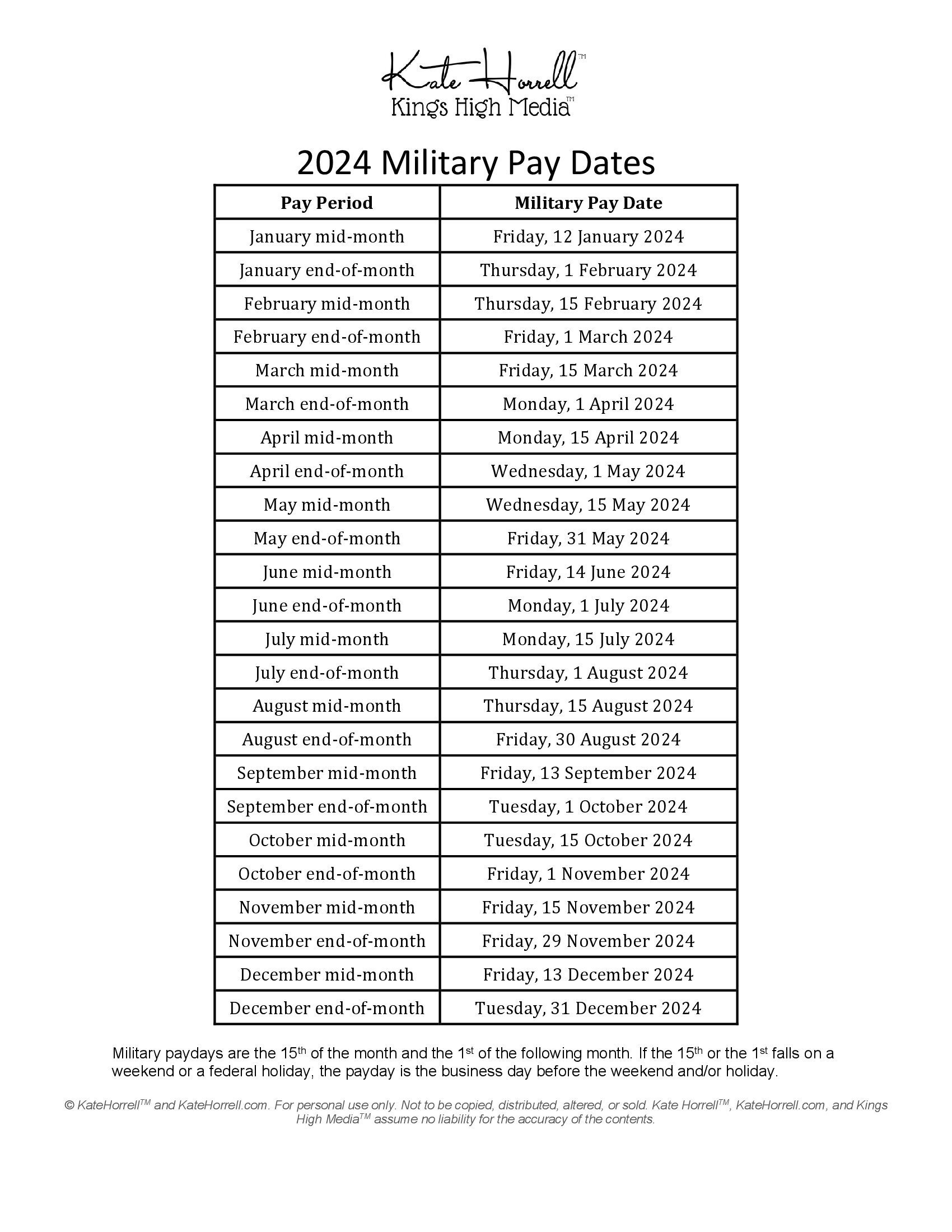

USAA typically follows a bi-weekly pay schedule, meaning you'll receive your salary every two weeks. However, it's important to note that pay dates may vary based on factors such as military pay cycles and holidays. To ensure you're prepared, here are the estimated pay dates for 2025:

| Pay Period | Pay Date |

|---|---|

| 1 | January 15, 2025 |

| 2 | January 29, 2025 |

| 3 | February 12, 2025 |

| 4 | February 26, 2025 |

| 5 | March 12, 2025 |

| 6 | March 26, 2025 |

| 7 | April 9, 2025 |

| 8 | April 23, 2025 |

| 9 | May 7, 2025 |

| 10 | May 21, 2025 |

| 11 | June 4, 2025 |

| 12 | June 18, 2025 |

| 13 | July 2, 2025 |

| 14 | July 16, 2025 |

| 15 | July 30, 2025 |

| 16 | August 13, 2025 |

| 17 | August 27, 2025 |

| 18 | September 10, 2025 |

| 19 | September 24, 2025 |

| 20 | October 8, 2025 |

| 21 | October 22, 2025 |

| 22 | November 5, 2025 |

| 23 | November 19, 2025 |

| 24 | December 3, 2025 |

| 25 | December 17, 2025 |

Special Pay Dates

In addition to the regular bi-weekly pay dates, USAA also processes special pay dates for specific events or circumstances. These may include:

- Mid-Month Pay: Some military members receive mid-month pay, which occurs on the 15th of each month. This pay date is typically for those with specific duty or deployment status.

