The Virginia State W-4 form is an essential document for employees working in Virginia. It plays a crucial role in determining the amount of tax that should be withheld from your paycheck, ensuring you don't pay more than necessary but also avoiding any potential penalties for underpayment.

In this comprehensive guide, we will delve into the intricacies of the Virginia State W-4 form, exploring its purpose, key components, and how to complete it accurately. Whether you're a new employee or seeking to update your tax withholding information, this guide will provide you with the knowledge and tools to navigate the process seamlessly.

Understanding the Purpose of the Virginia State W-4 Form

The Virginia State W-4 form, also known as the Employee's Withholding Allowance Certificate, is a vital document that informs your employer about your tax situation. It helps calculate the appropriate amount of Virginia state income tax to be withheld from your wages, ensuring you meet your tax obligations without overpaying.

By providing accurate information on the W-4 form, you can minimize the risk of owing additional taxes at the end of the year or, conversely, receiving a large tax refund. It's a delicate balance, and understanding the purpose of this form is the first step toward achieving it.

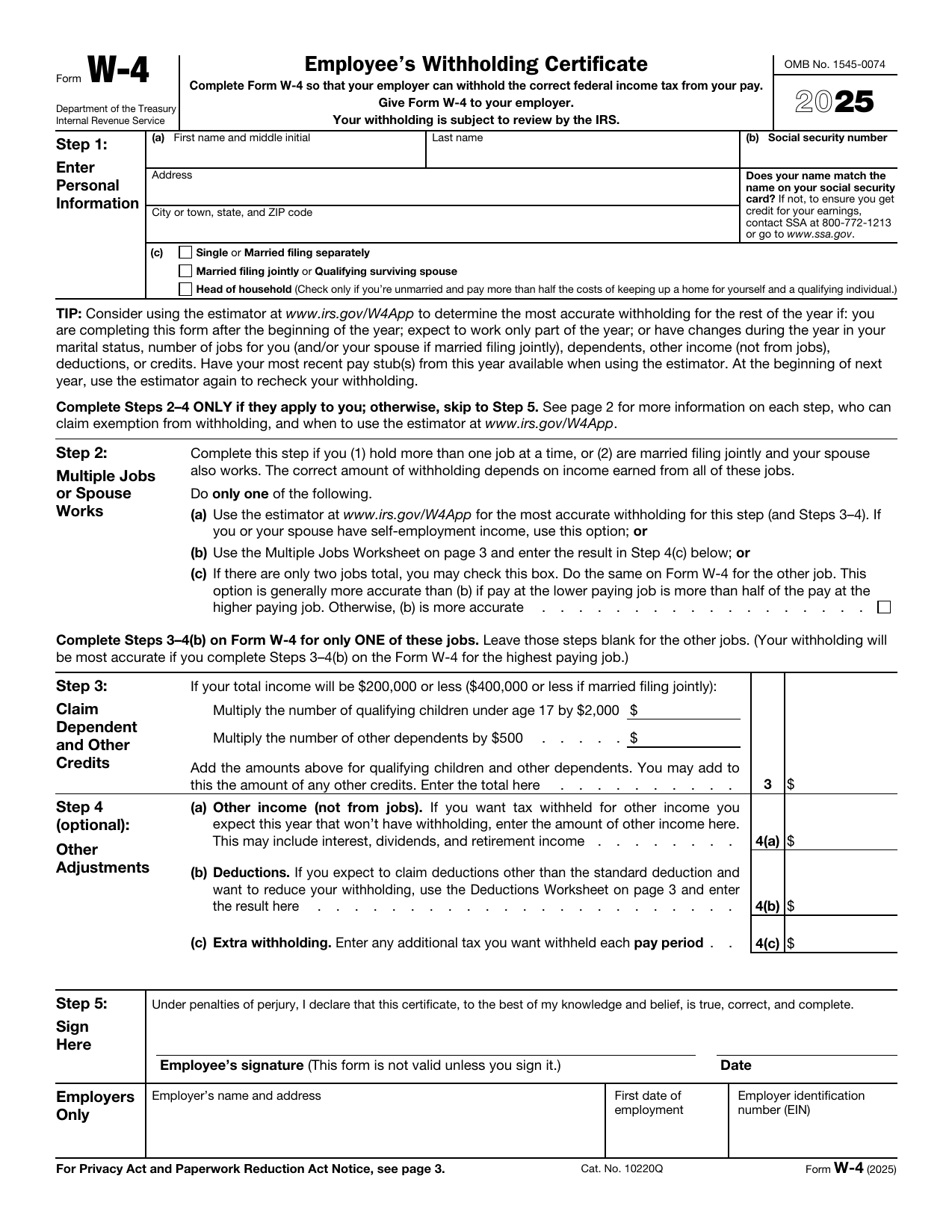

Key Components of the Virginia State W-4 Form

The Virginia State W-4 form consists of several sections, each designed to gather specific information about your tax situation. Let's break down the key components:

Personal Information

This section requires you to provide your basic details, including your name, address, and Social Security number. It's crucial to ensure the information is accurate and up-to-date to avoid any delays or errors in processing your tax withholdings.

Filing Status

Here, you'll indicate your filing status, which can be Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Widow(er). Your filing status determines your tax rate and the amount of tax you owe, so choose the one that best represents your situation.

Allowances and Adjustments

In this section, you can claim allowances, which reduce the amount of tax withheld from your paycheck. You can claim allowances for yourself, your spouse, and any dependents. Additionally, you can claim additional allowances for certain expenses or adjustments to your income.

