Understanding Vacation Pay in Ontario: A Comprehensive Guide

Vacation pay is an essential benefit that employees in Ontario are entitled to, providing a much-needed break and additional income. However, calculating vacation pay accurately can be a complex task, especially with various factors to consider. This guide aims to demystify the process and ensure you receive the correct vacation pay you're owed.

How to Calculate Vacation Pay in Ontario

In Ontario, the Employment Standards Act, 2000 governs vacation pay. According to this act, employees are entitled to four percent of their gross earnings as vacation pay. This amount is paid out in addition to their regular wages, providing a much-needed boost to their income during their vacation.

To calculate vacation pay, you'll need to follow these steps:

- Determine the employee's gross earnings for the vacation pay period. This includes all earnings before any deductions, such as overtime pay, commissions, and bonuses.

- Multiply the gross earnings by four percent to calculate the vacation pay amount.

- Ensure that the vacation pay is paid out separately from the employee's regular wages.

For example, if an employee's gross earnings for the vacation pay period are CA$50,000, their vacation pay would be calculated as follows:

CA$50,000 x 0.04 = CA$2,000

Therefore, the employee would be entitled to CA$2,000 in vacation pay.

Factors Affecting Vacation Pay

Several factors can impact the calculation of vacation pay in Ontario. Here are some key considerations:

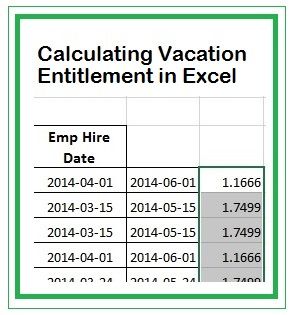

- Vacation Pay Period: The vacation pay period is typically the 12-month period from January 1 to December 31. However, for new employees, the vacation pay period may be pro-rated based on their start date.

- Part-Time Employees: Part-time employees are entitled to the same vacation pay as full-time employees, calculated based on their gross earnings during the vacation pay period.

- Vacation Time: Employees are entitled to at least two weeks of vacation time after completing a full year of employment. This time can be taken all at once or in shorter periods throughout the year.

- Unused Vacation Time: If an employee has unused vacation time at the end of the year, they can carry it over to the next year. However, employers are not required to pay out unused vacation time unless the employee's employment ends.

Example Vacation Pay Calculation

Let's walk through an example to better understand how vacation pay is calculated in Ontario.

Assume an employee has been working for a company for three years and their gross earnings for the 2023 vacation pay period (January 1, 2023, to December 31, 2023) are CA$60,000. Here's how their vacation pay would be calculated:

- Gross earnings for the vacation pay period: CA$60,000

- Vacation pay amount: CA$60,000 x 0.04 = CA$2,400

Therefore, the employee would be entitled to CA$2,400 in vacation pay for the 2023 vacation pay period.

FAQs

How often do employees receive vacation pay in Ontario?

+

In Ontario, employees receive vacation pay at least once a year, typically when they take their vacation time. However, employers may choose to pay out vacation pay more frequently, such as bi-weekly or monthly, along with regular wages.

Can vacation pay be paid out in advance in Ontario?

+

Yes, in Ontario, employers have the option to pay out vacation pay in advance. This means that employees can receive their vacation pay before taking their vacation time. However, it's important to note that the employer must still ensure that the employee has earned the vacation pay based on their gross earnings during the vacation pay period.

What happens if an employee leaves before their vacation pay period ends in Ontario?

+

If an employee leaves their job before the end of their vacation pay period, they are still entitled to their earned vacation pay. The employer must calculate the vacation pay based on the employee's gross earnings up to their last day of work and pay it out within the required timeframe.

Are there any exceptions to the four percent vacation pay rule in Ontario?

+

Yes, there are a few exceptions to the four percent vacation pay rule in Ontario. For example, employees in certain industries, such as construction, may be entitled to a higher rate of vacation pay. Additionally, some collective agreements may provide for a different vacation pay calculation.

Can vacation pay be used as a form of compensation for termination in Ontario?

+

No, in Ontario, vacation pay cannot be used as a form of compensation for termination. When an employee's employment ends, they are entitled to their earned vacation pay up to their last day of work, but not as a substitute for other termination payments or benefits.

Conclusion

Understanding how to calculate vacation pay in Ontario is crucial for both employees and employers. By following the guidelines outlined in this guide, you can ensure that vacation pay is calculated accurately and fairly. Remember to consider factors such as the vacation pay period, part-time employment, and unused vacation time when determining an employee's vacation pay entitlement. With proper calculation and timely payment, employees can enjoy their well-deserved vacations with the added benefit of additional income.

💡 Note: Always consult the Employment Standards Act, 2000 and seek professional advice for specific situations or complex employment scenarios.