- Bonus or Incentive Pay: USAA may offer bonus payments for various reasons, such as performance-based incentives or special achievements. These pay dates will be communicated separately.

- Holiday Pay: Holidays can impact pay dates. USAA ensures that you receive your pay on time, even if a holiday falls on a regular pay date. Holiday pay dates may be adjusted to the nearest business day.

Planning Your Finances with USAA Pay Dates

Now that you have a clear understanding of the USAA pay dates for 2025, it's time to put this knowledge into action and plan your finances effectively. Here are some practical tips to help you make the most of your pay dates:

Create a Budget

A budget is a powerful tool for managing your finances. Start by listing your monthly income, including your regular pay from USAA and any additional sources. Then, track your expenses, including fixed costs like rent and utilities, as well as variable expenses such as groceries and entertainment. By comparing your income and expenses, you can identify areas where you can save and allocate your funds wisely.

Set Financial Goals

Define your short-term and long-term financial goals. Whether it's saving for a down payment on a house, funding your child's education, or planning for retirement, having clear goals will motivate you to stay on track. Break down your goals into smaller, achievable milestones and allocate a portion of your income towards them with each pay date.

Automate Your Savings

Take advantage of USAA's automated savings tools. Set up automatic transfers from your paycheck to your savings account or investment portfolio. By doing so, you'll build your savings effortlessly and watch your money grow over time. Consider setting up different savings accounts for specific goals, such as an emergency fund or a vacation fund.

Manage Your Debt

If you have outstanding debts, such as credit card balances or loans, create a plan to pay them off efficiently. Allocate a portion of your pay towards debt repayment, focusing on high-interest debts first. USAA offers tools and resources to help you manage your debt, including debt consolidation options and financial counseling services.

Explore Investment Opportunities

Consider investing your money to grow your wealth over time. USAA provides a range of investment options, including stocks, bonds, and mutual funds. Research and educate yourself about different investment strategies, and consult with a financial advisor to determine the best approach for your risk tolerance and financial goals. Remember, investing carries risks, so it's important to be informed and cautious.

Review and Adjust Regularly

Financial planning is an ongoing process. Regularly review your budget, goals, and progress. As your circumstances change, such as a pay raise or a new financial commitment, adjust your plan accordingly. Stay informed about any changes to USAA's pay dates or policies, and seek professional advice if needed.

Maximizing Your USAA Membership Benefits

As a USAA member, you have access to a wide range of financial services and benefits. Make the most of your membership by exploring the following:

Banking Services

- Checking and Savings Accounts: USAA offers a variety of checking and savings account options with competitive interest rates and no monthly fees.

- Certificates of Deposit (CDs): Consider investing in CDs to earn higher interest rates on your savings.

- Online and Mobile Banking: Take advantage of USAA's convenient online and mobile banking platforms to manage your accounts, transfer funds, and pay bills on the go.

Insurance

- Auto Insurance: USAA provides competitive auto insurance rates and discounts for military members.

- Homeowners or Renters Insurance: Protect your home or rental property with comprehensive insurance coverage.

- Life Insurance: Ensure the financial security of your loved ones with life insurance policies tailored to your needs.

Investment Products

- Stocks and Bonds: USAA offers a range of investment options to help you build your portfolio.

- Mutual Funds: Consider investing in mutual funds for diversified and professional management of your investments.

- Retirement Planning: Explore USAA's retirement planning tools and resources to secure your financial future.

Additional Benefits

- Military Discounts: USAA partners with various companies to offer exclusive discounts on products and services for military members.

- Financial Education: Access educational resources and tools to enhance your financial literacy and make informed decisions.

- Online Security: Stay protected with USAA's advanced online security measures, ensuring the safety of your financial information.

FAQs

Are USAA pay dates the same for all military branches?

+No, USAA pay dates may vary slightly depending on the military branch and pay cycle. However, USAA strives to ensure timely payments for all members.

Can I change my pay date with USAA?

+While USAA follows a set pay schedule, it's not possible to change your individual pay date. However, you can manage your finances effectively by budgeting and planning around the bi-weekly pay dates.

How can I access my USAA pay stubs and tax information?

+You can access your pay stubs and tax information through your USAA online account. Log in to your account, navigate to the "My Pay" section, and download the necessary documents.

What should I do if I have a discrepancy in my pay or benefits?

+If you notice any discrepancies in your pay or benefits, contact USAA's member support team immediately. They will assist you in resolving any issues and ensure you receive the correct compensation.

Final Thoughts

Understanding your USAA pay dates is a crucial step towards achieving financial stability and reaching your goals. By creating a budget, setting financial goals, and utilizing the various benefits and services offered by USAA, you can take control of your finances and build a secure future. Remember to review and adjust your plan regularly, and don’t hesitate to seek professional advice when needed. With proper planning and discipline, you can make the most of your USAA pay dates and achieve financial success.