Other Adjustments and Deductions

If you have any additional adjustments or deductions that impact your taxable income, such as business expenses or retirement contributions, you can indicate them in this section. These adjustments can further reduce your tax liability and ensure accurate withholding.

Direct Deposit Information

The Virginia State W-4 form also allows you to provide your direct deposit information. By doing so, you can have your tax refunds and any overwithheld amounts directly deposited into your bank account, streamlining the process and reducing the risk of lost or delayed payments.

Completing the Virginia State W-4 Form

Now that we've covered the key components, let's walk through the process of completing the Virginia State W-4 form step by step:

Step 1: Obtain the Form

You can obtain the Virginia State W-4 form from your employer or download it directly from the Virginia Department of Taxation's website. Ensure you have the most recent version to avoid any discrepancies.

Step 2: Personal Information

Fill in your personal information accurately, including your name, address, and Social Security number. Double-check the spelling and ensure the information matches your official documents.

Step 3: Filing Status

Choose the filing status that applies to your situation. If you're unsure, consult the instructions provided with the form or seek guidance from a tax professional.

Step 4: Allowances and Adjustments

Claim allowances for yourself, your spouse, and any dependents. You can also claim additional allowances if you have significant expenses or adjustments to your income. Be mindful of the maximum number of allowances you can claim based on your filing status.

Step 5: Other Adjustments and Deductions

If applicable, enter any additional adjustments or deductions that impact your taxable income. This could include business expenses, retirement contributions, or other eligible deductions.

Step 6: Direct Deposit Information

Provide your direct deposit information if you prefer to have your tax refunds and overwithheld amounts deposited directly into your bank account. Include your account number and routing number accurately to ensure smooth processing.

Step 7: Sign and Submit

Review the completed form carefully to ensure all information is accurate and complete. Sign and date the form, and submit it to your employer. Keep a copy for your records to refer to in case of any future tax-related inquiries.

Common Mistakes to Avoid

When completing the Virginia State W-4 form, it's essential to avoid common mistakes that could lead to incorrect tax withholding. Here are some pitfalls to watch out for:

- Incorrect Personal Information: Double-check your name, address, and Social Security number to ensure accuracy. Any discrepancies can lead to delays or errors in processing your tax withholdings.

- Miscalculating Allowances: Claiming too many allowances can result in underwithholding, leading to a tax bill at the end of the year. Conversely, claiming too few allowances may result in overwithholding and a larger tax refund, but it could also mean you're paying more than necessary throughout the year.

- Forgetting to Update: Life circumstances change, and so do your tax obligations. Remember to update your W-4 form whenever there's a significant change in your marital status, number of dependents, or other factors that impact your tax situation.

- Overlooking Deductions: Ensure you claim all eligible deductions and adjustments to reduce your taxable income. Failing to do so could result in overwithholding and a larger tax refund, but it's better to claim all deductions to minimize your tax liability.

Tips for Maximizing Your Tax Withholdings

To ensure you're optimizing your tax withholdings, consider the following tips:

- Review Your W-4 Annually: Tax laws and your personal circumstances can change from year to year. Review your W-4 form annually to ensure it still reflects your current situation and make any necessary adjustments.

- Consider Your Deductions: If you have significant deductions, such as mortgage interest or charitable contributions, consider adjusting your W-4 to reduce the amount of tax withheld from your paycheck. This can help you avoid overpaying throughout the year.

- Consult a Tax Professional: If you have complex tax situations or are unsure about your withholdings, consider seeking advice from a tax professional. They can provide personalized guidance to ensure you're optimizing your tax strategy.

Frequently Asked Questions

What happens if I don't complete the Virginia State W-4 form?

+If you don't complete the Virginia State W-4 form, your employer will use default withholding assumptions, which may result in incorrect tax withholdings. This could lead to a tax bill or a larger refund at the end of the year, depending on your actual tax situation.

Can I change my W-4 form during the year?

+Yes, you can change your W-4 form during the year if your circumstances change significantly. This could include marriage, divorce, the birth or adoption of a child, or a substantial change in income. Consult your employer or the Virginia Department of Taxation for guidance on updating your W-4.

How often should I review my W-4 form?

+It's recommended to review your W-4 form annually to ensure it still reflects your current tax situation. Life events and changes in income can impact your tax obligations, so staying up-to-date with your W-4 is crucial for accurate tax withholding.

Can I claim allowances for my dependents on the W-4 form?

+Yes, you can claim allowances for your dependents on the W-4 form. Each dependent allowance reduces the amount of tax withheld from your paycheck. However, ensure you meet the criteria for claiming dependents, such as providing more than half of their support and meeting the relationship and age requirements.

What if I make a mistake on my W-4 form?

+If you discover a mistake on your W-4 form, contact your employer immediately to correct it. Mistakes can lead to incorrect tax withholdings, so it's crucial to address them promptly. Your employer can guide you on the process of updating your W-4.

Conclusion

Completing the Virginia State W-4 form accurately is crucial for ensuring your tax withholdings are in line with your actual tax obligations. By understanding the purpose of the form, its key components, and the steps to complete it, you can navigate the process with confidence. Remember to review your W-4 annually and seek professional guidance if needed to optimize your tax strategy.

With careful consideration and attention to detail, you can strike the right balance between avoiding underpayment and overpayment of taxes, leading to a smoother tax experience throughout the year.